Federal Reserve Leadership Change Sparks Growing Expectations for March Interest Rate Cut

Shifting Market Sentiment Following Warsh Nomination

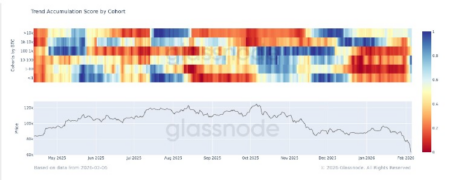

Financial markets are showing increasing anticipation of a potential interest rate reduction at the upcoming March Federal Open Market Committee meeting, with nearly a quarter of traders now betting on such a move. According to the latest data from the Chicago Mercantile Exchange Group, approximately 23% of market participants are currently expecting the Federal Reserve to lower interest rates when policymakers convene next month. This represents a notable shift in market sentiment, climbing roughly 5 percentage points from the previous Friday when only about 18% of traders were pricing in a rate cut. The change in expectations comes amid heightened uncertainty following President Donald Trump’s announcement that Kevin Warsh would be his choice to lead the Federal Reserve once current Chairman Jerome Powell’s term concludes in May.

Those traders who are positioning for a rate reduction are specifically forecasting a modest 25 basis point decrease, which translates to a quarter-percentage-point cut in the benchmark federal funds rate. Interestingly, market data shows that no investors are currently anticipating a more aggressive monetary policy shift, with zero expectations for a cut of 50 basis points or larger. This conservative outlook suggests that while some market participants see room for the Fed to ease monetary policy, they don’t anticipate any dramatic shifts in the central bank’s approach to managing inflation and economic growth. The speculation around interest rate policy has taken on added significance given the leadership transition at the nation’s central bank and questions about how the incoming chair might approach monetary policy differently than his predecessor.

The Connection Between Interest Rates and Cryptocurrency Values

Understanding why cryptocurrency investors and traders are paying such close attention to Federal Reserve policy decisions requires recognizing the fundamental relationship between interest rates and digital asset valuations. When the Federal Reserve lowers interest rates, it creates what economists call “easing liquidity conditions” in financial markets. In practical terms, this means money becomes cheaper to borrow and more cash flows through the economic system, which historically has served as a positive catalyst for cryptocurrency prices. Investors tend to view rate cuts as encouragement to take on more risk and invest in growth-oriented assets, including digital currencies like Bitcoin and Ethereum.

Conversely, when the Federal Reserve raises interest rates or maintains them at elevated levels—a policy stance known as “tightening”—it can negatively impact cryptocurrency prices and other risk assets. Higher interest rates make borrowing more expensive and can cause investment capital to dry up as financing becomes harder to access. Additionally, higher rates make traditional safe-haven investments like Treasury bonds more attractive compared to volatile assets like cryptocurrencies, potentially drawing investment dollars away from the crypto market. This fundamental economic relationship explains why cryptocurrency traders monitor Federal Reserve meetings and policy announcements so closely, recognizing that decisions made in the marble halls of the central bank can have immediate and substantial effects on their digital asset portfolios.

Market Anxiety Over the Incoming Fed Chairman’s Policy Stance

The financial community’s reaction to Kevin Warsh’s nomination has been anything but calm, according to market analysts who have been tracking investor sentiment. Crypto market analyst Nic Puckrin characterized the situation bluntly, stating that “the nomination of Kevin Warsh as the next Fed Chair has shaken markets to the core.” This strong language reflects genuine concern among investors about how monetary policy might evolve under new leadership. Puckrin pointed to concrete market movements as evidence of this anxiety, noting that precious metals—traditionally viewed as safe-haven investments—experienced sharp declines in late January and early February as investors processed what a Warsh-led Federal Reserve might mean for their portfolios.

The primary concern among market watchers centers on Warsh’s reputation as a monetary policy “hawk”—a term used to describe policymakers who favor maintaining higher interest rates for extended periods to ensure inflation remains under control. This hawkish orientation contrasts with a “dovish” approach that prioritizes economic growth and employment, often through lower interest rates. Puckrin highlighted specific comments from Warsh that have contributed to market unease, particularly his view that the Federal Reserve’s balance sheet is “trillions larger than it needs to be.” This assessment suggests Warsh may pursue policies aimed at shrinking the central bank’s holdings of securities, which would effectively remove liquidity from financial markets. As Puckrin explained, if Warsh follows through on implementing policies to reduce the Fed’s balance sheet, “markets will have to reckon with a lower-liquidity environment”—a scenario that could prove challenging for assets that thrive in conditions of abundant available capital, including cryptocurrencies.

Mixed Signals Creating Uncertainty for Cryptocurrency Investors

Adding another perspective to the discussion, Thomas Perfumo, who serves as a global economist at major cryptocurrency exchange Kraken, told Cointelegraph that Warsh’s nomination delivers what he characterized as a “mixed” macroeconomic signal to the investment community. This assessment captures the complexity facing traders trying to position themselves appropriately for the changing leadership at the Federal Reserve. On one hand, Warsh brings extensive financial expertise and market credibility; on the other hand, his known policy preferences suggest a more conservative approach to monetary expansion than some investors had hoped for.

Perfumo’s analysis suggests that the selection of Warsh may indicate that liquidity conditions and credit availability in the United States will stabilize at current levels rather than expand significantly—a development that runs counter to what many cryptocurrency investors had been anticipating and hoping for. Throughout recent market cycles, the crypto community has generally benefited from periods of monetary expansion when the Federal Reserve has kept interest rates low and its balance sheet large. These conditions create an abundance of investment capital seeking returns, and cryptocurrencies have frequently been beneficiaries of this dynamic. The prospect that this era of expanding liquidity might be ending or at least pausing has introduced considerable uncertainty into cryptocurrency market outlooks and investment strategies.

Broader Implications for Financial Markets and Investment Strategy

The current situation represents more than just speculation about a single interest rate decision—it reflects a potentially significant inflection point for monetary policy and financial markets more broadly. The transition from Jerome Powell to Kevin Warsh as Federal Reserve chairman occurs against a backdrop of ongoing debates about inflation, economic growth, employment levels, and the appropriate role of the central bank in managing these sometimes-competing priorities. Market participants are essentially trying to anticipate not just what will happen at the March FOMC meeting, but what the entire trajectory of monetary policy might look like over the coming years under new leadership.

For cryptocurrency investors specifically, this period of transition creates both risks and opportunities. Those who correctly anticipate the direction of monetary policy can position their portfolios advantageously, while those who miscalculate may face headwinds as market conditions shift. The fact that expectations for a March rate cut have risen to 23%—while still a minority position—suggests that markets remain divided about the near-term path forward. Some investors apparently believe that current economic conditions warrant modest monetary easing regardless of leadership changes at the Fed, while the majority remain skeptical that such action will materialize. As the March FOMC meeting approaches and as Warsh’s confirmation process proceeds, market participants will continue analyzing every statement and signal for clues about the future direction of monetary policy and what it means for their investments in both traditional assets and the evolving cryptocurrency ecosystem.