Ed Woodward and the Future of Football Ownership: A New Chapter Unfolds

Introduction: Ed Woodward’s Potential Role in Eagle Football Holdings

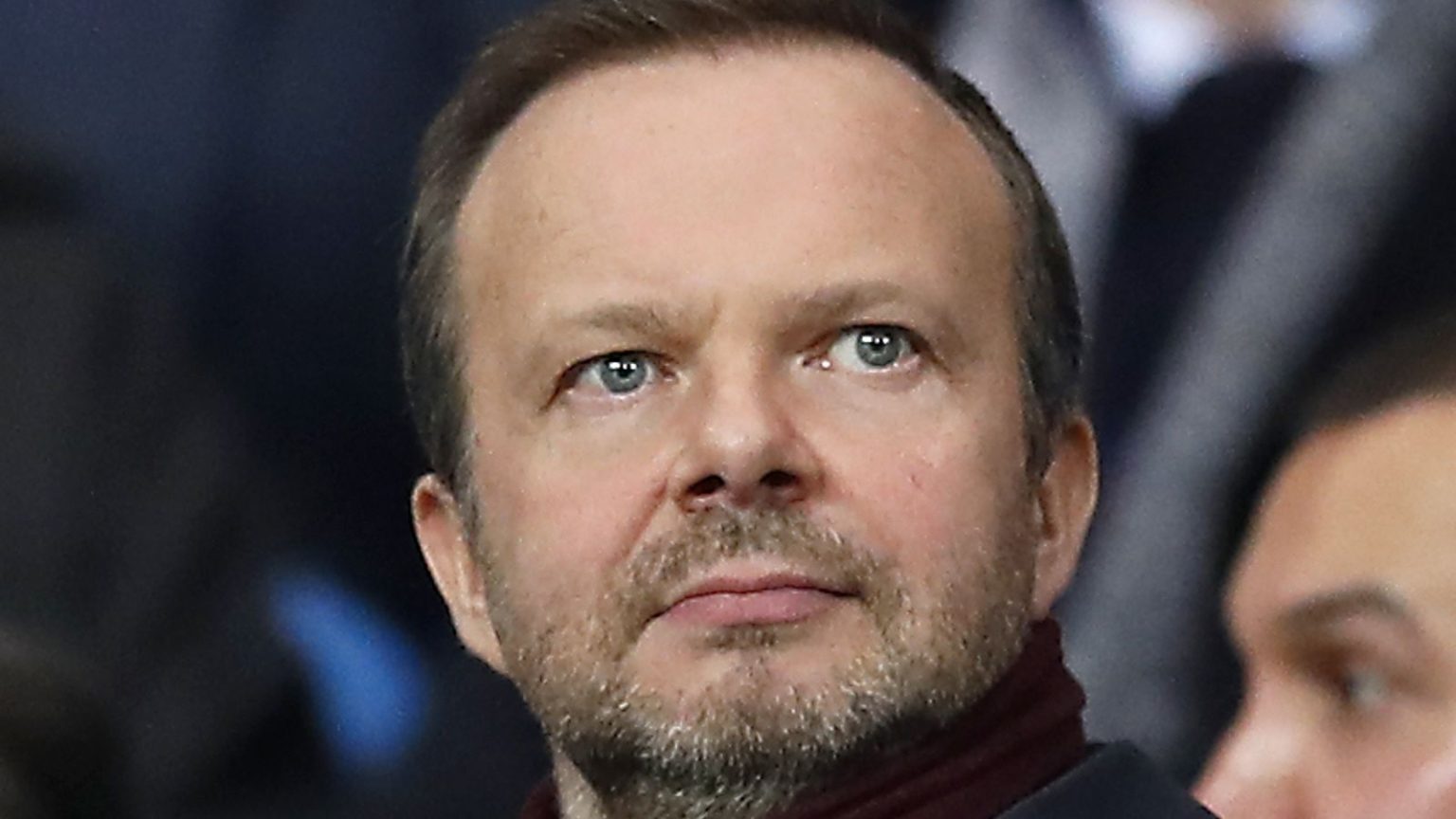

Ed Woodward, the former Manchester United chief executive who played a pivotal role in shaping the club’s modern era, has reportedly been approached to join Eagle Football Holdings, a vehicle with stakes in several football clubs, including Crystal Palace and Olympique Lyonnais. According to Sky News, Woodward, who left Old Trafford in 2022, is being considered as an independent director of Eagle Football as the company prepares for a U.S. initial public offering (IPO). This move could mark Woodward’s first major football-related directorship since his departure from Manchester United, where he spent 17 years and was instrumental in the club’s financial transformation under the Glazer family’s ownership. While sources emphasize that the appointment is not yet finalized, the possibility highlights Woodward’s enduring influence in the football industry and Eagle Football’s ambitious plans to expand its global reach.

Eagle Football Holdings: A Growing Force in Global Football

Eagle Football Holdings, controlled by American businessman John Textor, has emerged as a significant player in the ownership and management of football clubs worldwide. The company currently owns a 45% stake in Crystal Palace, a Premier League club, and has been exploring options for selling this stake in recent months. However, with Crystal Palace’s improved performance in the Premier League, Eagle Football may now reconsider its decision and retain the stake. In addition to its involvement with Crystal Palace, the company also owns stakes in Brazilian champions Botafogo, Belgian club RW Molenbeek, and FC Florida. Eagle Football’s diverse portfolio underscores its strategic approach to investing in football clubs with growth potential across different regions and leagues.

Preparing for the U.S. IPO: Eagle Football’s Next Big Move

Eagle Football is set to take a significant step forward with its plans to go public in the United States. The company is expected to file confidentially with U.S. regulators in the next fortnight, paving the way for a potential listing on a major U.S. stock exchange. The IPO is anticipated to raise several hundred million dollars, with the company’s valuation expected to exceed $2 billion. This move reflects the growing trend of football-related businesses turning to public markets to secure capital for expansion and investment in their operations. Eagle Football has already assembled a team of experienced financial advisors, including investment banks such as Stifel, TD Cowen, and UBS, to guide it through the IPO process.

