The Rise of Meme Coins: A New Frontier in Cryptocurrency

Introduction to Meme Coins

Meme coins, a unique and often whimsical subset of the cryptocurrency world, have carved out a niche for themselves as a blending of internet culture and financial speculation. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are often positioned as serious investments or mediums of exchange, meme coins are typically created as jokes, memes, or community-driven projects. These tokens often gain popularity due to their humorous or satirical nature, but they can also become surprisingly valuable as more people buy into the hype. The most famous example is Dogecoin, which started as a meme featuring a Shiba Inu dog but eventually became a widely recognized cryptocurrency with a significant market cap. However, the rise of meme coins has also led to questions about their regulatory status and the potential risks they pose to investors.

The SEC’s Stance on Meme Coins

On Thursday, [Date], the Securities and Exchange Commission (SEC) clarified its stance on meme coins, stating that these tokens are not subject to federal securities regulations. According to the SEC, meme coins are more akin to "collectibles" and do not fall under the category of securities under federal law. This designation is significant because it means that companies issuing meme coins, such as the one promoted by former President Donald Trump, are not required to register their transactions with the SEC or comply with the same regulations as traditional securities. The SEC’s division of corporate finance explained that meme coins are primarily purchased for entertainment, social interaction, and cultural purposes, with their value driven by market demand and speculation rather than any intrinsic value or promise of future returns. This ruling effectively shields companies like the one behind the $TRUMP meme coin from potential litigation and regulatory oversight.

The Volatility of Meme Coins

Meme coins are known for their extreme volatility, making them a high-risk, high-reward investment. While some meme coins can start as jokes, they can also become quite profitable for their promoters and early adopters. For example, the $TRUMP meme coin, which was promoted by former President Donald Trump just before his inauguration, was initially valued at over $74 but has since plummeted to around $12. This volatility highlights the speculative nature of meme coins and the potential for rapid price swings based on market sentiment, influencers, and community activity. Despite the risks, meme coins remain a popular and intriguing aspect of the cryptocurrency industry, appealing to those who enjoy the combination of humor, community, and financial speculation.

Legislative Response to Meme Coins

The SEC’s ruling comes at a time when House Democrats are planning to introduce legislation that would prohibit elected officials and their families from profiting from personal meme coins. California freshman Democrat Rep. Sam Liccardo is leading the charge with the proposed Modern Emoluments and Malfeasance Enforcement (MEME) Act. This legislation aims to prevent the president, vice president, members of Congress, senior executive branch officials, and their spouses and dependent children from issuing, sponsoring, or endorsing a security, future, commodity, or digital asset. Rep. Liccardo argues that public offices belong to the public, not the officeholders, and that officials should not leverage their political authority for financial gain. He highlights the potential for insider trading and foreign influence, as well as the ethical concerns surrounding the exploitation of public trust for personal profit.

