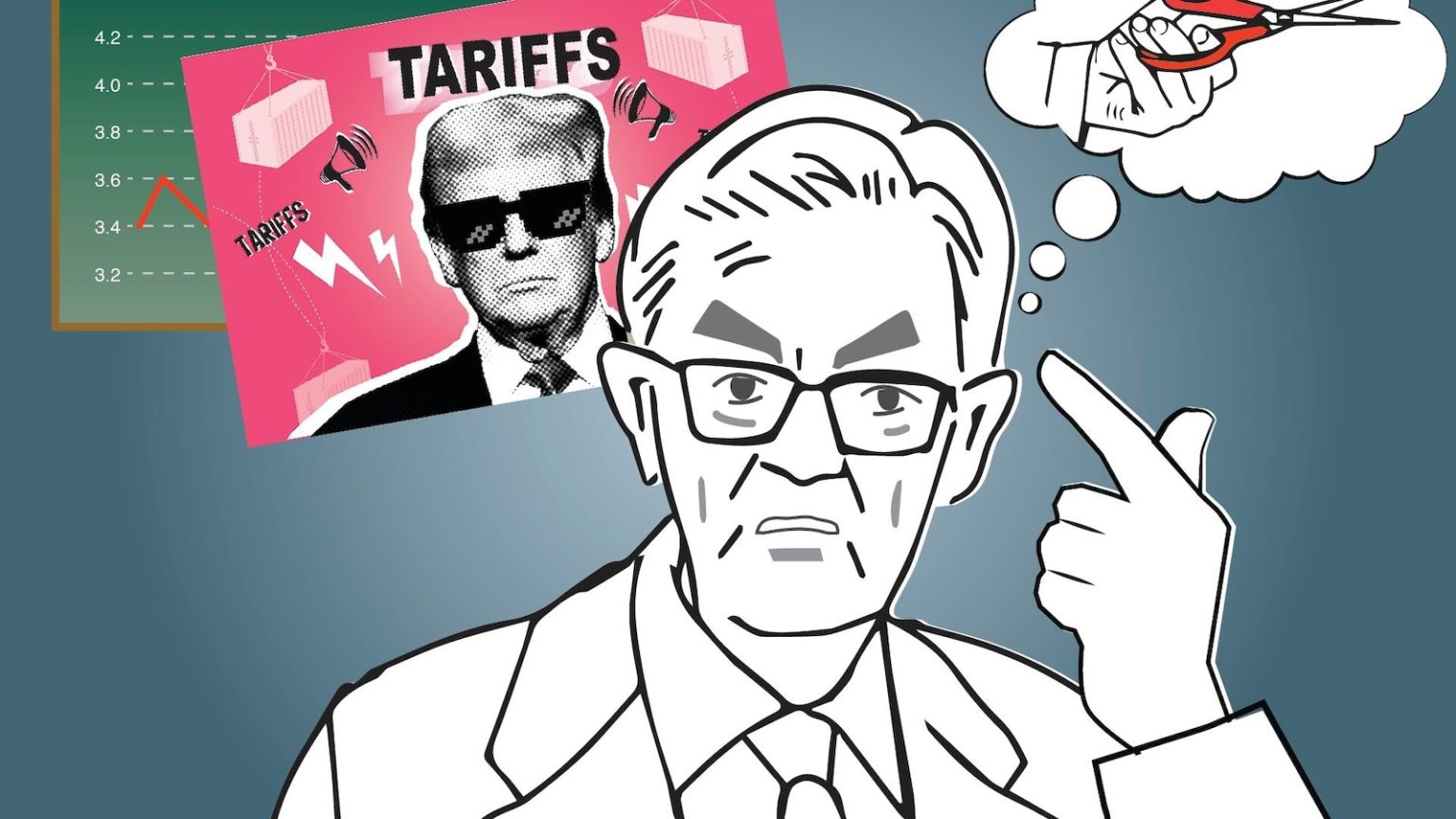

The Federal Reserve Enters aPhase of Observation and Patience

After cutting its key interest rate three times in 2019, the Federal Reserve, led by Chairman Jerome Powell, has adopted a more cautious approach. The central bank is now in a phase of observation and patience, closely monitoring the economy to determine its next steps. Federal Reserve officials, including Austan Goolsbee, president of the Chicago Fed, have emphasized the importance of waiting to see how inflation trends evolve and how new policies, particularly those implemented by President Donald Trump, such as tariffs, will impact the economy. This strategic pause is designed to allow policymakers to assess whether further interest rate cuts are necessary or if the current economic conditions are stable enough to warrant maintaining the status quo.

