The Crypto ETF Market: Trends and Insights Over the Past 30 Days

The cryptocurrency exchange-traded fund (ETF) market has experienced significant activity over the past 30 days. Despite a total net outflow of $41.20 million, the crypto ETF sector remains robust, with total assets under management (AUM) standing at $113.74 billion. This figure underscores the continued interest and investment in cryptocurrency-based ETFs, even as market dynamics shift. Bitcoin ETFs dominate the space, holding $104.4 billion in AUM, while Ethereum ETFs manage $9.2 billion. This gap highlights the differing investor sentiments toward these two leading cryptocurrencies.

Bitcoin ETFs Experience Inflows, Ethereum ETFs Face Outflows

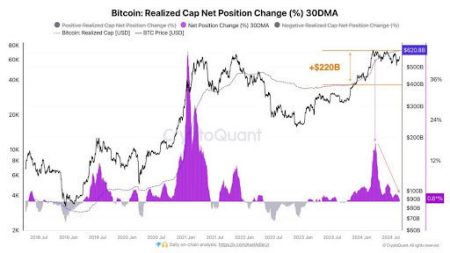

Over the past month, Bitcoin ETFs have shown resilience, with a net inflow of $22.1 million. This indicates sustained investor confidence in Bitcoin-based funds, despite broader market fluctuations. In contrast, Ethereum ETFs have struggled, experiencing a significant outflow of $63.3 million. This divergence suggests that investors are currently favoring Bitcoin over Ethereum when it comes to ETF investments. The gap in investor sentiment could be attributed to Bitcoin’s perceived stability and adoption as a long-term store of value, while Ethereum faces challenges related to regulatory scrutiny and ongoing network development.

Top Crypto ETFs: Performance and Market Presence

The cryptocurrency ETF landscape is led by several prominent funds, each with impressive AUM and trading volumes. The iShares Bitcoin Trust (IBIT) tops the list, managing over $50.3 billion in assets, with a market capitalization of $51.7 billion and a trading volume of $2.4 billion. The Fidelity Wise Origin Bitcoin Fund (FBTC) follows closely, holding $18.0 billion in assets and boasting a market cap of $18.1 billion. Grayscale Bitcoin Trust (GBTC) ranks third, with $17.7 billion in AUM and a matching market cap, alongside a trading volume of $150.5 million. Rounding out the top performers are the ARK 21Shares Bitcoin ETF and the Grayscale Bitcoin Mini Trust (BTC), which manage $4.3 billion and $4.0 billion in assets, respectively. These funds reflect the strong institutional and retail demand for Bitcoin ETFs.

Market Outlook: Investor Sentiment and Future Trends

The cryptocurrency ETF market is at a crossroads, with investor sentiment playing a pivotal role in shaping its future. While Bitcoin ETFs continue to attract steady inflows, signaling confidence in Bitcoin’s role as a long-term store of value, Ethereum ETFs are grappling with declining interest. This shift may be driven by institutional adoption of Bitcoin, which is increasingly viewed as a reliable asset for portfolio diversification. Conversely, Ethereum faces headwinds from regulatory uncertainty and the need for ongoing network upgrades. Despite the $41.20 million net outflow, the crypto ETF market remains strong, with AUM exceeding $113 billion.

The Role of Regulations and Economic Developments

The future growth of cryptocurrency ETFs will heavily depend on regulatory developments and broader economic trends. As governments and regulatory bodies worldwide clarify their stance on digital assets, investor confidence and participation are likely to evolve. Additionally, macroeconomic factors such as inflation, interest rates, and geopolitical stability will influence the attractiveness of crypto ETFs. The sector’s ability to adapt to these changes while maintaining transparency and compliance will be crucial for sustained growth. For now, the crypto ETF market continues to demonstrate resilience, with a strong foundation of over $113 billion in AUM.

Conclusion: The Road Ahead for Crypto ETFs

In summary, the past 30 days have highlighted the dynamic nature of the crypto ETF market. Bitcoin ETFs have emerged as the clear favorite among investors, with steady inflows and unmatched AUM. In contrast, Ethereum ETFs face challenges, reflecting broader uncertainties surrounding the second-largest cryptocurrency. Despite a net outflow of $41.20 million, the sector remains healthy, with total AUM surpassing $113 billion. Looking ahead, the crypto ETF market’s trajectory will be shaped by investor sentiment, regulatory clarity, and economic conditions. As digital assets continue to integrate into mainstream finance, crypto ETFs are poised to play a significant role in bridging traditional and digital markets.