In Tianjin, an industrial city in northern China, workers and machines are busy giving old electric vehicle (EV) batteries a second life. This process is part of a growing movement across the country to turn battery waste into a key part of its clean energy future.

China is the largest electric vehicle market in the world. Now it is leading a new industry—battery recycling. Startups like Tianjin Battery Technology are helping China reduce pollution and increase access to valuable battery materials. This growing sector also brings economic benefits and supports global environmental goals.

By the end of 2024, China had 31.4 million new energy vehicles on the road. That is about 9 percent of the country’s total car fleet. As more people trade in their old EVs, more batteries reach the end of their life. This trend is creating a new market for recycling and reuse. Government trade-in programs have also helped boost demand for new vehicles, increasing the number of used batteries needing disposal.

Since 2016, China has required carmakers to offer an 8-year or 120,000-kilometer warranty on key parts such as batteries. Because of this rule, many batteries are now reaching the end of their service period. Experts say China will have 1.04 million tonnes of retired EV batteries by 2025. This amount may rise to 3.5 million tonnes by 2030.

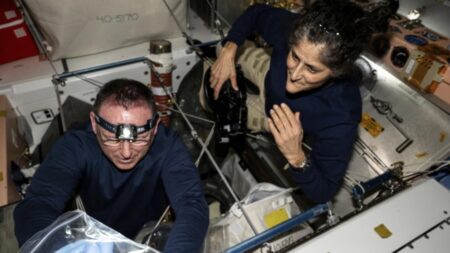

Tianjin Battery Technology plays an important role in this sector. The company recycles old batteries by removing useful parts, like modules and wiring. Some parts are used to fix second-hand vehicles. Others are broken down to extract copper, aluminum, and a black powder that becomes lithium carbonate. These materials are valuable in making new batteries. The factory can handle 10,000 tonnes of battery waste each year. Its lithium recovery rate is over 90 percent.

China relies on imports for many key battery materials like lithium, cobalt, and nickel. Recycling old batteries helps reduce this dependency. It gives local companies access to high-quality materials without needing to import from other countries. This also lowers costs and improves supply chain security.

Some recycling operations in China still use old and unsafe methods. However, large companies are now using new technology to improve the process. GEM, a major battery recycling firm based in Shenzhen, has built a smart system that takes batteries apart more safely and quickly. The company also uses special methods to recover lithium at both high and low temperatures. It has created a digital system to track each battery’s full lifecycle, from collection to reuse. In early 2025, GEM had more than 140 battery recycling sites in China and worked with over 750 companies worldwide. In the first three months of the year, the company recycled 10,800 tonnes of used batteries—37 percent more than the same time in 2024.

In Tianjin, factory teams have improved their tools to work faster and more safely. By modifying basic cutting and welding tools, they increased battery dismantling speed by 75 percent. These small changes make a big difference in overall productivity.

As China’s EV market grows, its recycling companies are also looking abroad. CATL, the world’s largest battery producer, is building a recycling plant in Hungary. The plant will open in 2026 and support local rules on battery disposal. GEM has opened seven recycling centers outside China, including in South Korea and Indonesia. Other Chinese companies are forming global partnerships. Gotion High-tech and Envision Greenwise plan to build 100 battery recycling and service centers around the world. Huayou Recycling has joined with France’s SUEZ Group to enter the European market.