Bitcoin’s Recovery Story: From Panic Selling to Strategic Buying

The Dramatic Price Swing That Changed Everything

The cryptocurrency market has witnessed one of its most turbulent periods in recent history, and Bitcoin’s rollercoaster ride through early February tells a compelling story about fear, value, and strategic opportunity. As we stepped into February, Bitcoin was comfortably sitting at around $80,000 per coin. The market landscape at this point was fascinating – large-scale investors, often called “whales” in crypto circles, were cautiously testing the waters with modest purchases, while everyday retail investors were doing exactly the opposite. Ordinary people who had jumped into Bitcoin during its highs were frantically selling off their holdings, spooked by market uncertainty and the fear of losing their investments. This divergence between institutional confidence and retail panic set the stage for what would become a dramatic market shift.

Then came February 5th, a date that will likely be remembered as a pivotal moment in Bitcoin’s 2025 timeline. In just seven short days from the beginning of the month, Bitcoin’s value dropped like a stone, plummeting from $80,000 all the way down to $60,000. That’s a staggering 25% loss in a single week – the kind of drop that makes headlines and sends shockwaves through investment communities worldwide. For context, imagine if a major stock lost a quarter of its value in seven days; the financial news networks would talk about nothing else. This crash represented one of the most severe capitulation events in Bitcoin’s entire history, a moment when even die-hard believers questioned their convictions and many investors simply gave up and sold at a loss.

Understanding the Shift: From Selling to Accumulating

However, what happened next is where the story gets really interesting and demonstrates the unique psychology of cryptocurrency markets. Rather than continuing its downward spiral or languishing at depressed prices, Bitcoin’s crash to $60,000 triggered a fundamental change in investor behavior. The very same drop that caused panic selling also created what savvy investors recognized as a massive buying opportunity. Market data now reveals a broad and significant shift toward accumulation across nearly all investor categories. In simple terms, people stopped selling in fear and started buying with conviction, recognizing that Bitcoin at $60,000 represented genuine value – especially considering it had been trading at over $120,000 just months earlier during its October all-time high.

This transition from panic to purposeful buying didn’t happen randomly. What we’re witnessing is the classic market cycle that has played out throughout Bitcoin’s history: a sharp decline shakes out weak hands (investors who bought without strong conviction), prices fall to levels that attract value-focused buyers, and then a new accumulation phase begins. The difference this time is the breadth of the accumulation – it’s not just one type of investor buying, but rather a synchronized movement across multiple investor categories, from individuals to institutions, all reaching the same conclusion that current prices represent an attractive entry point.

The Data Behind the Recovery

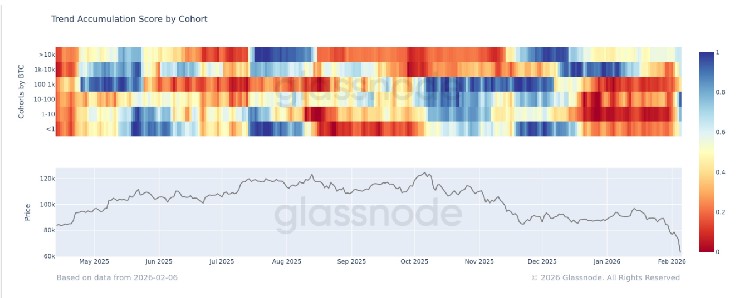

To understand just how significant this behavioral shift is, we need to look at the sophisticated metrics that track investor activity on the Bitcoin blockchain. Glassnode, one of the leading blockchain analytics firms, uses something called the “Accumulation Trend Score by cohort” to measure exactly this kind of market behavior. This isn’t just looking at price charts or trading volume; it’s a comprehensive metric that measures the relative strength of accumulation across different wallet sizes by considering both the size of the wallet (how much Bitcoin an investor holds) and the amount of Bitcoin they’ve been accumulating over the past 15 days.

The scoring system is elegantly simple yet powerfully insightful: a score closer to 1 indicates strong accumulation (investors are buying and holding), while a score closer to 0 indicates distribution (investors are selling off their holdings). Think of it as a thermometer for market sentiment, where the temperature reading tells you whether investors are confident or fearful. As of the latest data, this Accumulation Trend Score has climbed above 0.5, reaching an impressive 0.68 on an aggregate basis across all investor cohorts. This number might seem abstract, but its implications are profound.

A Historical Perspective on Market Bottoms

The current reading of 0.68 on the Accumulation Trend Score marks the first time since late November that such broad-based accumulation has been observed in the Bitcoin market. This historical parallel is particularly noteworthy because that late November period coincided with Bitcoin forming what traders call a “local bottom” near $80,000 – a price point that, at the time, represented a temporary floor before the market found its footing and began to recover. The fact that we’re seeing similar accumulation patterns now, but at the lower price of $60,000, suggests that investors believe this current price level represents even better value than the $80,000 level did back in November.

Market bottoms are notoriously difficult to identify in real-time; they’re usually only obvious in hindsight when you’re looking at a price chart months or years later. However, these accumulation patterns provide a real-time glimpse into collective investor psychology and behavior. When the smart money – those who have weathered multiple crypto cycles – starts buying aggressively, it often signals that fear has reached its maximum point and value has emerged from the wreckage of panic selling. The current data suggests we may be at or near such an inflection point, though as with all market analysis, nothing is guaranteed.

Who’s Buying and What It Means

Digging deeper into the data reveals fascinating details about exactly who is doing the buying during this accumulation phase. The cohort showing the most aggressive “dip buying” – purchasing assets when prices have fallen significantly – has been wallets holding between 10 and 100 Bitcoin. At current prices around $60,000, these wallets represent investors with holdings valued between $600,000 and $6 million. This isn’t retail money from casual investors putting in a few hundred dollars; these are serious, sophisticated investors with substantial capital who are making calculated decisions about value.

This particular investor category is especially interesting because they represent a middle ground between massive institutional whales and small retail investors. These are likely high-net-worth individuals, family offices, small investment firms, and seasoned crypto veterans who have both the capital to make meaningful purchases and the experience to recognize opportunity amidst chaos. Their aggressive buying, particularly as prices approached and fell to $60,000, suggests a strong conviction that Bitcoin is fundamentally undervalued at these levels. When this caliber of investor is buying heavily, it often presages broader market recovery because these investors typically have longer time horizons and more sophisticated analytical capabilities than the average market participant.

Looking Forward: Uncertainty with Optimism

As we assess the current state of the Bitcoin market, intellectual honesty requires acknowledging what we don’t know. While the data clearly shows a significant shift from capitulation to accumulation, and while historical patterns suggest we may be near a market bottom, it remains genuinely uncertain whether the ultimate bottom is actually in. Bitcoin could potentially test lower levels again if broader economic conditions deteriorate, if regulatory concerns emerge, or if market sentiment shifts once more. Cryptocurrency markets are notoriously volatile, and past performance, while informative, never guarantees future results.

That said, what is evident and indisputable from the available data is that investors are once again finding value in Bitcoin after experiencing a drawdown of more than 50% from its October all-time high of over $120,000. This represents a massive reset in valuation, creating the kind of entry point that historically has rewarded patient, value-focused investors. The synchronized accumulation across multiple investor cohorts, the aggressive buying from mid-sized wallets, and the historical parallels to previous market bottoms all paint a picture of a market that has moved through fear and is beginning to rebuild on a foundation of value recognition rather than speculative mania. Whether this marks the beginning of Bitcoin’s next major rally or simply a pause in a longer correction remains to be seen, but the shift in market dynamics is undeniable and significant for anyone following the cryptocurrency space.