Solid Growth, Stable Employment, and Progress on Inflation

In a recent interview with The Associated Press, Austan Goolsbee expressed optimism about the current state of the U.S. economy. Despite occasional challenges, Goolsbee noted that the economy has experienced solid growth and stable employment, with unemployment rates hovering around full employment levels. He highlighted the progress made toward the Fed’s inflation target of 2%, emphasizing that inflation is trending in the right direction. Goolsbee added that while there is always a risk of overheating in a strong economy, there are currently no clear signs of such a scenario. However, he cautioned that uncertainties, particularly those related to trade policies and tariffs, could create "fog" that obscures the economic outlook in the short term. If these uncertainties can be resolved, the underlying strength of the economy is likely to shine through.

A Cautious Approach to Interest Rates

Goolsbee also discussed the Federal Reserve’s approach to interest rates, noting that the central bank is now in a period of careful observation. After three rate cuts in 2019, officials are hesitant to act too quickly, preferring instead to "slow the rate at which we’re going down and feel our way to the stopping point." This cautious approach reflects the uncertainty surrounding the economy, particularly the potential impacts of tariffs and other policy changes. Goolsbee explained that the Fed is waiting for the "dust to clear" before making further moves, as clarity on these issues is essential for determining the appropriate monetary policy path. He emphasized that the Fed does not have a predetermined timeline for future rate adjustments, as the decision will depend on how economic conditions evolve.

The Impact of Tariffs on Inflation and the Economy

One of the key uncertainties the Fed is monitoring is the impact of tariffs on inflation and the broader economy. Goolsbee pointed to the experience of 2018, when tariffs were first implemented, as a useful reference point. At that time, the tariffs led to immediate price increases for affected goods, but they did not have a significant impact on overall inflation. Goolsbee noted that if tariffs do not lead to further increases in inflation, the Fed may resume cutting interest rates in the future. However, he also warned that distinguishing between temporary price increases caused by tariffs and more persistent inflationary pressures is a complex task that will require time to resolve. The Fed is carefully watching inflation trends to determine whether any increases are likely to be transitory or whether they represent a more sustained shift in the inflationary environment.

The Complexity of Inflation Analysis

Goolsbee highlighted the challenges the Fed faces in analyzing inflation and making decisions about interest rates. He explained that if inflation were to rise further, the Fed would need to carefully assess whether the increase is due to overheating in the economy or if it is the result of temporary factors, such as tariffs. This distinction is crucial, as it will influence the Fed’s policy response. For example, if inflation is driven by overheating, the Fed may need to take steps to cool the economy, such as raising interest rates. On the other hand, if the inflationary pressures are temporary, the Fed may choose to look through them and maintain its current policy stance. Goolsbee emphasized that this process of analysis is inherently uncertain and will take time to resolve.

A Patient and Data-Driven Approach Moving Forward

Looking ahead, Goolsbee reiterated the Fed’s commitment to a patient and data-driven approach to monetary policy. He expressed confidence in the underlying strength of the U.S. economy, noting that it is currently operating at or near full employment, with inflation trending toward the Fed’s 2% target. However, he also acknowledged that the economic environment is complex and uncertain, particularly given the ongoing impact of tariffs and other policy changes. Goolsbee stressed that the Fed will need to remain flexible and responsive to new information as it becomes available. While he did not speculate on the timing of future interest rate adjustments, he made it clear that the Fed is prepared to act if economic conditions warrant further action. For now, the Fed is content to wait and observe, using the time to gather more data and gain clarity on the economic outlook.

The Federal Reserve’s Strategic Balance

In summary, the Federal Reserve is navigating a complex economic landscape marked by solid growth, stable employment, and progress toward its inflation target, but also significant uncertainties, particularly related to trade policies and tariffs. The central bank has adopted a cautious and patient approach, pausing after three interest rate cuts in 2019 to observe how economic conditions evolve. Officials like Austan Goolsbee are emphasizing the importance of careful analysis and the need to distinguish between temporary and persistent inflationary pressures. As the Fed moves forward, it will continue to rely on a data-driven approach, remaining flexible and prepared to adjust its policy stance as needed. The goal is to support continued economic growth while maintaining low and stable inflation, striking a delicate balance that requires both patience and precision.