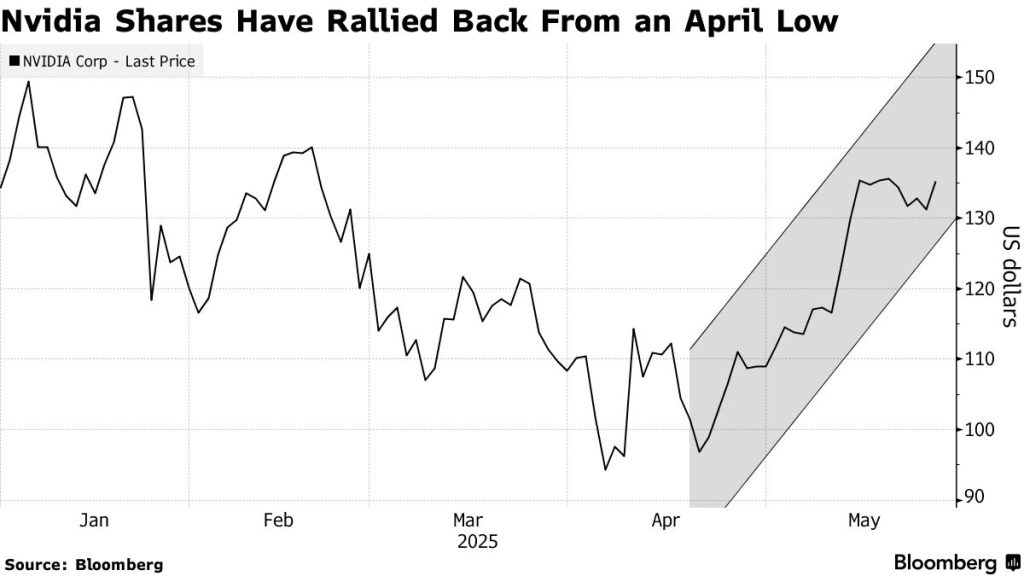

Nvidia Corp., the world’s top chipmaker, will release its first-quarter earnings report on Wednesday after the market closes. This report marks the last major earnings update in the current season for big technology companies. Since April, Nvidia shares have risen over 40 percent due to strong demand for its AI products and easing trade tensions.

Other leading tech firms like Microsoft and Meta Platforms have already reported solid earnings. Their results show growth continues despite uncertainties from U.S. trade policies under President Donald Trump. Nvidia’s report will reveal if this positive trend continues.

The recent strong earnings from major tech companies helped technology stocks recover after a market decline in April. The S&P 500 fell sharply last month because of concerns about tariffs and trade conflicts. Nvidia’s stock has gained value as its biggest customers, including cloud providers and governments in the Middle East, keep investing heavily in AI computing. However, the stock still trades about nine percent below its peak in January.

Investors will focus on Nvidia’s sales of new Blackwell chips. These chips power AI systems and faced production delays last quarter. The company expects to report about 19 billion dollars in net income and 43 billion dollars in revenue for the first quarter. These figures would represent a 31 percent and 66 percent increase from the same period last year.

Profit margins will also be under scrutiny. Nvidia previously said higher production costs for Blackwell chips would weigh on margins this quarter. The company expects margins to improve to the mid-70 percent range by the end of the year, up from about 71 percent in the first quarter.

Nvidia faces challenges from U.S. export restrictions on advanced chips sent to China. These rules aim to slow China’s technological progress. Last month, Nvidia wrote off 5.5 billion dollars in chip inventory affected by these limits. CEO Jensen Huang criticized the policies, warning they might cost Nvidia a market worth up to 50 billion dollars by 2026. Analysts expect mixed impacts from the restrictions, making this quarter’s results potentially complex.

Despite these challenges, demand for AI computing gear remains strong. Major buyers like Microsoft and Alphabet plan to increase their technology spending next year. Meta also raised its forecast for capital expenditures in 2025. This shows that large cloud providers believe they must keep investing to stay competitive.

Nvidia’s stock is currently valued at 29 times projected earnings over the next year, lower than its five-year average of 40 times. This suggests investors are cautious but hopeful about the company’s future. Nvidia remains the leading player in AI chip technology, a rapidly growing market.

In other industry news, French semiconductor supplier Soitec’s shares fell after missing sales targets and withdrawing future guidance due to market uncertainties. Meanwhile, Meta continues its legal battle against the U.S. Federal Trade Commission’s efforts to break up the company for alleged monopoly practices. Apple is preparing a new gaming app to attract more users. Shares of PDD Holdings dropped after missing earnings, showing ongoing effects of trade tensions.

Several other tech companies, including Salesforce and HP Inc., will release earnings soon. Investors will watch these results for broader trends in technology spending.