A Standoff Over Consumer Protection: Democrats Challenge the CFPB Takeover

In a bold move, 191 House and Senate Democrats have joined forces to oppose recent actions targeting the Consumer Financial Protection Bureau (CFPB). They expressed their concerns in a letter addressed to Russell Vought, the acting director of the Office of Management and Budget, and Treasury Secretary Scott Bessent. The Democrats urged the officials to reverse course on measures that have effectively halted the CFPB’s operations. This bureau, established after the 2008 financial crisis, is crucial for safeguarding consumers against unfair practices. The letter underscores the Democrats’ commitment to protecting this agency, which they believe is under threat from the new administration’s actions.

The CFPB’s Critical Role and Current Challenges

The CFPB was created to act as a watchdog, ensuring that financial institutions operate fairly. However, its operations have been severely impacted under the leadership of Vought, who recently issued a stop-work order to most staff. Additionally, personnel from Elon Musk’s Department of Government Efficiency (DOGE) have reportedly accessed the agency’s offices and data systems, raising concerns about privacy and operational integrity. Democrats are particularly troubled by this intrusion, fearing it could compromise sensitive information and undermine the CFPB’s ability to protect consumers.

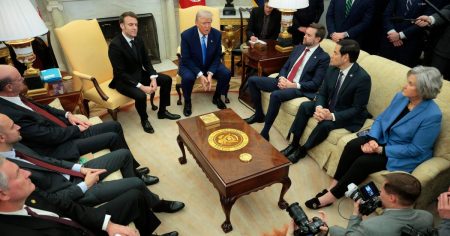

Trump’s Perspective and the Democrats’ Counterargument

President Donald Trump has openly criticized the CFPB, describing it as a hindrance to good businesses. He confirmed his intention to dismantle the agency, framing it as an effort to eliminate waste and fraud. However, Democrats vehemently disagree, arguing that this move will leave consumers vulnerable to exploitation. They contend that the CFPB’s dismantling is both harmful and potentially illegal, as it would allow predatory lenders and scammers to operate unchecked. Democrats emphasize that without the CFPB, there is no oversight to prevent injustices like illegal foreclosures and repossessions.

Broader Implications and Legal Challenges

This conflict is part of a larger struggle between the Trump administration and congressional Democrats. The Democrats are using all available tools to challenge what they perceive as overreach, not just at the CFPB but also at other agencies like USAID and FEMA. Legal action is underway, with the National Treasury Employees Union filing lawsuits against Vought, challenging both the CFPB takeover and unauthorized access to its records. Senator Elizabeth Warren, a key architect of the CFPB, is leading the charge, advocating for the agency’s preservation and criticizing Musk’s involvement.

The CFPB’s Impact and Warren’s Advocacy

Since its inception in 2011, the CFPB has recovered nearly $21 billion for consumers, addressing issues ranging from bank fees to student loans. Senator Warren has been a vocal defender of the agency, especially after Musk’s suggestive "RIP CFPB" post. During a Senate hearing, Warren pressed Federal Reserve Chairman Jerome Powell to collaborate in preventing Musk’s team from interfering with the CFPB’s mission. Powell acknowledged the CFPB’s unique role, agreeing that no other regulator can fulfill its oversight duties. Warren highlighted the risks of unchecked banking practices, referencing past scandals like Wells Fargo’s unauthorized accounts.

Republican Rebuttals and Democrats’ Resolve

Republicans have defended Trump’s actions as fulfillment of his campaign promises to cut government waste. They argue that existing banking laws remain unchanged and that Musk is merely advancing Trump’s agenda. However, Democrats remain resolute in their opposition. They have successfully defeated previous attempts to weaken the CFPB and are determined to do so again, employing all available tactics to protect an agency they deem vital to consumer protection. The outcome of this standoff will significantly impact the financial security of millions of Americans.