OKX Settles with the US Department of Justice: A Major Step in Regulatory Compliance

In a significant move to address its regulatory challenges, OKX, one of the world’s leading cryptocurrency exchanges, recently announced that it has reached a settlement with the US Department of Justice (DoJ), resolving previous investigations. The settlement involves OKX pleading guilty to several charges and agreeing to pay over $504 million in fines and forfeitures. This development marks a critical milestone in the exchange’s efforts to navigate the complex regulatory landscape in the US and globally.

Background and Key Details of the Settlement

OKX, which has been actively working to strengthen its regulatory compliance efforts worldwide, has faced scrutiny from US authorities over its operations. The exchange acknowledged that a small percentage of its US customers were able to use its international services due to historical compliance gaps. OKX has since claimed that its compliance controls are now among the strongest in the industry. In a statement, the company emphasized cooperation with the DoJ and described the matter as a "misunderstanding," though the DoJ’s press release painted a different picture, describing the violations as “flagrant” and “blatant disregard” for the law.

The settlement specifically involves Aux Cayes FinTech Co. Ltd., the operator of OKX, which admitted to allowing US customers to trade on its platforms without proper licensing. As part of the agreement, OKX will pay an $84 million fine and forfeit $421 million in user fees. This concludes a lengthy investigation into the firm’s activities, marking the end of a challenging chapter for the exchange.

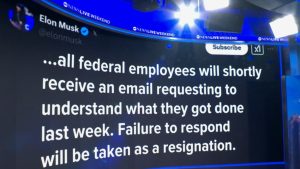

The DoJ’s Stance: A Firm Message to Crypto Exchanges

The US Department of Justice’s response to OKX’s settlement is notable for its severity. While OKX framed the resolution as a minor oversight, the DoJ’s language was starkly different. Officials emphasized that OKX had pled guilty to serious offenses, characterizing the violations as “flagrant” and “blatant.” This tough stance stands out compared to other federal regulators, such as the SEC, which recently dropped a major lawsuit against Coinbase and quietly dismissed an investigation into Robinhood’s potential misconduct.

The DoJ’s approach highlights a growing trend of increased regulatory scrutiny in the cryptocurrency space. While the broader attitude toward crypto in the US remains uncertain, the DoJ’s firm handling of OKX suggests that violations will not be taken lightly. The settlement underscores the government’s expectations for compliance and transparency within the industry.

Broader Implications for the Crypto Industry

The resolution of OKX’s case with the DoJ is more than just a legal or financial matter; it reflects a broader shift in how regulators are approaching the cryptocurrency industry. As the crypto market continues to mature, governments and regulatory bodies are increasingly demanding higher standards of compliance. OKX’s settlement serves as a reminder that even major exchanges are not immune to scrutiny and must adhere to the rules governing their operations.

The timing of the settlement is also significant. It comes on the heels of other major developments, such as OKX’s recent acquisition of a MiCA (Markets in Crypto-Assets) license for its operations in the European Union, allowing it to operate legally in the bloc. However, the exchange has also faced criticism for listing Pi Network’s token despite warnings from Chinese authorities, a decision that has raised eyebrows within the industry. These mixed signals highlight the challenges crypto companies face in balancing innovation with compliance.

OKX’s Road to Compliance: A Global Journey

OKX’s settlement with the DoJ is part of a larger effort to strengthen its regulatory standing worldwide. In addition to securing the MiCA license, the exchange has been actively working to address compliance issues in other jurisdictions. However, like many crypto exchanges, OKX operates in a complex and sometimes contradictory global regulatory environment, where laws and expectations vary significantly by country.

The settlement with the DoJ is a clear acknowledgment of past shortcomings, but OKX has emphasized its commitment to moving forward. The exchange has stated that its compliance controls are now among the best in the industry, a claim it will need to back up as it continues to expand its operations. For OKX, this settlement is not just about resolving past issues but also about positioning itself as a responsible player in the global crypto market.

Conclusion: A Costly but Necessary Step Forward

For OKX, the $504 million settlement is a hefty price to pay, but it is also a step toward putting legal challenges behind it. Despite the financial burden, the exchange expressed relief at resolving the matter, acknowledging that the cost was worthwhile to regain favor with US authorities. With over $1.5 billion in revenue last year and significant holdings and trading volumes, OKX has the resources to absorb this expense. However, the settlement serves as a reminder of the risks of non-compliance in the increasingly regulated crypto landscape.

The DoJ’s tough stance on OKX also sends a clear message to the broader crypto industry: compliance is non-negotiable. As regulators worldwide continue to tighten their grip on the sector, exchanges and other crypto companies will need to prioritize transparency, adherence to laws, and robust compliance measures to avoid similar fates. For OKX, the settlement marks both an end and a beginning—a resolution to past issues and a commitment to operating in a more regulated and accountable manner moving forward.