Bitcoin’s Wild Ride: Navigating Volatility as Whales Cash Out and Experts Debate the Bottom

A Rollercoaster 48 Hours for Bitcoin Investors

The cryptocurrency market just witnessed one of its most dramatic short-term reversals in recent memory, leaving investors both exhilarated and exhausted. Bitcoin, the world’s leading digital currency, experienced a gut-wrenching plunge to $60,000 before staging an impressive comeback that pushed prices back above the psychologically important $70,000 threshold—all within the span of just two days. This kind of extreme volatility, while not entirely unusual in the crypto space, serves as a stark reminder of the inherent risks and rewards that come with investing in digital assets. For those who bought during the dip, the rapid recovery offered validation of the “buy low, sell high” strategy that has enriched many crypto investors over the years. However, for those caught on the wrong side of leveraged positions or who panic-sold near the bottom, the whipsaw movement represented a painful and expensive lesson in market timing. The speed of both the decline and subsequent recovery has reignited fundamental questions about Bitcoin’s trajectory: Are we witnessing temporary turbulence in an ongoing bull market, or are these warning signs of a deeper correction yet to come? As traders and long-term holders alike try to make sense of these dramatic price swings, the cryptocurrency community finds itself once again divided between optimistic bulls who see opportunity in every dip and cautious bears who warn that the worst may still be ahead.

The Great Debate: Has Bitcoin Found Its Bottom?

In the aftermath of this volatility, cryptocurrency analysts, traders, and influencers have taken to social media, podcasts, and financial news networks to share their divergent perspectives on what comes next for Bitcoin. The question on everyone’s mind is deceptively simple yet profoundly complex: Has Bitcoin finally found its floor, or should investors brace themselves for another leg down? Those in the bullish camp point to several encouraging factors. They highlight the strength of the rebound itself as evidence of robust underlying demand, arguing that the rapid buying pressure that pushed Bitcoin back above $70,000 demonstrates that institutional and retail investors alike view prices in the $60,000 range as a compelling entry point. These optimists also reference historical patterns, noting that Bitcoin has weathered similar or worse drawdowns during previous bull cycles, only to reach new all-time highs. They emphasize fundamentals such as increasing institutional adoption, the upcoming halving effects still working through the system, and macroeconomic conditions that they believe favor hard assets like Bitcoin over traditional fiat currencies. On the other side of the debate, skeptics warn that the volatility itself is a red flag, suggesting that the market lacks the stability needed to sustain higher prices. These analysts point to concerning technical indicators, weakening momentum, and broader economic headwinds that could continue to pressure risk assets across all markets. Some suggest that the $60,000 level may be tested again, with potential for even deeper corrections if market sentiment continues to deteriorate. Between these two camps sits a more cautious middle ground of experts who acknowledge uncertainty, recommending that investors maintain balanced portfolios, use proper risk management, and avoid over-leveraging their positions regardless of their directional bias.

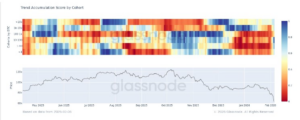

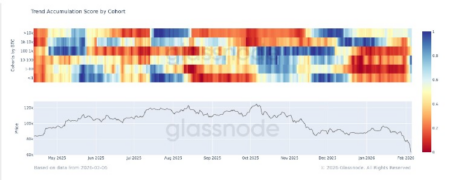

The Trump Insider Whale: A Shadow Over the Rally

Adding an intriguing subplot to Bitcoin’s price drama is the selling activity of what crypto watchers have dubbed the “Trump insider whale”—a large holder whose Bitcoin accumulation has been linked to optimism surrounding former President Donald Trump’s cryptocurrency-friendly rhetoric and policy positions. Blockchain analytics firms, which can track large Bitcoin movements across the transparent public ledger, have identified significant selling from wallets associated with this influential holder. The timing of these sales, coming right as Bitcoin attempts to establish support and build momentum for another leg higher, has raised concerns throughout the cryptocurrency community. Large holders, often called “whales” in crypto parlance, have outsized influence on market dynamics due to the sheer volume of their holdings. When whales decide to liquidate positions, they inject substantial selling pressure into the market, often overwhelming available buy-side liquidity and pushing prices lower. The fact that this particular whale appears to be systematically reducing exposure despite previously bullish positioning has led some analysts to question whether insiders might possess information suggesting headwinds ahead—whether regulatory, political, or market-related. Others interpret the selling more benignly, suggesting it might simply represent prudent profit-taking after substantial gains, portfolio rebalancing, or the need to raise capital for other investments or expenses. Regardless of motivation, the practical effect remains the same: additional supply entering a market still trying to find equilibrium after violent price swings. For smaller investors watching these whale movements, the selling creates a dilemma—should they interpret insider selling as a warning signal and follow suit, or should they view it as an opportunity to accumulate Bitcoin at prices that large holders are willing to accept, potentially positioning themselves for gains when the selling pressure eventually subsides?

