Trump’s Fed Chair Pick Sparks Rate Cut Speculation Amid Crypto Market Uncertainty

The Warsh Nomination Changes Market Expectations

When President Donald Trump announced his choice of Kevin Warsh to lead the Federal Reserve, replacing Jerome Powell whose term ends in May, financial markets immediately began recalculating their expectations for the future of American monetary policy. The announcement has created a fascinating dynamic where investors are simultaneously hopeful for interest rate cuts while remaining wary of Warsh’s reputation as someone who favors a more conservative approach to central banking. According to recent data from the Chicago Mercantile Exchange, the likelihood that markets are assigning to a rate cut at the March Federal Open Market Committee meeting has climbed to approximately 23%, representing a notable increase from the 18.4% probability that traders were pricing in just days before the announcement. This shift isn’t just a minor statistical fluctuation—it represents a meaningful change in how investors view the near-term trajectory of monetary policy. Traders are specifically betting on a 25-basis-point reduction, which signals growing speculation that despite Warsh’s traditionally hawkish stance, the new Fed chair might guide policy toward a more accommodative stance. What makes this particularly interesting is that these market movements are happening even as current Federal Reserve policymakers continue to signal caution about making any dramatic shifts in interest rate policy.

Mixed Messages Creating Market Confusion

The financial community finds itself in somewhat uncharted territory, trying to reconcile Kevin Warsh’s well-documented policy preferences with the current economic environment and political pressures. Crypto analyst Nic Puckrin captured the sentiment perfectly when he observed that “The nomination of Kevin Warsh as the next Fed Chair has shaken markets to the core.” This wasn’t hyperbole—precious metals markets experienced declines in late January and early February as investors began processing what a Warsh-led Federal Reserve might mean for their portfolios. Puckrin pointed out that investors are particularly focused on Warsh’s historical criticism of the Federal Reserve’s expanded balance sheet, which grew substantially during previous economic crises as the central bank purchased assets to inject liquidity into the financial system. If Warsh follows through on his stated preferences and pursues aggressive balance sheet reduction, investors could face a significantly more constrained liquidity environment than what they’ve grown accustomed to in recent years. Thomas Perfumo, who serves as a global economist at cryptocurrency exchange Kraken, echoed these concerns by noting that Warsh’s nomination sends a fundamentally divided macroeconomic message to markets. For cryptocurrency markets specifically, Perfumo suggested that traders may need to mentally prepare for an environment characterized by stable or even declining US liquidity and credit conditions rather than the expanding liquidity that typically benefits digital assets.

Cryptocurrency Markets Brace for Policy Shifts

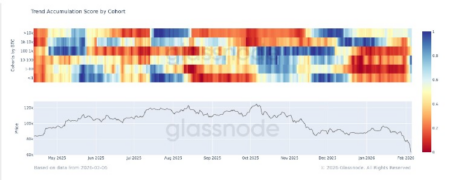

The cryptocurrency community is watching these developments with particular attention because digital assets have historically shown sensitivity to liquidity conditions and interest rate policies. When central banks cut rates and inject liquidity into the financial system, riskier assets like cryptocurrencies tend to benefit as investors search for higher returns and as the opportunity cost of holding non-yielding assets decreases. Conversely, when rates rise and liquidity tightens, cryptocurrencies often face headwinds as investors rotate toward safer, yield-generating investments. The prediction markets on Polymarket reveal the uncertainty that crypto traders are feeling about the Fed’s direction over the coming year. Currently, 27% of traders on the platform believe there will be two rate cuts this year, while a nearly identical 26% are wagering on three cuts. Only 13% see the possibility of four rate cuts materializing, suggesting that most traders don’t expect a dramatic shift toward monetary easing even with the leadership change. This distribution of expectations reflects the complexity of the current situation—while some hope that political pressure or economic conditions might push even a traditionally hawkish Fed chair toward rate cuts, others are taking Warsh’s historical policy positions seriously and preparing for an environment that remains relatively restrictive by recent standards.

Bitcoin’s Potential to Defy Traditional Patterns

Perhaps the most intriguing perspective on how cryptocurrency markets might navigate this uncertain policy environment comes from Jeff Park, the chief investment officer at ProCap Financial, who suggests that the crypto community might need to fundamentally rethink some of its assumptions about what drives digital asset prices. Park challenges the conventional wisdom that has dominated cryptocurrency investment thinking for years—the idea that falling interest rates and quantitative easing are necessary prerequisites for sustained bull markets in Bitcoin and other digital assets. “I think we should expect that having more accommodative policies may, in fact, actually not be the catalyst to help us go into a bull market. We have to accept that reality and possibility,” Park stated, encouraging investors to prepare mentally for a scenario that differs from the typical playbook. He goes further to suggest that Bitcoin’s biggest rally might actually occur if the cryptocurrency continues climbing even in an environment of elevated Federal Reserve interest rates, a phenomenon he refers to as “positive row Bitcoin.” This scenario would represent a fundamental departure from the quantitative easing theory that has dominated cryptocurrency market analysis, where digital assets were expected to benefit primarily from central bank money printing and declining rates.

The Holy Grail Scenario and Its Implications

Park’s vision of Bitcoin rising alongside interest rates represents what he calls “the mythical, elusive perfect holy grail of what Bitcoin is meant to be”—a truly independent store of value that appreciates regardless of traditional monetary policy settings. This counterintuitive scenario would fundamentally challenge how traditional finance prices assets and calculates risk. If Bitcoin were to establish itself as an asset that thrives even when interest rates rise, it would compromise the reliability of the risk-free rate as a baseline for valuing other investments, potentially upending the mathematical models that underpin modern portfolio theory and asset pricing. Park acknowledges the radical nature of this possibility, noting that it would mean traditional methods for pricing the yield curve would no longer function as reliably as they have for decades. However, he also offers a broader critique of the current monetary system, suggesting that its flaws are already apparent and that the coordination between the Federal Reserve and the Treasury Department isn’t as effective as it needs to be for properly managing national securities and economic stability. From this perspective, Bitcoin’s potential to behave independently of traditional monetary policy isn’t just a theoretical curiosity—it could represent a genuine alternative that gains appeal as confidence in conventional monetary management wavers.

Navigating Uncertainty in the Months Ahead

As financial markets move through the transition period before Kevin Warsh officially takes the helm at the Federal Reserve, investors across all asset classes face the challenge of positioning themselves for multiple possible futures. The 23% probability now assigned to a March rate cut represents market participants’ attempts to price in possibilities even before official policy signals emerge, reflecting the high stakes involved in getting the Fed’s direction right. For cryptocurrency investors specifically, the coming months will test whether digital assets can maintain momentum in a potentially less favorable liquidity environment, or whether they might even demonstrate the kind of independence from traditional monetary policy that Park envisions. The diversity of opinions among analysts and the spread of probabilities in prediction markets suggests that no consensus has emerged about the most likely path forward. What seems clear is that the nomination of Kevin Warsh has injected fresh uncertainty into monetary policy expectations at a time when markets were already grappling with questions about inflation, economic growth, and the appropriate stance for central bank policy. Whether this uncertainty resolves into the accommodative policies that some traders are betting on, the more restrictive approach that Warsh’s reputation suggests, or something entirely different will have profound implications not just for traditional financial markets but for the evolving cryptocurrency ecosystem that has become increasingly intertwined with broader macroeconomic conditions.