The White House Announces a Strategic Bitcoin Reserve: A New Era for Digital Assets

Introduction to the Strategic Bitcoin Reserve

In a groundbreaking move, the White House has announced the establishment of a Strategic Bitcoin Reserve, a decision that marks a significant shift in how the U.S. government approaches digital assets. On Thursday, March 6, 2025, David Sacks, the White House’s crypto czar, revealed that President Trump had signed an Executive Order to create this reserve. The announcement sent shockwaves through the cryptocurrency market, sparking both intrigue and concern among industry insiders and analysts alike. The reserve is set to be capitalized with Bitcoin that is currently in the possession of the federal government, obtained through criminal or civil asset forfeiture proceedings. This move is seen as a strategic step to harness the value of Bitcoin, often referred to as "digital gold," and to create a "digital Fort Knox" for these assets.

Understanding the Strategic Bitcoin Reserve

The Strategic Bitcoin Reserve is designed to serve as a secure repository for the Bitcoin holdings of the U.S. government. According to estimates, the government currently holds approximately 200,000 BTC, which has been seized in various criminal or civil cases. The Executive Order mandates a comprehensive accounting of all digital assets held by the federal government, ensuring transparency and clarity in the management of these holdings. Sacks emphasized that the government has no intention of selling the Bitcoin deposited into the reserve, instead choosing to hold it as a store of value. This approach aligns with the idea that Bitcoin, like gold, can serve as a long-term asset that appreciates over time.

The Government’s Digital Asset Strategy: A Focus on Bitcoin

The announcement also clarified that the U.S. government will not be expanding its cryptocurrency holdings beyond what it already possesses through forfeiture proceedings. This means that the government will not be purchasing additional Bitcoin or other cryptocurrencies, such as Ethereum, XRP, Solana, or Cardano, to add to its reserve. This decision is in line with President Trump’s earlier remarks, in which he mentioned a list of altcoins that were met with skepticism by many within the Bitcoin community, who labeled them as “shitcoins.” The focus on Bitcoin underscores the administration’s belief in its superior value and stability compared to other cryptocurrencies.

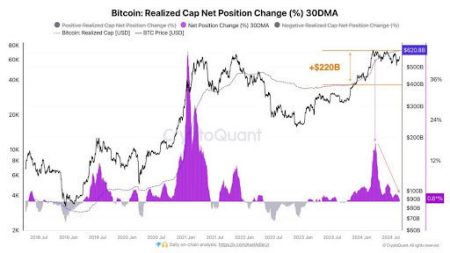

The Market Reacts: A $200 Billion Loss and Growing Skepticism

Despite the bullish sentiment that one might expect from such a move, the cryptocurrency market reacted negatively to the announcement. Within hours of the news breaking, the total market capitalization of cryptocurrencies plummeted by over $200 billion, a staggering 5% drop. This brought the total capitalization below $3 trillion, a stark reminder of the volatility that continues to plague the crypto market. Bitcoin, which had been trading at around $90,000, saw its value drop by $5,000 within a short period, falling to $85,000 before partially recovering to $87,000. Ethereum similarly experienced a 5% drop, falling to $2,150. Altcoins such as XRP, SOL, and ADA were hit even harder, with losses ranging from 8% to 10%.

Industry Reactions: Skepticism and Ridicule

The announcement of the Strategic Bitcoin Reserve and the government’s decision to stockpile digital assets has been met with skepticism and even ridicule from some industry executives and analysts. When President Trump first proposed the idea on March 2, 2025, he mentioned several altcoins, which many prominent Bitcoiners dismissed as inferior. The concept of a government-run digital asset reserve has been particularly contentious, with some questioning the wisdom of centralizing digital assets, given the decentralized nature of cryptocurrencies. Despite the criticism, David Sacks remain