House Budget Blueprint: A Vision for Economic Reform

The U.S. House of Representatives, led by Republicans, recently passed an ambitious budget blueprint designed to advance President Donald Trump’s economic agenda. This plan outlines significant tax cuts and spending reductions, aiming to stimulate economic growth and reduce the national debt. The proposed tax cuts amount to $4.5 trillion, accompanied by spending slashes of $2 trillion. This budget is a cornerstone of Republican efforts to deliver on campaign promises and fulfill Trump’s vision for economic reform.

Challenges in Balancing Act: Tax Cuts vs. Spending Reductions

Implementing this budget presents considerable challenges, particularly balancing substantial tax reductions with necessary spending cuts. Republicans face tough decisions on where to cut, with potential targets including healthcare, food stamps, green energy, and student aid. These cuts are intended to offset the costs of tax breaks, ensuring the national debt does not balloon further. However, the political difficulty of these choices is significant, as they impact millions of Americans and require bipartisan agreement.

Democratic Opposition: Strong Resistance and Personal Stories

Democrats vehemently oppose the budget, arguing it prioritizes tax breaks for the wealthy over vital social programs. Lawmakers like Brittany Pettersen highlighted personal sacrifices, such as returning to vote with a newborn, to emphasize the stakes. Democrats assert that the budget undermines healthcare and increases the deficit, framing it as irresponsible. Their opposition is vocal, with plans to alert the public about potential consequences.

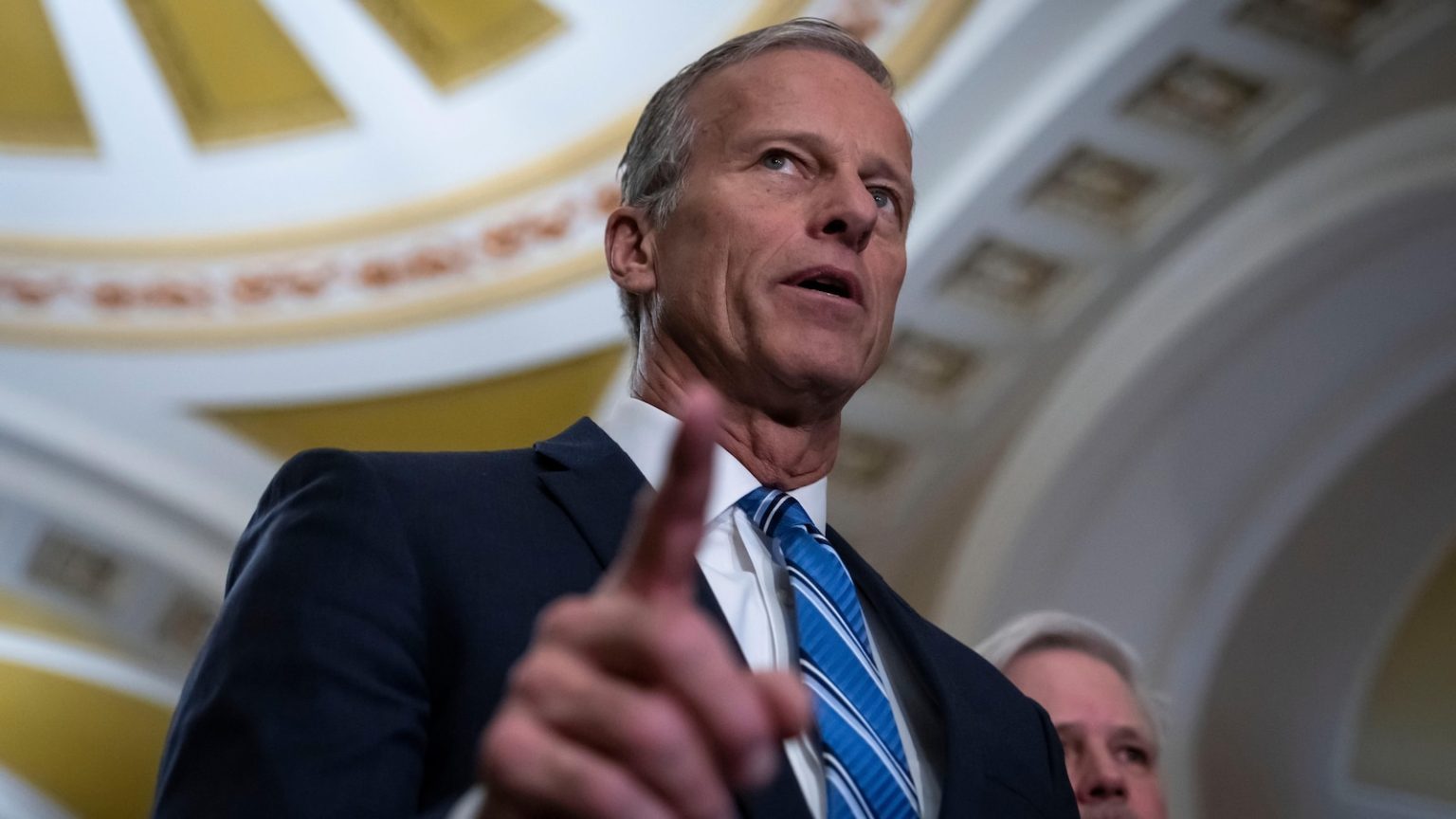

Senate’s Role and Strategies: Navigating Legislative Complexity

The Senate will play a crucial role in shaping the final legislation. Senate Republicans aim to make tax cuts permanent, which could escalate costs. Strategies include treating tax cuts as "existing policy" to avoid offsetting cuts, a move Democrats label as "funny math." The Senate must reconcile its priorities with the House’s blueprint, complicating the legislative process and testing bipartisan cooperation.

Targeted Program Cuts: Impact on Healthcare and Welfare

The budget targets specific programs for cuts, notably Medicaid and food stamps. Republicans propose efficiency measures and work requirements to reduce Medicaid costs without directly cutting benefits. However, these adjustments may still affect vulnerable populations. Similarly, while food stamps are purportedly safe, program changes could impact recipients. These cuts aim to offset tax reductions but face criticism for endangering social safety nets.

Potential Impact and Political Fallout: A Divided Nation

The budget’s implications are far-reaching, affecting healthcare access, food security, and economic growth. Political tactics are intensifying, with Democrats warning of dire consequences and Republicans emphasizing economic benefits. Reaching a consensus will be challenging, as the budget reflects broader ideological divides on government role and economic policy. The outcome will significantly influence the nation’s economic trajectory and political landscape.