The Call for Registration: A Step Towards Regulatory Clarity

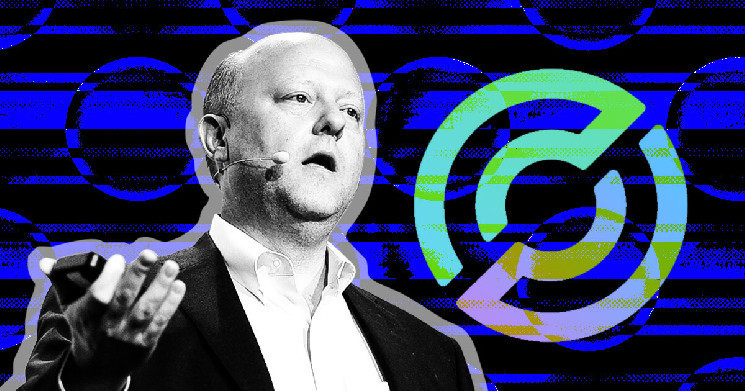

In the evolving landscape of digital finance, stablecoins have emerged as a crucial bridge between traditional financial systems and cryptocurrencies. These digital assets, pegged to the value of a traditional currency like the US dollar, offer stability in a volatile market. Recently, Jeremy Allaire, co-founder of Circle, a prominent issuer of the second-largest stablecoin, USDC, emphasized the need for stablecoin issuers to register in the United States. This call for registration comes amid growing discussions in Washington about oversight, signaling a pivotal moment in crypto regulation.

Allaire’s statement during a Bloomberg interview on February 26 highlights his advocacy for a regulated environment, a stance Circle has long maintained. He argues that formal registration would provide the clarity needed for stablecoins to operate within a defined legal framework, rather than in the ambiguous regulatory zones they currently occupy. This move could enhance trust and consumer protection, essential for the growth of digital assets. However, some industry players express concerns that such measures might hinder innovation and competition in a global market.

Stablecoins: Bridging Traditional Finance and Cryptocurrencies

Stablecoins are integral to the cryptocurrency ecosystem, facilitating transactions and serving as a stable store of value. Their role in connecting traditional finance with digital assets underscores their importance in the financial ecosystem. However, regulatory uncertainty persists, with questions surrounding reserve backing, consumer safeguards, and potential risks to financial stability. These issues have sparked debates among policymakers and regulators, who are grappling with how to oversee this rapidly expanding market.

The significance of stablecoins is evident in their increasing adoption, with Circle’s USDC and Tether’s USDT leading the market. These coins are not just tools for traders; they are integral to decentralized finance (DeFi) platforms, enabling lending, borrowing, and other financial activities. Their role in enhancing payment efficiency and innovation cannot be overlooked, yet the lack of clear regulations poses challenges for issuers and users alike.

Legislative Efforts: Shaping the Future of Stablecoins

Senator Bill Hagerty’s recent introduction of a bill aimed at establishing a federal framework for stablecoin regulation marks a significant step in addressing these challenges. This legislation is among the first crypto-related measures expected to be debated during President Donald Trump’s second term. Trump has expressed support for positioning the U.S. as a leader in the crypto industry, indicating potential regulatory shifts that could impact stablecoin issuers like Circle.

Hagerty’s bill is part of broader legislative efforts to create a structured environment for stablecoins. It addresses critical issues such as reserve requirements, disclosure standards, and the potential risks associated with these digital assets. The bill’s provisions aim to balance consumer protection with innovation, ensuring that stablecoins can thrive under a clear regulatory framework.

Industry Advocacy: The Push for Regulatory Clarity

Circle has been a vocal advocate for regulatory clarity, positioning itself as a compliant and transparent issuer in a market often criticized for opacity. As the second-largest stablecoin by market capitalization, USDC’s credibility is crucial. Allaire’s call for registration aligns with the company’s broader strategy to legitimize stablecoins within the U.S. financial system, emphasizing the need for trust and stability.

However, not all industry players support increased regulation. Some argue that stringent rules could stifle innovation and drive businesses offshore, undermining U.S. leadership in the global crypto market. This tension highlights the delicate balance policymakers must strike between oversight and fostering growth in a nascent industry.

The Road Ahead: Implications for Digital Finance

The ongoing debate over stablecoin regulation is shaping the future of digital finance in the U.S. Whether Hagerty’s bill gains traction or undergoes revisions, the push for clarity marks a crucial moment. The discussions around stablecoins reflect broader questions about the role of digital assets in the financial system and the government’s approach to regulating them.

As the market evolves, the outcome of these deliberations will have far-reaching implications. Well-regulated stablecoins could enhance payment systems and innovation, while overly restrictive regulations might hinder growth. The challenge for lawmakers is to craft a framework that addresses risks without stifling the potential of digital assets to transform finance.

Conclusion: A Pivotal Moment in Digital Finance

Jeremy Allaire’s call for stablecoin issuers to register in the U.S. underscores the need for regulatory clarity in a rapidly evolving industry. Stablecoins are pivotal in the cryptocurrency ecosystem, but their growth is hampered by uncertainty. The legislative efforts, such as Senator Hagerty’s bill, represent a step towards addressing these issues, reflecting the broader debate about the role of digital assets in finance.

The path ahead is crucial. Policymakers must balance innovation with consumer protection, ensuring that regulations foster growth while mitigating risks. The outcome of this regulatory debate will shape the future of digital finance, determining whether the U.S. leads in this transformative era or cedes ground to other nations. As the industry and policymakers navigate this complex landscape, the decisions made today will have lasting implications for the future of money and finance.