Bitcoin’s Price Movement and ETF Launch

Bitcoin’s journey since the launch of its ETF has been marked by significant price fluctuations. The cryptocurrency reached a peak of $94,000, but soon saw a decline to $86,000 as selling activity increased. This movement is particularly notable when considering the timing relative to the ETF’s introduction. The peak occurred 54 weeks after the ETF’s launch, mirroring the pattern observed with the Nasdaq QQQ ETF, which also reached its peak around the same timeframe after its debut in 1999. This synchronization may indicate a broader market pattern influencing Bitcoin’s trajectory.

Historical Comparison with QQQ ETF

Drawing parallels between Bitcoin’s ETF and the QQQ ETF offers insights into potential future movements. Both assets achieved their highest points 54 weeks post-launch, followed by a sustained correction phase. This historical precedent suggests that Bitcoin may be following a similar path. The QQQ ETF’s performance, which involved years of range-bound trading before resuming an upward trend, hints at a possible long-term consolidation phase for Bitcoin, with resistance levels between $80,000 and $100,000. Understanding these comparisons can provide traders with a framework for anticipating Bitcoin’s future behavior.

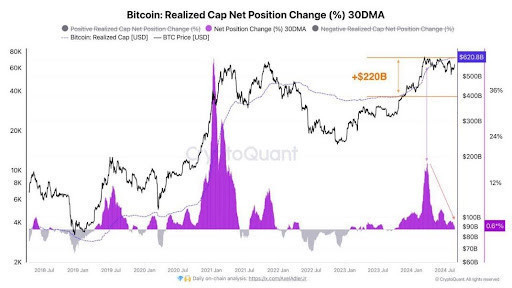

Retail Investors and Liquidity Shift

The influx of new tokens, including celebrity and politically endorsed meme coins, has captivated retail investors, diverting their attention and capital away from Bitcoin. This shift in liquidity has weakened Bitcoin’s upward momentum. Retail traders, often drawn to speculative projects, have somewhat loosened Bitcoin’s dominance in the market. As a result, Bitcoin’s price has faced downward pressure, highlighting the impact of retail investor behavior on market dynamics.

The Correction Phase and Bitcoin’s Drop

Bitcoin’s decline from $94,000 to $86,000 signals the onset of a correction phase, a common market cycle following significant peaks. Factors contributing to this correction include the natural market cycle and the migration of retail capital to alternative assets. The correction phase is characterized by reduced liquidity in the crypto space, as traders seek opportunities elsewhere. Historical data from the QQQ ETF suggests that such corrections can be prolonged, potentially spanning several years before an upward trend resumes.

Long-Term Implications and Market Dynamics

The correction phase for Bitcoin may extend beyond a brief period, influenced by broader market liquidity trends and institutional investment strategies. While traders remain optimistic about a potential rebound, historical patterns indicate that Bitcoin might endure an extended accumulation phase before reclaiming its previous highs. This period could be crucial for establishing a stable foundation for future growth, as seen with the QQQ ETF’s eventual recovery and ascent.

Conclusion and Future Outlook

In conclusion, Bitcoin’s current trajectory, influenced by its ETF and comparisons to the QQQ ETF, suggests a complex interplay of market dynamics and investor behavior. The correction phase, while challenging, may present opportunities for consolidation and long-term growth. As the market evolves, understanding these patterns can aid traders in navigating the cryptocurrency landscape. Bitcoin’s resilience and adaptability will be key in determining its future success in the face of shifting market trends and investor sentiments.