**President Trump Signs Executive Order to Establish Strategic Bitcoin Reserve**

In a significant move to solidify the United States’ position in the digital asset space, President Donald Trump has signed an executive order creating a Strategic Bitcoin Reserve. This initiative is part of a broader strategy to leverage Bitcoin and other cryptocurrencies as a long-term store of value for the nation. The reserve will be capitalized exclusively with Bitcoin that has been seized through criminal and civil forfeiture cases, ensuring that the financial burden does not fall on taxpayers. This approach aims to maximize the potential of digital assets without dipping into public funds.

**Funding the Reserve: Seized Assets and Taxpayer Relief**

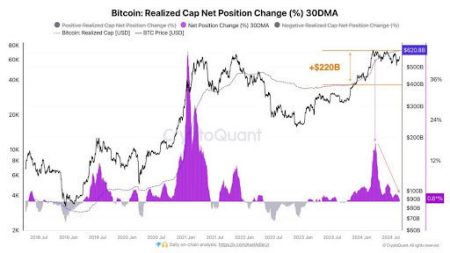

The Strategic Bitcoin Reserve will primarily be funded with Bitcoin confiscated in criminal and civil asset forfeiture proceedings. Estimated to hold around 200,000 Bitcoin, the U.S. government has accumulated a substantial amount of cryptocurrency through various legal actions. However, an official audit to confirm the exact figure is yet to be conducted. By utilizing seized assets, the reserve avoids imposing additional costs on taxpayers, making it a cost-effective initiative. This strategy aligns with the administration’s goal of enhancing the country’s financial stability through innovative asset management.

**Comprehensive Review and Prohibition of Bitcoin Sales**

President Trump’s executive order mandates a thorough review of the federal government’s digital asset holdings. This review will provide a clearer understanding of the current portfolio and help in making informed decisions regarding the management of these assets. Furthermore, the order prohibits the sale of Bitcoin from the reserve, signaling a commitment to treating it as a long-term investment rather than a liquid asset. This prohibition ensures that the reserve serves as a stable and secure store of value, safeguarding against market volatility.

**Expansion Beyond Bitcoin: The U.S. Digital Asset Stockpile**

While the Strategic Bitcoin Reserve focuses on Bitcoin, the executive order also establishes a U.S. Digital Asset Stockpile. This stockpile, managed by the Treasury Department, will encompass other confiscated cryptocurrencies. The inclusion of assets like Ethereum (ETH), Ripple (XRP), Solana’s SOL token, and Cardano’s ADA coin reflects the administration’s recognition of the diversity and potential within the digital asset ecosystem. This move is expected to diversify the nation’s digital holdings and foster innovation in the crypto sector.

**Reactions from Crypto Investors and Trump Supporters**

The announcement of the Strategic Crypto Reserve has sparked mixed reactions within the crypto community. Some investors who have been vocal supporters of President Trump expressed concerns upon learning that the reserve would include other cryptocurrencies alongside Bitcoin. These concerns likely stem from the belief that diversification might dilute Bitcoin’s prominence. However, others view this as a positive step towards broader adoption and recognition of the multifaceted nature of digital assets.

**Implications for the Future of Digital Assets in the U.S.**

The establishment of the Strategic Bitcoin Reserve and the U.S. Digital Asset Stockpile underscores the growing importance of cryptocurrencies in the nation’s economic strategy. By leveraging seized assets, the government is not only enhancing its financial capabilities but also signaling a proactive approach to the evolving digital landscape. As the administration continues to explore the potential of digital assets, this initiative sets the stage for further developments in regulation, innovation, and financial security. This move is poised to have a lasting impact on the U.S. economy and its position in the global digital economy.