Solana’s Selection in the U.S. Crypto Reserve: A Major Milestone for the Ecosystem

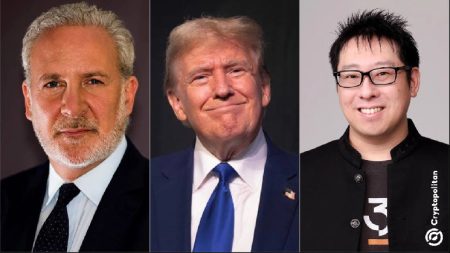

The cryptocurrency world has been abuzz with excitement following a historic announcement by President Trump regarding the creation of a U.S. Crypto Strategic Reserve. Among the cryptocurrencies selected for this prestigious reserve is Solana (SOL), marking a significant milestone for the Solana ecosystem. This recognition not only underscores the U.S. government’s growing acceptance of digital assets but also highlights Solana’s potential as a key player in the crypto space. The inclusion of SOL in the reserve is a testament to its robust network growth, liquidity, and overall market confidence, positioning it as one of the preferred assets for the next major bullish wave in the crypto market.

Solana Price Action Surges in Response to the Announcement

The news of Solana’s inclusion in the U.S. Crypto Reserve sent shockwaves through the market, triggering a massive bullish rally for SOL. After a challenging February where the price dipped to a low of $125.55, Solana’s price surged to $179.85 following the announcement. While it retraced slightly to $166 at press time, this still represented a 31% gain from its recent low and a 42% increase from its daily high. This price action not only pulled SOL out of oversold territory but also indicated a strong shift in investor sentiment. Technical indicators such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) further confirmed this bullish momentum, with the RSI rising to 46 and the MACD forming a bullish crossover. Analysts are now optimistic that this could be the start of a new upward trend, with some predicting that SOL could push past the $200 mark in the coming weeks.

Solana’s Network Growth and Liquidity: A Strong Foundation

Behind the price rally is Solana’s impressive network growth, which has been a key factor in its selection for the U.S. Crypto Reserve. Despite the bearish price action in February, Solana maintained healthy growth in key metrics such as Total Value Locked (TVL) and stablecoin market capitalization. Its TVL surged to 66.33 million coins by February 27, nearing its previous all-time high set in 2022. Similarly, Solana’s stablecoin market capitalization reached a record $12.67 billion on February 12, reflecting increased liquidity and investor confidence. These metrics highlight Solana’s robust ecosystem and its ability to attract and retain capital, making it an attractive choice for inclusion in the U.S. Crypto Reserve.

Solana’s Active Address Growth: A Sign of Adoption

Another significant factor contributing to Solana’s selection is its impressive address growth. Recent data revealed that Solana now boasts 2.43 million active addresses, matching the numbers of the Tron network. This growth is particularly notable given Solana’s relatively short history in the crypto space and demonstrates its increasing popularity among users. The surge in active addresses not only reflects greater adoption but also points to the network’s scalability and usability, which are critical factors for long-term success. This growth has been a key driver of Solana’s inclusion in the U.S. Crypto Reserve, further solidifying its position as a leading blockchain platform.

The Future Implications of Solana’s Inclusion in the U.S. Crypto Reserve

The inclusion of Solana in the U.S. Crypto Reserve is expected to have far-reaching implications for both the network and the broader crypto market. For Solana, this recognition could lead to increased institutional adoption, as the U.S. government’s endorsement adds credibility and trust to the network. Additionally, the reserve status may attract more liquidity, further driving up the price of SOL and positioning it as a preferred asset during the next major market rally. This could also set a precedent for other cryptocurrencies, as governments worldwide begin to explore similar reserve strategies, potentially accelerating the mainstream adoption of digital assets.

Risks and Challenges: A Balanced Perspective

While the inclusion of Solana in the U.S. Crypto Reserve is undoubtedly a positive development, it is important to acknowledge the associated risks and challenges. The crypto market remains highly volatile, and while the current price action suggests a bullish trend, market conditions can shift rapidly. Regulatory changes, geopolitical factors, and technological advancements could all impact Solana’s performance in the coming months. Furthermore, while Solana’s network growth is impressive, it must continue to innovate and improve its infrastructure to maintain its competitive edge. Investors should remain vigilant and consider these factors when making investment decisions.

Conclusion: A New Era for Solana and the Crypto Market

The inclusion of Solana in the U.S. Crypto Reserve marks the beginning of a new era for both the network and the broader cryptocurrency market. With its robust network growth, increasing liquidity, and growing adoption, Solana is well-positioned to capitalize on this momentum. As the crypto market continues to evolve, Solana’s inclusion in the reserve is likely to play a pivotal role in shaping its future trajectory. While challenges remain, the current outlook is promising, and the next few months could be transformative for SOL and the crypto space as a whole.