Navigating the New Economic Landscape: Bitcoin’s Emerging Role

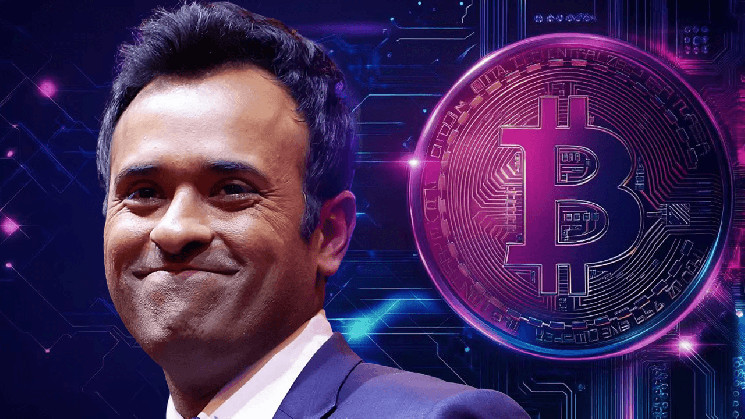

In today’s evolving economic environment, marked by tightening monetary policies, businesses are compelled to reevaluate their financial strategies. This shift has sparked interest in alternative assets, with Bitcoin emerging as a potential staple in corporate treasuries. Entrepreneur and former presidential candidate Vivek Ramaswamy predicts that as the era of easy money fades, Bitcoin will become a key player in institutional finance. This transition signals a broader change in how companies manage their funds, moving away from traditional assets towards more resilient options.

Bitcoin as a Hedge: Ramaswamy’s Perspective

Vivek Ramaswamy, renowned for his advocacy of Bitcoin, suggests that companies will increasingly adopt Bitcoin as a hedge against economic uncertainties like inflation. He points to the success of firms like MicroStrategy, which have leveraged Bitcoin to enhance their treasury reserves. Ramaswamy’s argument is bolstered by the growing interest from corporate entities in holding Bitcoin, a trend that reflects a shifting mindset towards embracing digital assets as a strategic safeguard.

Support and Reactions: A Diverse Perspective

The debate sparked by Ramaswamy’s remarks showcases a range of opinions. Preston Pysh, co-founder of The Investor’s Podcast, endorses the idea, highlighting the importance of Bitcoin holdings relative to traditional assets. Others, like a user invoking a maritime metaphor, emphasize Bitcoin’s role in economic survival, urging companies to avoid debased assets. These reactions illustrate the dynamic discussion around Bitcoin’s potential, blending support with critical scrutiny.

Counterarguments and the Maritime Metaphor

Critics caution against overoptimism, using analogies like the maritime metaphor to stress the challenges of adapting to new economic realities. They argue that while Bitcoin offers protection against devaluation, not all companies may navigate this transition successfully. This viewpoint underscores the potential risks and the need for strategic agility in a changing financial landscape.

Implications for Corporate Strategies and Economic Survival

The shift towards higher hurdle rates due to tighter monetary policies means companies must prioritize investments with clear returns. Bitcoin, with its scarcity, offers a unique value proposition as a shield against economic instability. This strategic focus on resilience could redefine corporate finance, making Bitcoin an essential tool for navigating austerity and ensuring long-term viability.

Conclusion: Bitcoin’s Role in Future Economics

As economic dynamics evolve, Bitcoin is poised to play a pivotal role in reshaping corporate finance strategies. While challenges remain, the growing interest in Bitcoin as a treasury asset reflects a broader trend towards innovation and risk management. Ramaswamy’s insights, along with the diverse reactions they provoke, highlight the transformative potential of Bitcoin in fostering a more resilient economic future.