A Temporary Reprieve for the CFPB: A Court-Ordered Halt to Mass Firings

In a significant legal development, government lawyers representing the acting director of the Consumer Finance Protection Bureau (CFPB) reached a temporary agreement during a court conference on February 10, 2025, to pause mass firings of CFPB employees. This decision comes as a lawsuit challenging the Trump administration’s dismantling of the agency moves forward in court. U.S. District Judge Amy Berman Jackson approved a consent order that blocks the CFPB from firing employees for reasons unrelated to their job performance or conduct. Additionally, the order prevents the Trump administration from redirecting the agency’s funding or altering sensitive records maintained by the CFPB. Judge Jackson also signaled her willingness to consider a longer-term preliminary injunction during a hearing scheduled for March 3.

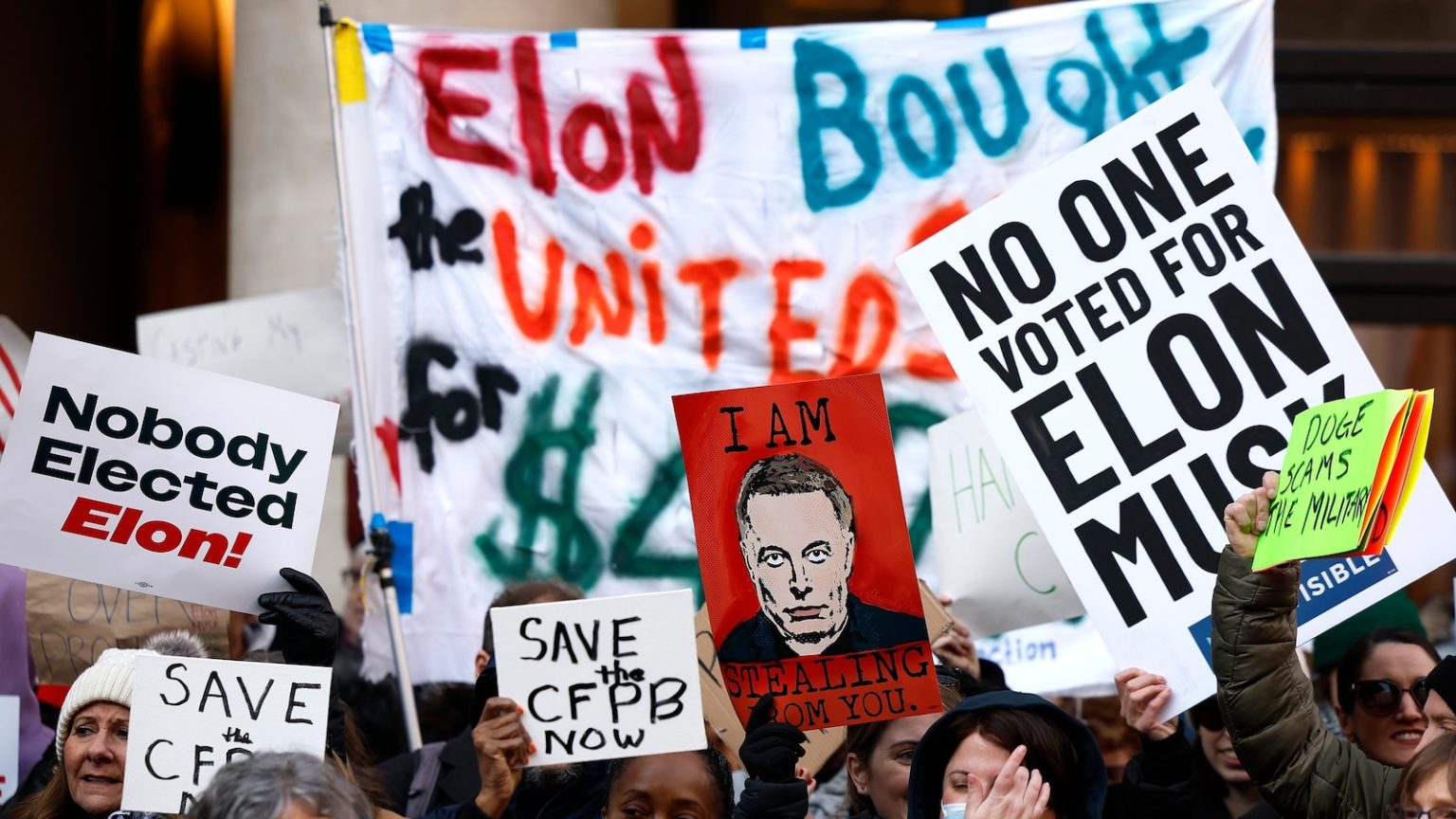

The agreement comes amid a broader controversy surrounding the Trump administration’s efforts to slash the federal workforce, with the CFPB being a primary target. The agency, which was created in 2011 in response to the 2008 financial crisis, has faced intense scrutiny and opposition from the administration. Employees of the CFPB have expressed deep concerns about the potential consequences of these firings, both for their own livelihoods and for the consumers they are tasked with protecting.

