Binance Strengthens User Protection Through Strategic Bitcoin Investment in SAFU Fund

Understanding Binance’s Bold Move to Convert SAFU Reserves to Bitcoin

In a significant development that underscores the evolving dynamics of cryptocurrency security and user protection, Binance, the world’s leading cryptocurrency exchange, has announced a strategic shift in how it manages its emergency insurance fund. The exchange is actively converting the reserves of its SAFU Fund from traditional stablecoins into Bitcoin, with a commitment to complete this substantial transition within 30 days of the initial announcement. This move represents more than just a portfolio adjustment; it’s a statement of confidence in Bitcoin’s long-term viability and a demonstration of Binance’s commitment to strengthening user protection through innovative approaches. The SAFU Fund, which stands for Secure Asset Fund for Users, was purposefully established as a safety net to protect users during extreme situations such as security breaches, hacking incidents, or catastrophic system failures. By choosing to hold these critical reserves in Bitcoin rather than stablecoins, Binance is making a calculated bet on the world’s premier cryptocurrency while simultaneously addressing potential concerns about stablecoin reliability and regulatory uncertainties.

The Strategic Significance of SAFU and Its Role in User Protection

The SAFU Fund has been a cornerstone of Binance’s commitment to user security since its inception, functioning as an insurance mechanism that provides peace of mind to millions of traders and investors who use the platform daily. This emergency fund was designed with a singular purpose: to ensure that users would be compensated and protected in worst-case scenarios where unexpected events might threaten their assets. Whether facing sophisticated cyberattacks, technical glitches, or other unforeseen circumstances, the SAFU Fund represents Binance’s promise to stand behind its users when they need it most. The decision to convert these reserves from stablecoins to Bitcoin is not merely a technical adjustment but rather a philosophical shift that reflects changing perceptions about what constitutes the most reliable store of value in the cryptocurrency ecosystem. Stablecoins, while useful for their price stability and ties to traditional fiat currencies, carry their own set of risks including depegging events, regulatory uncertainties, and concerns about the transparency of their underlying reserves. By transitioning to Bitcoin, Binance is choosing an asset with a proven track record, genuine decentralization, and widespread acceptance as digital gold—a store of value that has withstood numerous market cycles and emerged stronger each time.

Binance’s Substantial Bitcoin Acquisition and Market Timing

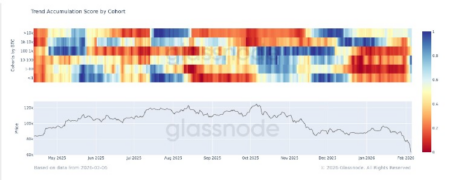

According to BSCDaily, a prominent cryptocurrency news platform that broke the story through its official social media channels, Binance has already made significant progress toward its conversion goal by purchasing 3,600 Bitcoin for the SAFU Fund, representing an investment of approximately $250 million in stablecoins. This substantial acquisition comes at a particularly opportune moment in the market cycle, as Bitcoin has experienced a significant price correction from its recent highs. The timing of this purchase demonstrates shrewd market awareness, as Binance is effectively buying the dip—a strategy that savvy investors employ to maximize value by acquiring assets when prices are temporarily depressed. For the broader cryptocurrency community, this move sends a powerful signal about institutional confidence in Bitcoin’s future prospects. When one of the industry’s most influential players commits hundreds of millions of dollars to Bitcoin during a market downturn, it suggests a conviction that current prices represent a favorable entry point rather than a cause for concern. This vote of confidence from Binance may help stabilize market sentiment and reassure investors who might be wavering during this period of price volatility.

Long-Term Implications for User Confidence and Fund Transparency

The strategic decision to hold SAFU reserves in Bitcoin carries profound implications for user confidence and the transparency of emergency funds across the cryptocurrency industry. By converting to Bitcoin, Binance is essentially anchoring its user protection mechanism to an asset that offers unparalleled transparency—every Bitcoin held by the SAFU Fund can be verified on the blockchain, providing users with the ability to independently confirm that the reserves exist and remain intact. This level of transparency stands in stark contrast to the opacity that sometimes surrounds stablecoin reserves, where users must trust that the issuing entity maintains adequate backing without always having direct verification methods available. Furthermore, Bitcoin’s status as a decentralized, censorship-resistant asset means that the SAFU Fund’s holdings are less vulnerable to the regulatory uncertainties and potential freezing risks that centralized stablecoins might face in various jurisdictions. For users worldwide, this translates to greater assurance that the emergency fund will remain accessible and functional regardless of changing regulatory landscapes or political pressures. The move also demonstrates Binance’s willingness to align its risk management strategy with the fundamental principles of cryptocurrency—decentralization, transparency, and resistance to single points of failure.

Bitcoin’s Proven Track Record as the Premier Cryptocurrency Asset

Bitcoin’s journey from an experimental digital currency to a globally recognized store of value provides the foundation for Binance’s strategic decision. Unlike the thousands of alternative cryptocurrencies that have emerged over the years, Bitcoin has consistently demonstrated resilience, security, and staying power that set it apart from all competitors. Its track record includes surviving multiple market cycles, enduring regulatory scrutiny across numerous countries, overcoming technological challenges, and continuously attracting both retail and institutional investment despite periodic downturns. This durability makes Bitcoin uniquely qualified to serve as the backing for an emergency fund that must maintain its value and accessibility across all market conditions. The cryptocurrency’s fixed supply of 21 million coins creates inherent scarcity that has historically driven long-term value appreciation, while its widespread acceptance and deep liquidity ensure that it can be converted to other currencies quickly when needed. By choosing Bitcoin as the reserve asset for SAFU, Binance is effectively betting on the continuation of these favorable characteristics—a bet that aligns with the views of a growing number of institutions, corporations, and sovereign entities that have added Bitcoin to their balance sheets. This institutional adoption trend further validates Bitcoin’s status as digital gold and reinforces the wisdom of holding it as a long-term reserve asset.

Broader Market Implications and Binance’s Industry Leadership

Binance’s decision to convert the SAFU Fund to Bitcoin resonates far beyond the immediate impact on its own operations, serving as a potential catalyst for industry-wide changes in how cryptocurrency exchanges approach risk management and user protection. The move highlights Bitcoin’s continued dominance and unique position within the cryptocurrency ecosystem, even as thousands of alternative projects compete for attention and investment. By publicly committing to this strategy and setting a 30-day timeline for completion, Binance is demonstrating the kind of transparency and decisive action that can help restore trust in an industry that has been shaken by various scandals and failures in recent years. This approach emphasizes security, resilience, and trust-first infrastructure—principles that should guide all cryptocurrency platforms but which have sometimes been honored more in rhetoric than in practice. As other exchanges observe Binance’s strategy and its reception among users and the broader community, we may see a trend toward similar conversions, potentially increasing demand for Bitcoin and further cementing its role as the foundational asset of the cryptocurrency economy. Ultimately, Binance’s Bitcoin strategy reflects a maturing industry that is learning from past mistakes and building more robust systems to protect users while maintaining the innovative spirit and transformative potential that make cryptocurrencies such a revolutionary technology for financial freedom and inclusion.