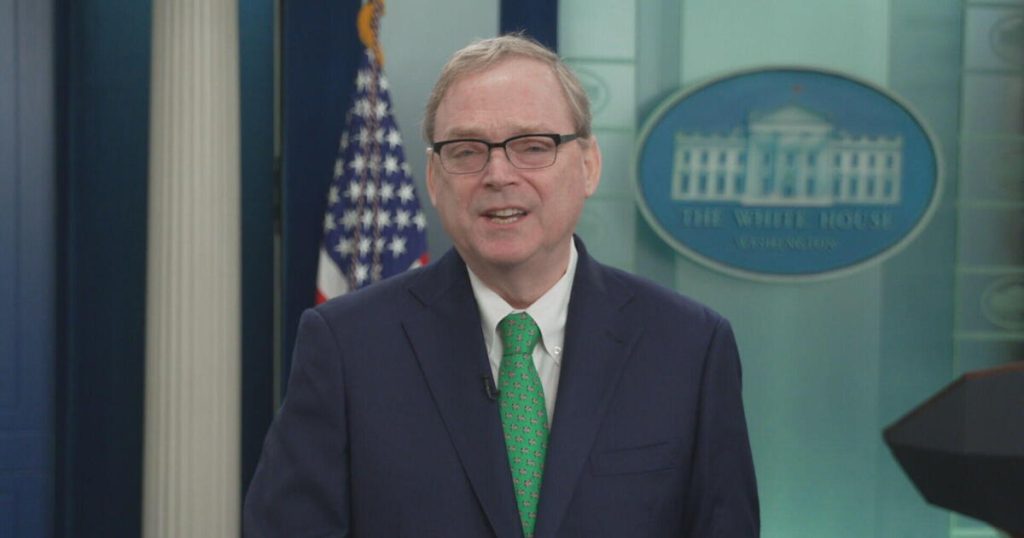

The State of the Economy and Inflation: An Interview with Kevin Hassett

Introduction to the Interview and Economic Challenges

On February 16, 2025, Kevin Hassett, Director of the National Economic Council, joined Margaret Brennan on "Face the Nation" to discuss the current state of the economy, with a particular focus on inflation and its impact on everyday Americans. The conversation began with a acknowledgment of the rising inflation rate, which has increased by 3% compared to the previous year. Hassett emphasized that inflation remains a significant challenge, particularly in the wake of the avian flu outbreak, which has led to record-high egg prices. Brennan highlighted the frustration many Americans feel when they see their grocery bills, especially for staples like eggs, go up due to factors like labor costs and supply chain disruptions.

Hassett quickly shifted the conversation to place blame on the policies of the Biden administration, arguing that the stagflation—or stagnant economic growth combined with high inflation—created by Biden’s fiscal spending has been worse than initially thought. He cited the consumer price index (CPI) data, which showed an average inflation rate of 4.6% over the past three months, well above the Federal Reserve’s target rate. Hassett also referenced criticisms from prominent economists, including Jason Furman and Larry Summers, who warned against the inflationary consequences of Biden’s policies. He described the situation as a "tragedy" and emphasized the need for a multi-faceted approach to bring inflation under control.

Addressing Inflation: The Administration’s Plan

Hassett outlined the administration’s strategy to tackle inflation, which includes a combination of supply-side tax cuts, reduced government spending, and deregulation. He argued that these measures would help increase supply and reduce demand, thereby reversing the macroeconomic forces that have driven inflation. Specifically, he mentioned efforts to boost energy production, which he believes will help alleviate inflationary pressures in the energy sector.

In addition to these broader economic measures, Hassett emphasized the need for targeted solutions to specific inflationary pressures, such as the avian flu outbreak. He criticized the Biden administration’s handling of the crisis, which he said focused primarily on killing large numbers of chickens within a perimeter of infected birds. Hassett argued that this approach was not only ineffective but also counterproductive, as it led to egg shortages and higher prices for consumers. He noted that he and Brooke Rollins, another official, have been working on a new plan to address the avian flu outbreak more effectively. This plan, which Hassett said would be ready for the president the following week, focuses on improving biosecurity measures and using medication to prevent the spread of the virus, rather than simply killing infected chickens.

Hassett also pointed out that the avian flu is primarily spread by ducks and geese, which are more mobile than chickens, and questioned the logic of killing chickens to control the outbreak. He argued that the administration’s new approach would be more efficient and would help stabilize egg prices.

Interest Rates and the Federal Reserve

The conversation then turned to the topic of interest rates and their role in combating inflation. Brennan noted that higher interest rates are a key tool used by the Federal Reserve to reduce inflation, but she pointed out that the president had recently called for lower interest rates. Hassett responded by emphasizing the importance of maintaining a good relationship with the Federal Reserve, which operates independently of the White House. He revealed that he had recently arranged to resume regular lunches with Federal Reserve Chairman Jay Powell to discuss economic issues and share perspectives.

While acknowledging the Fed’s independence, Hassett argued that the president’s opinions on economic policy should still be considered. He suggested that if the administration is successful in bringing inflation under control, it would reduce the pressure on the Fed to raise interest rates. To support this claim, he pointed to recent declines in long-term interest rates, such as the 10-year Treasury rate, which had dropped by about 40 basis points in the preceding weeks. Hassett attributed this decline to the administration’s announcement of its inflation-fighting plan and estimated that it would save the American people approximately $40 billion.

Tariffs and Trade Policy

Finally, Brennan raised the issue of tariffs and their potential impact on consumer prices. She noted that the president had recently expressed interest in imposing reciprocal tariffs on countries that levy value-added taxes (VATs) on U.S. goods. Hassett explained that the administration is exploring ways to address the imbalance in tax payments between U.S. companies operating abroad and foreign companies operating in the U.S. Currently, U.S. companies pay approximately $370 billion annually in taxes to foreign governments, while foreign companies pay just $57 billion in taxes to the U.S. government.

Hassett argued that these tariffs could help level the playing field and reduce the financial burden on American businesses and consumers. He estimated that over a 10-year period, the U.S. could recover up to $5 trillion in taxes paid to foreign governments, which could offset the cost of proposed tax cuts. He emphasized that the goal of the tariff policy is to ensure fairness in international trade and to put more money back in the pockets of American workers and families.

Conclusion: A Focus on Economic Solutions

In summary, Kevin Hassett’s interview on "Face the Nation" provided a detailed overview of the administration’s approach to addressing the current economic challenges, particularly inflation. He placed significant blame on the previous administration’s policies and outlined a comprehensive plan to reduce inflation through supply-side measures, deregulation, and targeted solutions to specific issues like the avian flu outbreak. Hassett also emphasized the importance of working with the Federal Reserve to manage interest rates and highlighted the administration’s efforts to reform trade policies and reduce the tax burden on American businesses.

While the conversation was largely focused on the administration’s policies, Hassett’s candor and willingness to engage in detailed discussions about economic challenges and solutions provided valuable insights into the White House’s strategy for putting the economy back on track. As the administration moves forward with its plans, it remains to be seen how effective these measures will be in addressing the inflationary pressures and other economic challenges facing the country.