Nvidia’s Stellar Fourth-Quarter Earnings Reflect AI Boom’s Explosive Growth

A Stellar Financial Performance for Nvidia

Nvidia, the Santa Clara, California-based tech powerhouse, delivered a jaw-dropping earnings report for its fourth quarter, wrapping up a year that underscored its pivotal role in the artificial intelligence (AI) revolution. The figures were nothing short of impressive: the company posted a whopping $39.3 billion in revenue for the quarter ending January 26, marking a 12% increase from the previous quarter and a staggering 78% year-over-year surge. On the profit front, Nvidia reported adjusted earnings of 89 cents per share, surpassing Wall Street’s expectations of 85 cents per share on $38.1 billion in revenue, according to data from FactSet. This performance solidified Nvidia’s position as a poster child of the AI boom, with its market worth soaring to over $3 trillion, making it the second-largest company on Wall Street. Its influence on the stock market is monumental, with its stock movement carrying more weight on the S&P 500 and other indexes than any company except Apple.

The Rise of AI and the Demand for Blackwell Chips

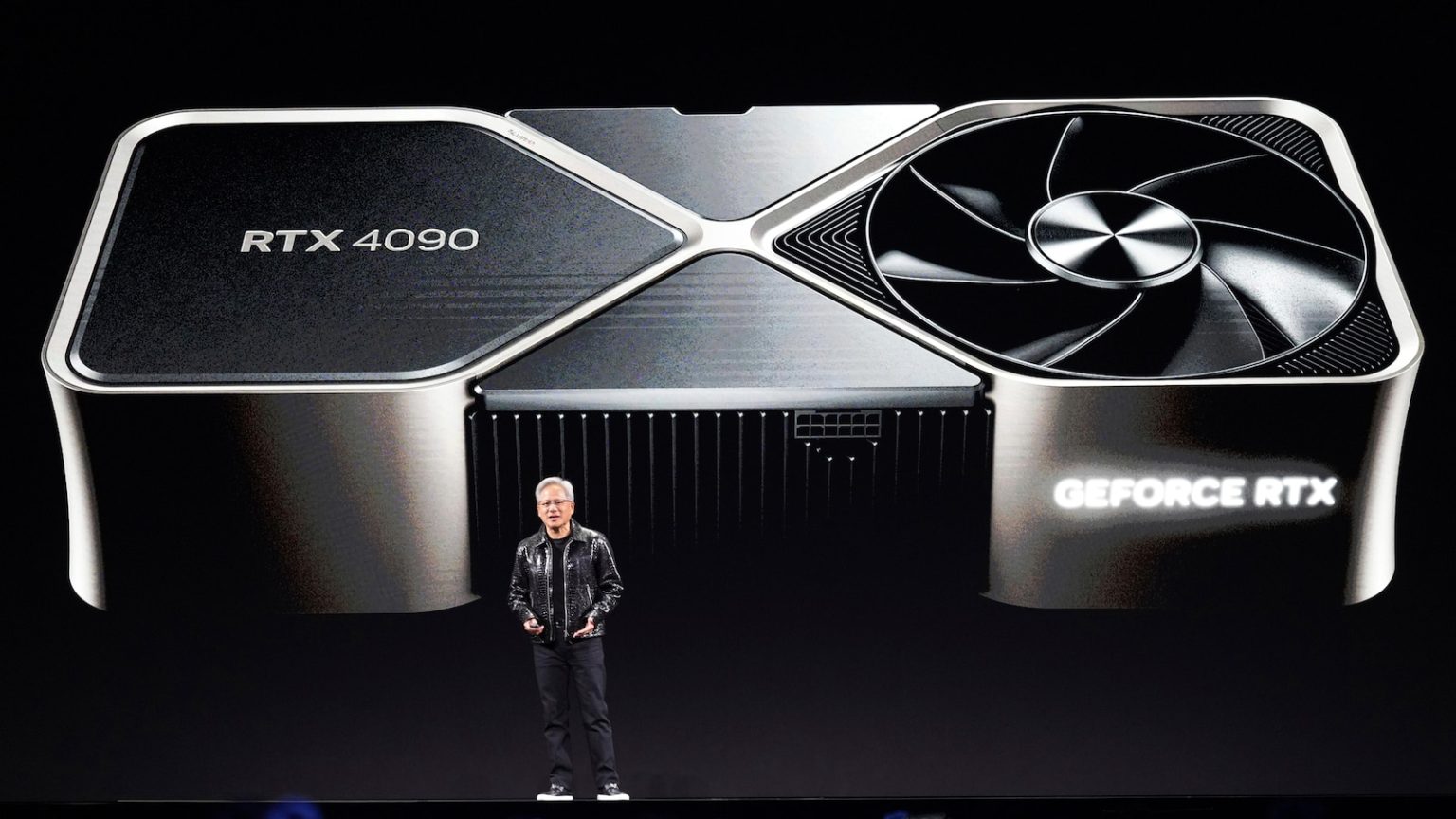

At the heart of Nvidia’s success is the swelling demand for its specialized Blackwell chips, which are the backbone of AI systems. Jensen Huang, Nvidia’s visionary founder, highlighted the incredible demand for these chips, stating, "Demand for Blackwell is amazing as reasoning AI adds another scaling law—increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter." This statement captures the essence of Nvidia’s winning strategy: its chips are not just powering AI systems but are also driving advancements in AI capabilities, creating a virtuous cycle of innovation and growth. The company’s focus on developing high-performance computing solutions tailored for AI has positioned it as an indispensable player in this rapidly evolving field.

The DeepSeek Factor: A Competitive Edge in AI

Nvidia’s earnings report came on the heels of a significant development in the AI landscape. DeepSeek, a Chinese company, announced that it had developed a large language model capable of competing with ChatGPT and other U.S. rivals, with the added advantage of being more cost-effective in its use of Nvidia chips for training. While this news initially caused a stir, with Nvidia’s market value briefly plummeting by $595 billion, the company responded graciously, commending DeepSeek’s achievement as "an excellent AI advancement" that leveraged "widely-available models and compute that is fully export control compliant." This response reflects Nvidia’s confidence in its position in the AI ecosystem, recognizing that advancements in the field, even by competitors, ultimately benefit the industry as a whole.

Nvidia’s Role in the AI Revolution

Nvidia’s success is not just a testament to its engineering prowess but also a reflection of its strategic foresight. The company has been at the forefront of the AI revolution, anticipate