The Historic Decline of Bitcoin Mining in China: Understanding the Challenges and Changes

A Record-Breaking Drop That Shook the Industry

The Bitcoin mining landscape in China has experienced a seismic shift that has sent ripples through the global cryptocurrency community. According to data released by Mempool, a prominent Bitcoin network explorer, on Saturday, February 7, China witnessed an unprecedented 11.16% decline in mining difficulty, plummeting to a historic low of 125.86 trillion. This dramatic downturn represents more than just numbers on a chart—it’s a clear signal that the Bitcoin mining industry is facing serious headwinds. Bitcoin developer Mononaut emphasized the severity of the situation by highlighting that this represents the single largest one-time reduction in mining difficulty since the country implemented comprehensive restrictions on cryptocurrency mining five years ago. When placed in historical context, this recent decline ranks as the tenth-largest percentage drop ever recorded in Bitcoin mining history, underlining just how significant this moment is for the industry. For those who follow cryptocurrency markets closely, this development serves as a wake-up call about the volatility and challenges that continue to define the digital currency landscape.

What’s Behind the Dramatic Decline? Experts Weigh In

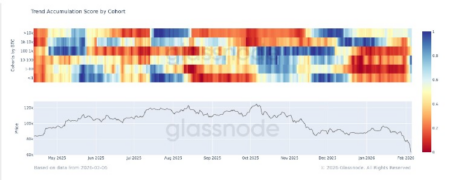

Industry analysts and researchers haven’t been sitting idle as these dramatic changes unfold. They’ve rolled up their sleeves and dug deep into the data to understand what’s driving this unprecedented decline. Their findings paint a troubling picture: the drop in mining difficulty correlates directly with an approximately 20% decrease in total hashrate—essentially the computational power dedicated to mining Bitcoin—over the past month. Luxor Technology Corporation, a leading provider of comprehensive Bitcoin mining services, released compelling data through their Hashrate Index that shows mining power dropped by 11% in just one week, hitting a low of 863 exahashes per second (EH/s). To put this in perspective, this figure represents a significant fall from the all-time high of over 1.1 zettahashes per second (ZH/s) recorded in October. The hashrate essentially measures how much computing power miners are dedicating to the Bitcoin network, and when it drops, it indicates that miners are shutting down their operations or scaling back significantly. This isn’t just a technical concern—it’s a clear indication that mining Bitcoin has become less profitable and more challenging for operations in China and potentially worldwide.

The Price Problem: When Bitcoin’s Value Falls, Miners Suffer

At the heart of this mining crisis lies a fundamental economic reality: the dramatic decline in Bitcoin’s price has made mining operations increasingly unprofitable. The cryptocurrency that once soared to dizzying heights above $126,000 in October has experienced a brutal correction, falling more than 45% from that peak. Data from February 5 painted an even grimmer picture, showing Bitcoin’s price had crashed to approximately $60,000 before managing a modest recovery to around $68,800. This isn’t happening in isolation—the broader financial markets are experiencing significant turbulence. Higher yields on U.S. Treasury bonds are drawing investors toward safer, government-backed securities, while Bitcoin exchange-traded funds (ETFs) have been experiencing persistent outflows, meaning investors are pulling their money out rather than investing more. The entire “risk-on” asset category, which includes not just cryptocurrencies but also stocks and commodities, has seen investors retreating to safer ground. SoSoValue, a Singapore-based cryptocurrency research platform that utilizes artificial intelligence for market analysis, confirmed this trend by reporting that U.S. spot Bitcoin ETFs have actually become net sellers this year—meaning more Bitcoin is being sold through these investment vehicles than is being purchased. For miners who have invested millions in equipment and electricity costs, these market conditions create a perfect storm of financial pressure that forces many to shut down operations entirely.

When Nature Strikes: Winter Storm Fern’s Impact on Mining Operations

As if market pressures weren’t challenging enough, Mother Nature decided to pile on additional difficulties for Bitcoin miners, particularly those operating in the United States. Winter Storm Fern emerged as a powerful weather event created when an Arctic air mass collided with moisture from the Gulf of Mexico, creating severe conditions across multiple regions. The storm struck in late January, forcing mining operations across various parts of the United States to make difficult decisions about their operations. In an act of responsible citizenship, many mining facilities voluntarily scaled back or completely shut down their power-intensive operations to help stabilize residential power grids that were being pushed to their limits by households struggling to heat their homes during the extreme cold. The impact was substantial—approximately 200 exahashes per second of mining power went offline because of the storm. Foundry USA, one of the major mining pools, saw its hash rate plummet to roughly 60% of normal capacity. This situation perfectly illustrates one of the often-overlooked vulnerabilities of Bitcoin mining: its dependence on reliable, affordable electricity and its susceptibility to disruption from extreme weather events that are becoming increasingly common due to climate change.

The Profitability Crisis: When Mining No Longer Makes Financial Sense

The financial pressures on Bitcoin miners have reached a critical point where the fundamental business model is being questioned. Ben Harper, who serves as the Director of Derivatives at Luxor Technology, brought attention to a particularly concerning metric called “hashprice”—this measures the expected daily revenue that a miner can generate for each unit of computing power they contribute to the network. On February 2, this crucial profitability indicator crashed to an unprecedented low of $33.31 per petahash per second per day, with February 1 seeing an average daily low of $34.91. These numbers might seem abstract, but they have very real implications for mining operations. The industry generally uses $40 per petahash per second per day as the benchmark threshold—operations falling below this level are typically losing money when all costs are considered. The situation has created a stark divide in the mining community. According to data from Antpool, only miners operating the latest generation Antminer S23 series machines are currently generating meaningful profits. Older equipment models, including the Whatsminer M6 series and Antminer S21 units, have either reached the point of unprofitability or are dangerously close to it. This creates a difficult situation for miners who made significant capital investments in equipment that has now become obsolete or unprofitable much faster than anticipated.

Looking Ahead: A Challenging Road for China’s Bitcoin Mining Industry

The current state of Bitcoin mining in China presents a sobering reality check for the industry. When compared to previous downturns, this decline surpasses even the approximately 7.5% reduction seen in June of last year, which was attributed to hashrate reductions caused by extreme heat waves forcing operations to shut down or scale back. The recurring pattern of weather-related disruptions, combined with market pressures, suggests that Bitcoin mining faces systemic challenges that won’t be easily resolved. Perhaps most concerning is the fundamental economic equation that miners now face. Research from Checkonchain reveals that the average cost to mine a single Bitcoin has risen to approximately $87,000 when accounting for equipment costs, electricity, facility maintenance, and other operational expenses. Meanwhile, the spot market price for Bitcoin hovers around $69,000—roughly 20% below the cost of production. This negative margin means that every Bitcoin mined represents a loss rather than a profit, an unsustainable situation that cannot continue indefinitely. The industry now stands at a crossroads, with only the most efficient operations using cutting-edge technology and accessing the cheapest electricity sources able to continue profitably. For China’s Bitcoin mining sector specifically, which once dominated global mining activity before facing regulatory restrictions, the future remains uncertain as operators must navigate both market pressures and the ongoing regulatory environment while competing with mining operations in other countries that may have access to cheaper energy or more favorable conditions.