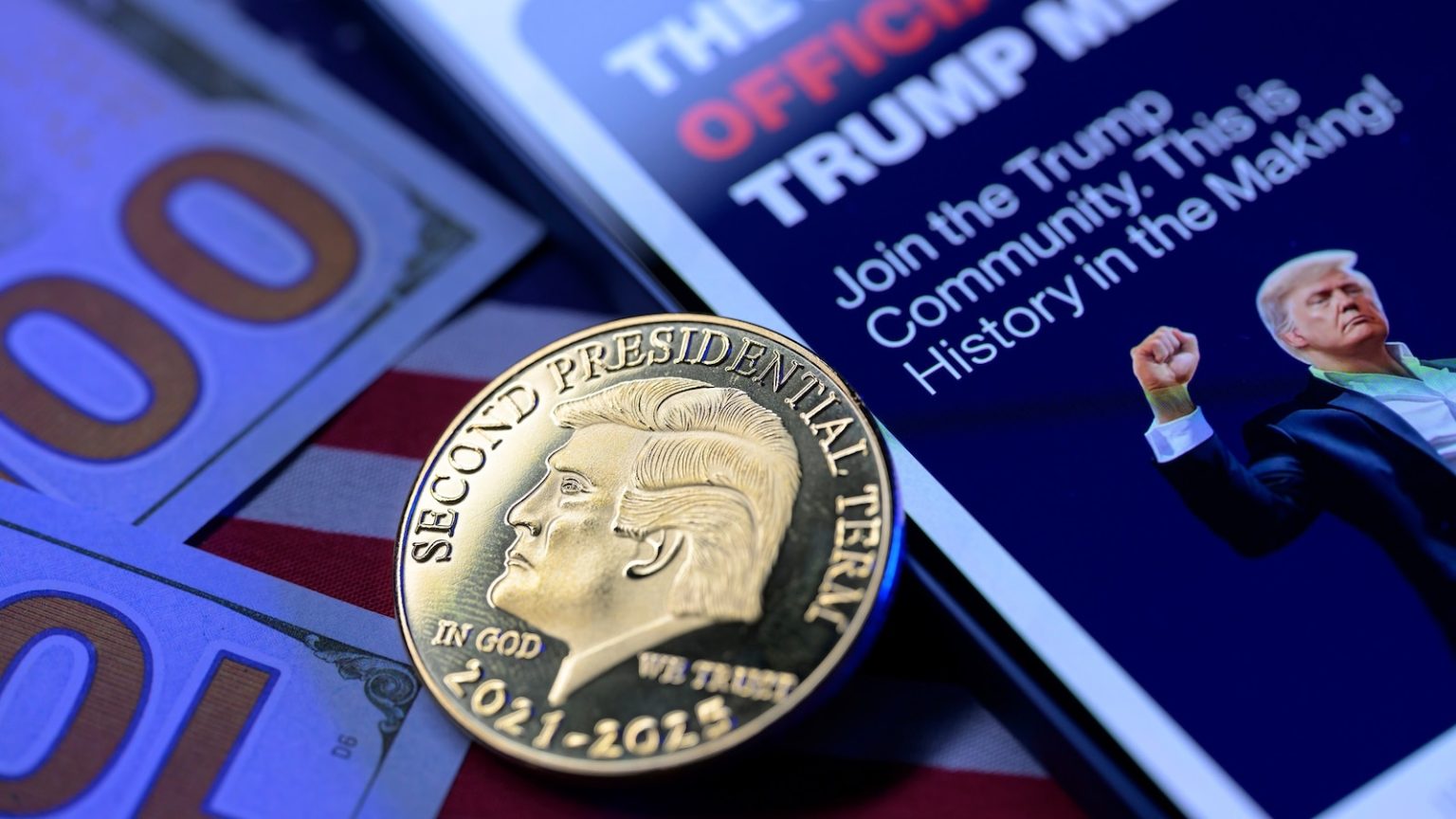

The Trumps and Their Meme Coin

The issue of meme coins gained national attention when former President Donald Trump launched his own meme coin just before his inauguration. The $TRUMP coin was initially valued at over $74 but has since seen a significant decline in value, dropping to around $12. This rapid price swing underscores the volatility of meme coins and the speculative nature of the market. While the SEC’s ruling shields the companies behind these tokens from federal securities regulations, it also means that investors who lose money on these investments are not protected by federal securities laws. Critics argue that the issuance of meme coins by public figures like Trump exploits the public’s trust and creates opportunities for insider trading and other forms of financial impropriety. The Trumps’ involvement in the meme coin market has raised eyebrows and sparked calls for greater oversight and regulation.

The Future of Meme Coins and Cryptocurrency Regulation

The SEC’s ruling on meme coins and the proposed MEME Act represent the latest developments in the ongoing debate over cryptocurrency regulation. While the SEC has taken a hands-off approach to meme coins, labeling them as collectibles rather than securities, the legislative response reflects growing concerns about the potential misuse of these tokens by public officials and the risks they pose to investors. As the cryptocurrency market continues to evolve, it is likely that we will see further attempts to regulate this space, balancing innovation with investor protection. For now, meme coins remain a fascinating and unpredictable corner of the financial world, offering a unique blend of humor, community, and speculation that continues to attract attention and investment. Whether this phenomenon will lead to long-term growth or eventual regulation remains to be seen, but one thing is certain: meme coins are here to stay, at least for the foreseeable future.