The Paradox of China’s Crypto Policy: Blockchain Yes, Crypto Maybe

China’s stance on blockchain and cryptocurrency is a study in contrasts. On one hand, the Chinese government has wholeheartedly embraced blockchain technology, viewing it as a cornerstone of future innovation and development. On the other hand, it has been consistently hostile to cryptocurrencies, banning trading and imposing strict restrictions on their use. This dichotomy has left many in the crypto community scratching their heads, especially as neighboring Hong Kong begins to offer regulated crypto markets, creating a potential loophole that mainland investors might exploit. The question on everyone’s mind is: if China allows its investors to buy U.S. stocks through programs like the Qualified Domestic Institutional Investor (QDII), why not extend the same logic to Bitcoin? The answer, according to experts, lies in control—a theme that has defined Beijing’s approach to financial regulation.

The QDII Program: A Blueprint for Crypto Access?

China’s QDII program provides a fascinating case study for how the country might approach regulated crypto markets. Under QDII, select investors are allowed to purchase U.S. ETFs using RMB, but with a critical caveat: the program is tightly controlled, ensuring that capital does not flow freely out of China. Similarly, the Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect programs enable mainland investors to buy and sell Hong Kong stocks through domestic securities firms, with all trades settled in RMB. The key here is that while investors gain exposure to international markets, the capital itself never leaves China. This model could potentially be extended to cryptocurrencies, allowing mainland investors to trade crypto assets through regulated intermediaries without violating China’s strict capital controls.

Capital Controls: The Linchpin of China’s Financial Strategy

Capital controls are the backbone of China’s financial strategy, and they play a crucial role in maintaining the stability and value of the RMB. The government’s primary concern is preventing excessive currency fluctuations and capital flight, which could undermine the economy. This is why Hong Kong’s crypto ETFs, with their in-kind redemptions, have not been allowed on the mainland. However, experts argue that there is no inherent reason why a similar system to QDII couldn’t be applied to crypto assets. If Chinese investors could buy and sell crypto through a regulated intermediary using RMB, without any actual transfer of capital across borders, it would align perfectly with the existing framework for stock and ETF investments. The crypto assets themselves would be held by a licensed securities firm, much like mainland investors never directly hold the U.S. ETFs they purchase through QDII.

A New Model for Crypto Investment in China

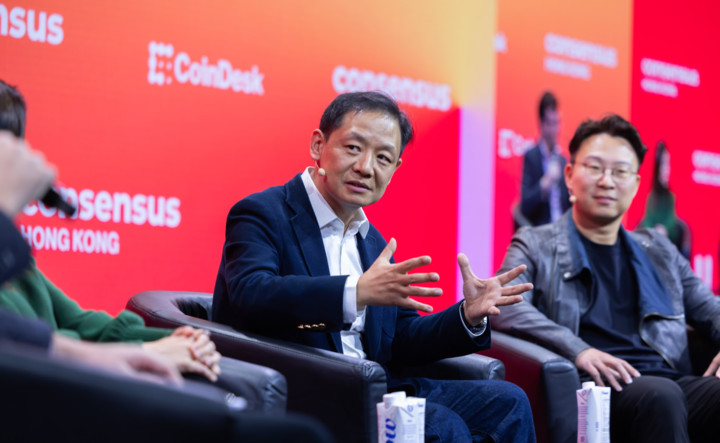

The model proposed by experts like Yifan He, CEO of Red Date Technology, would allow Chinese investors to gain exposure to crypto assets while keeping the actual custody of the assets with a licensed intermediary. This approach mirrors the way mainland investors currently trade U.S. ETFs through QDII—without ever taking direct custody of the underlying assets. In this scenario, Chinese investors could buy crypto directly, but the assets would be held by a security company, ensuring that no money moves across borders. This system would not only comply with China’s capital controls but also provide a regulated pathway for retail investors to participate in the crypto market without undermining the government’s financial stability goals.

Blockchain vs. Crypto: China’s Dual Approach

China’s distinction between blockchain technology and cryptocurrencies is deliberate and pragmatic. Blockchain is seen as a strategic technology with applications across industries, from finance to healthcare. The government has actively promoted its development, viewing it as essential for maintaining technological competitiveness on the global stage. Cryptocurrencies, on the other hand, have been treated with suspicion, largely due to their potential to disrupt capital controls and facilitate illicit financial activities. However, there are signs that this stance may be softening. Financial regulators are beginning to take a closer look at digital assets, and some experts believe there is now more than a 50% chance that China could open up to broader crypto adoption within the next three years.

The Future of Crypto in China: A Calculated Compromise

For a country with 200 million retail investors and an economy in need of stimulus, regulated access to crypto assets could offer a carefully calibrated compromise. By leveraging Hong Kong’s regulated crypto market as a sandbox, Beijing could provide mainland investors with controlled exposure to cryptocurrencies while maintaining its grip on capital flows. This approach would allow China to tap into the potential of digital assets without compromising its financial stability. While the path forward is still uncertain, the signals from regulators suggest that China may be on the verge of a significant shift in its crypto policy—one that could reshape the global financial landscape. As Yifan He quipped, you can take those odds to Polymarket.