John Textor’s Vision for the Future of Football Ownership

John Textor, the driving force behind Eagle Football, has long advocated for greater transparency and accountability in the ownership of football clubs. He has expressed his belief that public ownership of clubs can democratize decision-making and provide fans with clearer insights into the financial and operational aspects of their teams. This vision aligns with broader debates about the future of football governance, particularly in the UK, where a new Labour government is expected to reintroduce legislation aimed at regulating the sport and ensuring greater fan involvement. Textor’s approach to ownership reflects a shift toward more inclusive and sustainable models of club management, which could have far-reaching implications for the football industry.

The Implications of Eagle Football’s IPO for Global Football

Eagle Football’s IPO has the potential to reshape the landscape of football ownership and investment. By going public, the company will gain access to significant capital to strengthen its existing assets and potentially acquire stakes in additional clubs. This could lead to a more integrated and centralized approach to managing football clubs, with a focus on improving performance, increasing revenue, and building a stronger connection with fans. The involvement of high-profile figures like Ed Woodward and John Textor also highlights the importance of experience and expertise in navigating the complexities of the football industry. However, the success of the IPO will depend on a range of factors, including market conditions, investor sentiment, and the company’s ability to deliver on its ambitious growth plans.

Conclusion: A New Era for Football Ownership and Governance

The potential appointment of Ed Woodward to Eagle Football Holdings’ board and the company’s plans for a U.S. IPO represent a significant chapter in the evolving story of football ownership. As the sport continues to attract investment from around the world, the balance between financial ambition and fan-centric governance will remain a critical issue. Eagle Football’s approach, with its emphasis on transparency and public ownership, offers a glimpse into a future where fans and investors alike can play a more active role in shaping the direction of their clubs. While challenges remain, the involvement of experienced leaders like Woodward and Textor suggests that the company is well-positioned to navigate the complexities of this fast-changing landscape. As the football industry adapts to new realities, the success of Eagle Football’s IPO and its ongoing investments will be closely watched by stakeholders across the globe.