Understanding Whale Behavior and Market Psychology

The influence of large holders on cryptocurrency markets represents one of the unique challenges facing Bitcoin and other digital assets. Unlike traditional financial markets with their decades of regulation, circuit breakers, and distributed ownership, cryptocurrency markets remain relatively concentrated, with a significant percentage of total supply controlled by a comparatively small number of wallets. This concentration creates both opportunities and risks for everyday investors. When whales accumulate, they can provide price support and signal confidence to the broader market; when they distribute, they can create cascading sell-offs as other market participants react to the price pressure and volume signals. The psychological impact often exceeds the purely mechanical effects of the trading itself. Retail investors, seeing large sales and associated price declines, may panic and add to the selling pressure, creating a self-reinforcing downward spiral. Conversely, when whales accumulate during periods of fear and uncertainty, their contrarian positioning can provide comfort to nervous holders and attract new buyers who interpret the whale activity as a vote of confidence. The “Trump insider whale” designation adds another layer of intrigue, as it implies potential access to information or insights that ordinary market participants lack. Whether or not this implication is accurate, the perception alone can influence how traders interpret the selling activity. In the current environment, with Bitcoin having just recovered from a sharp drawdown, whale selling introduces additional uncertainty at a time when the market is seeking direction and stability. Smart investors recognize that while whale activity provides valuable data points, it should be just one factor among many in making investment decisions, always balanced against personal financial situations, risk tolerance, and investment timelines.

Technical Levels and What Comes Next

From a technical analysis perspective, Bitcoin’s recent price action has created both opportunities and warning signs. The drop to $60,000 tested a significant support level that has served as a foundation during previous consolidation periods. The fact that this level held—at least temporarily—and generated enough buying interest to propel prices back above $70,000 could be interpreted as a successful retest of support, a classic bullish pattern that often precedes sustained upward movement. However, technical analysts also note that the volatility itself, with a roughly 15% swing in just 48 hours, suggests an unsettled market where neither bulls nor bears have established clear control. The volume profile during both the decline and recovery will be scrutinized for clues about whether the buying pressure on the rebound matches or exceeds the selling pressure that drove the initial drop. Moving averages, relative strength indicators, and other technical metrics are being recalculated and reassessed in real-time as traders attempt to position themselves advantageously for whatever comes next. Key resistance levels above current prices represent potential profit-taking zones where previous buyers might look to exit, while support levels below provide potential safety nets should selling pressure resume. The ongoing whale selling adds complexity to this technical picture, as large liquidations can overwhelm technical levels that might otherwise hold. For traders navigating these waters, the message from technical analysis seems to be one of cautious optimism tempered by recognition that further volatility is likely, and that protective stops and position sizing remain essential risk management tools.

Navigating Uncertainty: Practical Guidance for Bitcoin Investors

For the average Bitcoin holder or prospective investor trying to make sense of these dramatic developments, the path forward requires balancing multiple considerations. First and foremost, the recent volatility underscores the importance of only investing capital that you can afford to lose entirely. Bitcoin and cryptocurrencies broadly remain speculative assets with the potential for both substantial gains and complete loss. The wild price swings we’ve just witnessed—from $70,000 to $60,000 and back again in mere hours—demonstrate that even at mature market capitalizations, Bitcoin can experience stock-rattling volatility that would be extraordinary in traditional asset classes. Those considering entering the market or adding to positions should employ dollar-cost averaging strategies that spread purchases over time, reducing the impact of buying at local peaks. Those already holding Bitcoin must decide whether their conviction in the long-term thesis remains intact despite short-term price fluctuations. The whale selling, while concerning, doesn’t necessarily invalidate the fundamental case for Bitcoin as a scarce digital asset with unique properties in an increasingly digital economy. However, it does suggest that even sophisticated, well-connected holders see current prices as attractive exit points, at least for portions of their holdings. Perhaps the wisest approach in the current environment combines elements of both bullish and bearish perspectives: maintaining exposure for those who believe in Bitcoin’s long-term potential, while also respecting the real possibility of further downside by avoiding over-leverage, maintaining diversification, and keeping some dry powder available to deploy if prices do test lower levels again. As always in cryptocurrency markets, the only certainty is uncertainty, and those who survive and thrive are typically those who prepare for multiple scenarios rather than betting everything on a single outcome.