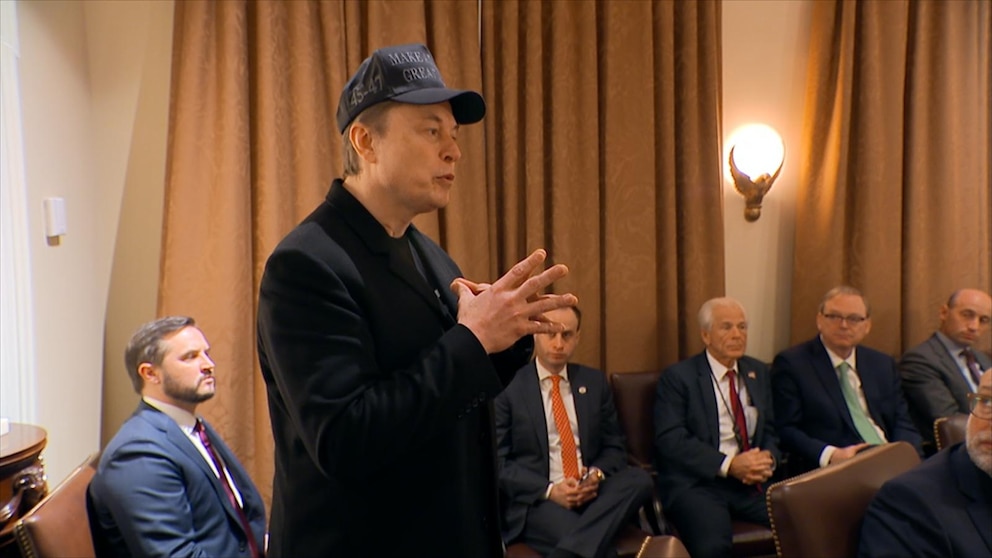

Elon Musk Warns at Trump Cabinet Meeting: U.S. Will Go ‘Bankrupt’ Without DOGE

In a shocking and unexpected turn of events, Elon Musk, the billionaire CEO of Tesla and SpaceX, made a startling statement during a recent Trump Cabinet meeting. Musk, known for his bold and often controversial remarks, warned that the United States would face bankruptcy if it does not adopt Dogecoin (DOGE) as a national currency. The statement sent shockwaves through the financial and political spheres, sparking intense debates about the future of cryptocurrency and its role in the global economy.

The Rise of DOGE: From Meme to Mainstream

Dogecoin, originally created as a joke in 2013, has recently gained traction as a serious contender in the world of cryptocurrency. What started as a meme featuring a Shiba Innu has evolved into a viable digital currency, thanks in part to Musk’s vocal support. The currency’s price has seen significant fluctuations, but its popularity continues to grow, especially among younger investors and tech enthusiasts. Musk’s endorsement of DOGE has been a key factor in its rise, with his tweets often causing sharp increases in its value.

Economic Implications: Can DOGE Save the U.S. from Bankruptcy?

Musk’s claim that the U.S. will go bankrupt without DOGE has raised eyebrows among economists and financial experts. While some have dismissed the idea as hyperbole, others have taken it as a call to action. The U.S. economy is currently facing numerous challenges, including rising debt levels, inflation, and a shrinking middle class. Could adopting DOGE as a national currency provide a solution to these problems? Proponents argue that cryptocurrency offers transparency, efficiency, and accessibility, which could help stabilize the economy. However, critics point out the volatility of DOGE and the lack of a clear regulatory framework as major concerns.

The Road to Adoption: Challenges and Hurdles

Adopting DOGE as a national currency would require significant changes to the U.S. financial system. The first major hurdle is regulatory. Cryptocurrencies currently operate in a gray area, with unclear regulations and oversight. The government would need to establish a framework to govern the use of DOGE, including tax policies, anti-money laundering measures, and consumer protections. Additionally, there is the issue of acceptance. Businesses and individuals would need to be willing to accept DOGE as a form of payment, which would require a cultural shift.

Global Economic Shift: The Future of Currency

Musk’s statement is part of a larger conversation about the future of currency. As digital transactions become more prevalent, traditional fiat currencies are facing increasing competition from cryptocurrencies. The rise of DOGE and other digital currencies like Bitcoin and Ethereum is forcing governments and financial institutions to rethink their approach to money. Some countries, like El Salvador, have already embraced Bitcoin as legal tender, while others are exploring the creation of their own central bank digital currencies (CBDCs). The U.S. is under pressure to keep up with these changes, or risk falling behind in the global economy.

Conclusion: The Future of Money and the Role of DOGE

In conclusion, Elon Musk’s warning that the U.S. will go bankrupt without DOGE has sparked a necessary conversation about the role of cryptocurrency in the future of finance. While there are certainly challenges to overcome, the potential benefits of adopting DOGE as a national currency cannot be ignored. As the world continues to evolve towards a more digital economy, it is crucial for governments and financial institutions to adapt. Whether or not the U.S. ultimately adopts DOGE, one thing is clear: the future of money is digital, and those who fail to embrace this reality risk being left behind. Musk’s statement serves as a wake-up call, urging the nation to consider the opportunities and challenges that lie ahead.