A New Era for Cryptocurrency: Trump Announces Expansion of US Strategic Reserve

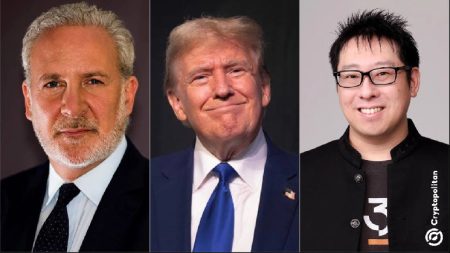

In a groundbreaking announcement, former US President Donald Trump revealed that Bitcoin and Ethereum will now be included in the US cryptocurrency strategic reserve. This decision comes on the heels of the initial selection of Solana, Cardano, and Ripple for the reserve, marking a significant step forward in the integration of digital currencies into the nation’s financial framework. Trump emphasized that the inclusion of Bitcoin and Ethereum is a "natural progression" in the evolution of this strategic initiative. This move is widely seen as a testament to the growing recognition of cryptocurrencies as a vital component of modern finance.

The selection of these cryptocurrencies underscores the administration’s commitment to fostering innovation and maintaining technological leadership in the global economy. By diversifying the reserve with a mix of established players like Bitcoin and Ethereum and newer platforms like Solana, Cardano, and Ripple, the US is signaling its intent to create a robust and inclusive digital asset strategy. This approach not only acknowledges the maturity and market dominance of Bitcoin and Ethereum but also highlights the potential of other cryptocurrencies to drive progress in blockchain technology and decentralized systems.

The Strategic Significance of Including Bitcoin and Ethereum

Bitcoin and Ethereum, often regarded as the titans of the cryptocurrency world, bring unparalleled stability and adoption to the US strategic reserve. Bitcoin, as the first and most widely recognized cryptocurrency, has long been a benchmark for the industry, while Ethereum’s smart contract platform has revolutionized the way applications are built on blockchain technology. Their inclusion in the reserve is expected to bolster confidence in the initiative and attract greater institutional and retail investment.

Moreover, the addition of these two cryptocurrencies reflects a pragmatic approach to building a resilient financial ecosystem. Bitcoin’s role as a store of value, often compared to gold, and Ethereum’s versatile ecosystem for decentralized applications (dApps) and decentralized finance (DeFi) make them indispensable assets in a forward-looking reserve. This move is likely to encourage other nations to consider similar strategies, fostering global collaboration and standardization in the cryptocurrency space.

Economic and Technological Implications of the US Cryptocurrency Reserve

The establishment of a US cryptocurrency strategic reserve sends a powerful message about the government’s willingness to embrace digital innovation and stay ahead of the curve. By holding a diversified portfolio of cryptocurrencies, the US is positioning itself to leverage the benefits of decentralization, increased transaction efficiency, and enhanced security. This initiative could pave the way for the integration of cryptocurrencies into mainstream financial systems, creating new opportunities for economic growth and job creation.

From a technological standpoint, the inclusion of these cryptocurrencies in the reserve serves as a catalyst for further innovation. Platforms like Cardano and Solana, known for their focus on scalability and sustainability, could play a critical role in shaping the future of blockchain technology. Meanwhile, Ripple’s emphasis on cross-border payments and Ethereum’s dominance in smart contracts provide a comprehensive foundation for building a cutting-edge financial infrastructure.

Market Reaction and the Path to Widespread Adoption

The announcement has elicited a mixed reaction from the cryptocurrency community, ranging from optimism to cautious skepticism. Proponents view this as a major milestone in the journey toward mainstream adoption, as government endorsement often serves as a seal of approval. The inclusion of Bitcoin and Ethereum, in particular, is expected to drive higher adoption rates, as these cryptocurrencies are already widely recognized and utilized.

However, some industry experts have raised concerns about the potential regulatory implications of such a move. The integration of cryptocurrencies into a national strategic reserve may necessitate clearer guidelines and oversight mechanisms to ensure transparency and accountability. Additionally, the environmental impact of certain blockchain networks, such as Bitcoin’s energy-intensive proof-of-work mechanism, could become a point of contention in public discourse.

The Road Ahead: Regulation and the Future of Cryptocurrency

As the US moves forward with its cryptocurrency strategic reserve, the need for a comprehensive regulatory framework becomes increasingly apparent. Policymakers will need to strike a delicate balance between fostering innovation and protecting consumers from the risks associated with digital assets. The success of this initiative will depend on collaboration between government agencies, industry leaders, and other stakeholders to create a supportive yet regulated environment for cryptocurrencies.

Looking ahead, the inclusion of Bitcoin, Ethereum, Solana, Cardano, and Ripple in the US cryptocurrency strategic reserve could set a precedent for other nations to follow. This move has the potential to redefine the global financial landscape, accelerating the transition to a digital economy. While challenges lie ahead, the willingness of the US to embrace cryptocurrencies signals a promising future for this rapidly evolving industry.

In conclusion, Trump’s announcement marks a pivotal moment in the history of cryptocurrency. The expansion of the US strategic reserve to include Bitcoin and Ethereum, alongside Solana, Cardano, and Ripple, reflects a bold vision for the future of finance. As the world watches this development unfold, one thing is clear: the integration of cryptocurrencies into national strategies is no longer a matter of if, but when—and how.