Shiba Inu Shows Signs of Recovery as Investor Demand Surges

Market Sentiment Shifts from Bearish to Bullish

After what seemed like an endless stretch of concerning market signals, Shiba Inu is finally experiencing a welcome change in fortune. For days on end, the popular meme cryptocurrency had been displaying consistently bearish indicators that left investors worried about its future trajectory. The exchange flow data, which tracks how tokens move in and out of trading platforms, had been painting a gloomy picture. However, the tide appears to be turning as fresh demand is flooding back into the market, coinciding with a remarkable price recovery that has caught many observers by surprise. This shift represents more than just a temporary blip on the radar – it suggests that investor confidence in Shiba Inu is being restored after a challenging period. The renewed interest comes at a crucial time, as the broader cryptocurrency market had been experiencing significant turbulence that tested the resolve of even the most committed crypto enthusiasts.

Recovering from Market-Wide Turbulence

The recent difficulties faced by Shiba Inu weren’t happening in isolation. The entire cryptocurrency landscape had been going through a rough patch, with volatility shaking investor confidence across the board. Major cryptocurrencies, including the market leader Bitcoin, experienced substantial drops in their trading values, creating a ripple effect that impacted virtually every digital asset. Meme coins like Shiba Inu were particularly vulnerable during this downturn, as they often experience more dramatic price swings compared to their more established counterparts. The selling pressure was intense, and for a while, it seemed like the bearish trend might continue indefinitely. However, as is often the case in the dynamic world of cryptocurrency, the market has proven its resilience. After weathering the storm, momentum has returned, and Shiba Inu has staged what can only be described as a massive comeback. This recovery hasn’t just been a modest uptick – it represents a significant reversal that has reinvigorated the community and attracted fresh attention from both seasoned traders and newcomers looking for opportunities.

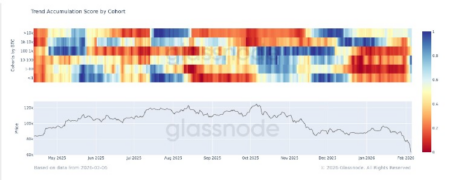

Strong Buying Pressure Emerges from All Investor Types

What makes this Shiba Inu recovery particularly noteworthy is the composition of the buying pressure behind it. The price surge hasn’t been driven by just one segment of the market – instead, it reflects strong demand from both retail investors and institutional players. This broad-based support is evident in the exchange movement data, which reveals fascinating insights into trader behavior. Rather than seeing the typical pattern where rising prices trigger profit-taking and selling, the data shows that investors are actually more inclined to accumulate additional tokens than to dump their holdings. This represents a significant vote of confidence in the asset’s future prospects. According to information from CryptoQuant, a respected on-chain analytics platform, the numbers tell a compelling story. As of Saturday, February 7, Shiba Inu’s netflow across all supported cryptocurrency exchanges registered at negative 212,479,300,000 SHIB tokens. For those unfamiliar with how to interpret this metric, a negative netflow is actually positive news – it means more tokens are leaving exchanges than entering them.

Understanding the Exchange Flow Dynamics

To fully appreciate what’s happening with Shiba Inu, it’s important to understand what exchange flow data reveals about investor behavior. When people want to sell cryptocurrency, they typically transfer their tokens to an exchange where they can find buyers. Conversely, when investors purchase tokens with the intention of holding them, they often move these assets off exchanges and into private wallets for safekeeping. This practice, sometimes called “self-custody,” is considered a bullish signal because it suggests people are buying for the long term rather than quick trading profits. The current Shiba Inu data showing a netflow of negative 212 billion tokens means that over the past day, the amount of SHIB withdrawn from exchanges for buying and holding purposes exceeded the amount deposited for selling by more than 212 billion tokens. This is a massive differential that speaks volumes about current market sentiment. It indicates that investors aren’t just cautiously dipping their toes back into Shiba Inu – they’re diving in with both feet. The data suggests a fundamental shift in investor psychology, from fear and uncertainty to renewed optimism and confidence that the asset has genuine upside potential ahead.

The Price Rally and Subsequent Cooling Period

The numbers behind Shiba Inu’s recent price action have been impressive by any standard. Over a concentrated two to three-day period, the meme coin experienced extraordinary gains, with daily price increases exceeding 15% – the kind of movement that gets investors’ hearts racing and generates headlines across crypto news platforms. These weren’t modest, incremental gains but rather the type of explosive growth that Shiba Inu became famous for during its earlier runs. However, as is typical with such rapid price movements, the asset has entered a cooling-off phase. Despite maintaining its position in positive territory – meaning it’s still trading above its recent low points – Shiba Inu has stepped back from those insane price surges. As of the latest data, the token is showing a more modest gain of 0.85% over the previous 24-hour period. This cooling shouldn’t necessarily be interpreted as a warning sign. In fact, many market analysts view such consolidation periods as healthy and necessary after rapid appreciation. Assets that go straight up without pausing often face more severe corrections when profit-taking eventually occurs, whereas those that take breathers along the way tend to build more sustainable upward trends.

Looking Ahead: What the Data Suggests

Despite the recent cooling in price momentum, the underlying fundamentals revealed by exchange movement data paint an encouraging picture for Shiba Inu’s future prospects. The fact that demand remains exceptionally high even as the price has stabilized suggests that the current rally may have more room to run. Investors aren’t panicking or rushing to lock in profits at the first sign of slowing momentum – instead, they’re continuing to accumulate tokens, suggesting confidence that current price levels represent good value relative to where the asset might head next. This sustained high demand indicates that the recent price recovery wasn’t merely a dead-cat bounce or short-lived speculative frenzy, but rather reflects genuine renewed interest in the project. Market observers are increasingly optimistic that Shiba Inu will soon resume its upward trajectory and potentially reclaim the higher price levels it achieved in the past. Of course, cryptocurrency markets are notoriously unpredictable, and past performance never guarantees future results. However, the combination of recovering prices, strong exchange outflows, and broad-based investor participation across both retail and institutional segments creates a compelling case for continued optimism. As the broader crypto market continues to stabilize and potentially enter a new growth phase, Shiba Inu appears well-positioned to benefit from improved sentiment and renewed capital inflows.