Origin Token (OGN) Faces Severe Market Turbulence: What Investors Need to Know

Understanding Origin Protocol and Its Native Token

For those invested in or watching the cryptocurrency space, Origin Token (OGN) deserves your immediate attention. This digital asset serves as the backbone of Origin Protocol, an innovative decentralized finance platform that’s reimagining how we conduct commerce online. Think of it as a marketplace where buyers and sellers can connect directly without the usual middlemen taking their cut. The protocol enables people to buy and sell goods and services through decentralized platforms, eliminating traditional intermediaries like payment processors and marketplace operators. This means lower fees for everyone involved and more control over transactions. However, despite this promising foundation, the token is currently experiencing significant headwinds that have caught the attention of prominent market analysts, particularly Crypto Patel, who has issued warnings that investors shouldn’t ignore.

The fundamental idea behind Origin Protocol is compelling – creating a true peer-to-peer commerce ecosystem where transactions happen directly between parties in a decentralized manner. This approach theoretically benefits both buyers and sellers by reducing costs and increasing transparency. But like many promising technologies in the crypto space, having a good concept doesn’t automatically translate to price stability or growth, especially when market conditions turn unfavorable.

The Current Price Situation and Recent Declines

The numbers tell a sobering story for OGN holders. As of the latest data, Origin Token is trading at approximately $0.02229, which represents a small 3.3% uptick over the past day. While that single-day movement might seem encouraging, zooming out reveals a much more concerning picture. Over the past week, the token has dropped 17.9%, and the monthly decline stands at a steep 27.0%. These aren’t small fluctuations – they represent significant value erosion that has understandably made investors nervous and cautious about their positions.

What makes this situation particularly worrisome is the velocity of the decline. Cryptocurrency prices are notoriously volatile, but sustained double-digit percentage drops over consecutive timeframes suggest something more than normal market fluctuation. This pattern indicates that investor confidence in the token has been shaken, whether due to specific concerns about Origin Protocol itself or broader market conditions affecting the entire cryptocurrency ecosystem. The sharp price movements have created an atmosphere of uncertainty, with many holders questioning whether they should cut their losses or wait for a potential recovery.

Why Analyst Crypto Patel Sees Further Downside

Market analyst Crypto Patel has laid out a detailed case for why he expects OGN to decline further, and his reasoning is based on multiple technical indicators that all point in the same bearish direction. In his analysis shared on social media platform X, Patel highlighted several specific factors that have shaped his negative outlook. First among these is the market structure itself, which shows a clear bearish pattern characterized by “lower lows” and “lower highs” – technical terms that describe a downward staircase pattern where each price peak is lower than the previous one, and each valley is also lower than before. This pattern indicates that sellers are firmly in control, consistently pushing prices down.

Beyond just the price pattern, Patel pointed to on-chain data showing that OGN is currently trading below its 7-day, 30-day, and 200-day moving averages. Moving averages are important technical indicators that smooth out price data to show the underlying trend, and when a price falls below these key levels, it typically signals oversold conditions and momentum working against the asset. The fact that OGN has broken below all three suggests there’s no immediate bullish reversal in sight. Additionally, Patel identified that while the token is currently holding around the $0.0299 support zone (a price level where buying interest has historically emerged), the formation of what’s called a “bearish pennant pattern” on the weekly higher timeframe chart suggests that if this support breaks, the token could see another 23% decline from current levels.

Patel’s specific entry point for a short position sits at $0.02600 (the 1D FVG or Fair Value Gap), with a stop loss at $0.02854, and targets ranging down to $0.02280, $0.02050, and potentially as low as $0.01870. His analysis also mentions concepts like “buyside liquidity sweep” and “mean reversion toward external liquidity,” which are advanced trading concepts suggesting that the price might temporarily rise to trigger buy orders before reversing downward again.

