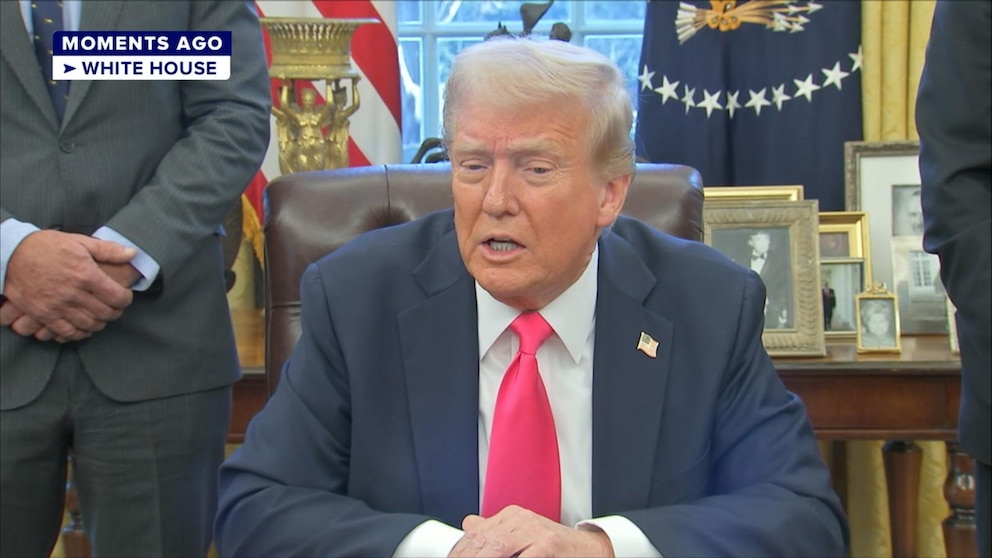

The Big Story: White House Defends DOGE Actions

The White House has recently found itself in the spotlight as it defends its actions regarding Dogecoin (DOGE), a cryptocurrency that has gained significant attention over the past year. The situation has sparked debates about the government’s role in regulating cryptocurrencies, the legality of its actions, and the potential implications for the broader crypto market. In this summary, we break down the key points of the story, the arguments from both sides, and what this means for the future of cryptocurrency regulation in the U.S.

A Complex Web of Decisions

The White House’s involvement with DOGE has been met with both praise and criticism. Proponents argue that the administration’s actions were necessary to stabilize the cryptocurrency market, which has been known for its volatility. They claim that the government’s intervention was aimed at protecting investors and ensuring the integrity of the financial system. On the other hand, critics argue that the White House overstepped its authority and that its actions could set a dangerous precedent for future government interference in decentralized markets.

The situation is further complicated by the fact that DOGE, initially created as a meme coin, has evolved into a serious player in the cryptocurrency space. Its rise in value and popularity has led to increased scrutiny from regulatory bodies. The White House’s decisions have been shaped by a combination of factors, including the need to regulate the crypto market, protect consumers, and maintain the stability of the U.S. economy.

Market Reactions and Public Opinion

The cryptocurrency market has reacted strongly to the White House’s actions. Prices of DOGE and other cryptocurrencies have seen significant fluctuations, as investors try to gauge the impact of the government’s decisions. Some investors have expressed concern that increased regulation could stifle innovation and limit the growth of the crypto market. Others have welcomed the move, believing that clearer guidelines will provide much-needed clarity and legitimacy to the industry.

Public opinion is equally divided. Supporters of the White House’s actions argue that regulation is necessary to prevent fraud, money laundering, and other illicit activities that have been associated with cryptocurrencies. They also point to the potential benefits of a more regulated market, such as increased investor confidence and greater adoption by mainstream financial institutions. Critics, however, argue that the government’s actions are an infringement on the decentralized nature of cryptocurrencies and could drive innovation overseas.

The Regulatory Landscape: What’s Next?

The debate over the White House’s actions highlights the larger issue of cryptocurrency regulation in the U.S. As the crypto market continues to grow, regulators are under increasing pressure to provide clear guidelines and frameworks. The question of how to balance innovation with consumer protection is at the heart of the discussion.

The White House’s decisions on DOGE could set a precedent for how other cryptocurrencies are treated in the future. If the administration’s actions are deemed successful, they could pave the way for a more comprehensive regulatory framework for the crypto market. On the other hand, if the actions are seen as overreach, they could lead to pushback from the industry and potentially slower adoption of cryptocurrencies in the U.S.

The Bigger Picture: Cryptocurrency’s Role in the Global Economy

The White House’s actions on DOGE are part of a larger conversation about the role of cryptocurrencies in the global economy. As more countries consider central bank digital currencies (CBDCs) and other forms of digital money, the debate over regulation and oversight is likely to intensify. The U.S. has a unique opportunity to shape the future of cryptocurrency regulation, not just domestically but also on the global stage.

The outcome of the current situation will have far-reaching implications. If the White House is successful in its approach, it could position the U.S. as a leader in the crypto space, attracting investment and innovation. However, if the actions are seen as heavy-handed, they could lead to a fragmented market and hinder the development of the crypto industry.

Conclusion: A Delicate Balance

In conclusion, the White House’s defense of its actions regarding DOGE highlights the delicate balance between regulation and innovation in the cryptocurrency space. The administration’s decisions have sparked a lively debate about the role of government in the crypto market and the potential implications for the broader economy. While the outcome is uncertain, one thing is clear: the way the U.S. approaches cryptocurrency regulation will have a profound impact on the future of digital currencies.

As the situation continues to unfold, stakeholders across the globe will be watching closely. The White House’s actions on DOGE are not just about one cryptocurrency; they represent a broader shift in how governments are approaching the rapidly evolving world of digital money. Whether the administration’s decisions will be seen as a step in the right direction or a misstep will depend on how they are implemented and received by the crypto community and the public at large.