Employees Speak Out: Fear, Uncertainty, and the Loss of a Critical Agency

The CFPB’s employees have been at the center of this storm, with many facing sudden and unexpected terminations. According to multiple employees who spoke to ABC News on the condition of anonymity, the agency has already begun firing probationary workers, with the remaining staff bracing for mass layoffs. One agency lawyer described the situation in stark terms: "All term employees were fired tonight, and it looks like the rest of us will be fired tomorrow but for cause rather than via a RIF [reduction in force], which means no severance I think." Another employee reported that three out of four teammates were fired, leaving only permanent employees behind.

The situation has left employees feeling vulnerable and uncertain about their future. Many have been told not to report to work or access the agency’s Washington, D.C., headquarters, while others found their credentials restricted from satellite offices in cities like San Francisco, Chicago, New York, and Atlanta. The abrupt nature of these firings has compounded the sense of chaos and disarray within the agency.

The CFPB’s Critical Role in Consumer Protection

The CFPB was established in 2011 as a direct response to the 2008 financial crisis, which was fueled by risky subprime mortgages and a lack of regulatory oversight. The agency’s mandate is to protect American consumers from predatory financial practices, oversee financial institutions, and enforce laws designed to prevent another economic meltdown. Over the years, the CFPB has played a vital role in addressing consumer complaints, freezing illegal activities, and holding corporations accountable for unethical behavior.

For the employees of the CFPB, their work is not just a job but a mission driven by a deep commitment to public service. As one employee explained, "What about the people who use our complaints to get their loans straightened out or their bank accounts unfrozen? They’ve already tried calling the company and gotten nowhere. Who will help them now? Will the companies get bold and screw over their customers without our robust oversight?" Another employee expressed similar concerns, noting the rise of fintech companies and the potential consequences of losing regulatory oversight.

Broader Implications: A Blow to Consumer Protection and Financial Oversight

The dismantling of the CFPB has far-reaching implications for American consumers and the stability of the financial system. Employees fear that without the agency’s oversight, corporations will be emboldened to engage in predatory practices, leaving vulnerable populations, such as low-income families and the elderly, at greater risk. The agency’s role in regulating emerging technologies, such as fintech, also cannot be overstated. As one employee noted, "There’s a lot of fintech companies, and I don’t know what’s going to happen if we don’t have purview over that."

The potential consequences of the CFPB’s demise extend beyond individual consumers to the broader economy. Without a robust regulatory framework, the financial system becomes more vulnerable to abuse and instability, which could lead to another crisis. Employees also expressed concerns about the access of powerful figures, such as Elon Musk, to the CFPB’s sensitive database, which contains critical information about companies that his planned "X Money" online payment service would compete with. This raises ethical and competitive concerns, as the same individuals tasked with regulating Musk’s ventures could potentially exploit this data for their own gain.

A Clash of Values: Public Service Under Attack

The employees of the CFPB are not just worried about their jobs; they are deeply concerned about the erosion of public trust and the attack on the values of public service. Many of these employees are passionate about their work and see it as a way to give back to their communities. As one employee shared, "A lot of people are actively giving back and serving. Some donate from our paychecks—donations for nonprofits, volunteering, donating, giving back to our community, fostering dogs, they’re involved in a lot of causes. I work with remarkable people who never stop serving."

For many, working at the CFPB was a dream come true—a chance to make a difference in the lives of everyday Americans. One employee reflected on their journey: "Me personally, this was my dream job in college, and I couldn’t even believe I got in. It was so competitive. I’m too young to retire, and I believe in the work we did. Everyone I work with felt the same." Now, these dedicated public servants are facing an uncertain future, their livelihoods threatened by political decisions that seem to prioritize corporate interests over consumer protection.

The Fight to Preserve the CFPB: A Battle for Consumer Rights

As the legal battle over the future of the CFPB continues, the stakes could not be higher. The agency’s employees, federal unions, and consumer advocates are fighting to preserve an institution that has been instrumental in holding financial institutions accountable and protecting the rights of American consumers. The consent order approved by Judge Jackson offers a temporary reprieve, but the broader fight is far from over.

At its core, this is a battle over the role of government in protecting the public interest. The CFPB’s fate reflects a larger debate about whether regulatory agencies should serve as a check on corporate power or be dismantled to favor business interests. As the court considers the long-term fate of the agency, one thing is clear: the consequences of its demise would be felt far beyond the halls of the CFPB, impacting millions of consumers who rely on its oversight to navigate the complex and often treacherous financial landscape.

The coming months will be critical in determining the future of the CFPB and the protections it provides to American consumers. For now, the employees of the agency remain hopeful that the courts will recognize the importance of their work and act to preserve the integrity of the CFPB. As one employee put it, "It’s going to be a nightmare," but for now, they are holding onto the hope that justice will prevail.