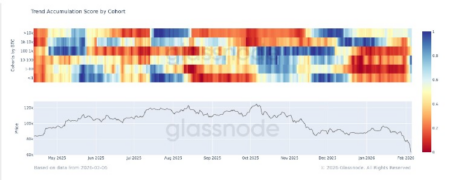

Broader Market Context and Extreme Fear

While OGN’s troubles might seem isolated to that particular token, the reality is that the entire cryptocurrency market is currently experiencing extreme turbulence. The Coinglass Fear and Greed Index, which measures market sentiment across the crypto ecosystem, currently registers at just 5 out of 100 – a reading that indicates “extreme fear.” This is significant because it tells us that OGN’s decline isn’t happening in a vacuum. Instead, it’s part of a broader panic that’s gripping the entire market, with investors fleeing from risky assets across the board.

When market sentiment turns this negative, even fundamentally sound projects can see their token prices decline simply because investors are selling everything to move to safer assets or cash. This creates a challenging environment where technical factors, fundamental analysis, and project quality all take a backseat to raw emotion and risk aversion. The extreme fear reading suggests that investors are expecting further declines across the market, creating a self-fulfilling prophecy as selling begets more selling. For OGN specifically, this means the token faces headwinds both from its own technical weaknesses and from the broader market’s negative sentiment.

Trading Volume Collapse Signals Deep Concern

Perhaps one of the most alarming indicators for OGN comes from trading volume data. According to CoinMarketCap, OGN’s trading volume has plummeted by 47.56% recently. This isn’t just a technical statistic – it tells us something important about investor behavior. When trading volume drops this dramatically during a price decline, it typically indicates that the selling pressure comes from panic rather than strategic profit-taking. In other words, investors aren’t carefully evaluating their positions and making calculated decisions to exit; they’re rushing for the doors because they’re afraid of further losses.

This distinction matters because panic-driven selloffs can create opportunities for contrarian investors, but they can also signal genuine problems that the market is recognizing before they become widely known. The volume collapse suggests that liquidity is drying up in OGN markets, which means that even relatively small sell orders can have outsized impacts on price. This creates a potentially dangerous feedback loop where declining prices lead to more panic, which leads to more selling, which pushes prices even lower due to thin liquidity. For investors still holding positions, this creates a dilemma: selling might mean taking a significant loss, but holding could mean watching the value erode further if the analyst’s predictions prove accurate.

What This Means for Investors Going Forward

For anyone holding Origin Token or considering entering a position, the current situation demands careful consideration and realistic expectations. The technical indicators, analyst warnings, and market context all suggest significant near-term challenges ahead. If Crypto Patel’s analysis proves correct and the support level breaks, the 23% further decline would bring additional pain to already-battered portfolios. However, it’s important to remember that market analysis, even when conducted by experienced analysts, isn’t prophecy. Markets can behave unpredictably, and sentiment can shift rapidly, especially in the volatile cryptocurrency space.

The smartest approach for most investors involves honest assessment of their risk tolerance and investment thesis. If you invested in OGN because you believe in the long-term vision of decentralized commerce and the Origin Protocol’s ability to execute on that vision, then short-term price movements, while painful, might not change your fundamental position. Long-term investors often view significant declines as opportunities to acquire more of an asset they believe in at discounted prices. However, if your investment was based primarily on price momentum or short-term trading, the current technical setup clearly suggests caution.

For those considering new positions, Crypto Patel’s analysis provides specific levels to watch. Waiting for the price to reach his entry point and then confirming the bearish thesis with lower timeframe confirmation would be the disciplined approach for anyone looking to profit from the anticipated decline. Conversely, those looking for potential long entries might wait for signs of a genuine reversal – such as the price holding above support levels, volume increasing on up days, or the broader market fear index starting to improve. Whatever approach investors choose, the current environment demands vigilance, risk management through position sizing and stop losses, and a clear plan for both scenarios: further decline or unexpected recovery. In today’s crypto market, hope is not a strategy, but informed decision-making based on multiple data points can help navigate these turbulent waters.