The Epstein Documents and Bitcoin: Separating Fact from Fiction

The Release That Shook Multiple Worlds

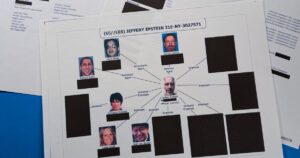

On January 30th, the United States Department of Justice released an enormous trove of documents related to the late Jeffrey Epstein, totaling approximately 3.5 million pages. The release sent shockwaves far beyond the expected circles of politics and business, unexpectedly reaching into the cryptocurrency community. Within hours of the documents becoming public, social media platforms erupted with sensational claims linking Epstein to Bitcoin’s creation. Assertions ranged from “Satoshi is in the documents” to more elaborate conspiracy theories suggesting “Epstein created Bitcoin” or even that “The CIA is behind Bitcoin.” These claims spread rapidly across Twitter, Reddit, and other platforms, creating confusion and concern among cryptocurrency enthusiasts and investors alike. The timing and volume of these allegations created a perfect storm of misinformation, requiring careful examination to separate genuine revelations from fabricated content. The question that emerged from this chaos was straightforward but critically important: Do the leaked documents actually establish any direct connection between Bitcoin’s mysterious and pseudonymous creator, Satoshi Nakamoto, and the convicted sex offender Jeffrey Epstein? Understanding the answer requires diving into what the documents actually contain versus what internet speculation has manufactured.

Debunking the Viral Fake Evidence

Among the most widely circulated pieces of “evidence” on social media was a purported email allegedly sent by Jeffrey Epstein to his associate Ghislaine Maxwell. The image that went viral showed a message supposedly dated October 31, 2008—significantly, the same day that Bitcoin’s whitepaper was published to a cryptography mailing list. The email’s content appeared damning at first glance, reading: “The pseudonym ‘Satoshi’ works perfectly. Our little digital gold mine is ready for the world.” If authentic, such a message would have been explosive proof of Epstein’s involvement in Bitcoin’s creation. However, investigators and fact-checkers quickly determined that this image was completely fabricated. Several technical errors betrayed the forgery’s amateur construction. Most obviously, the document contained two separate “To:” lines, a formatting impossibility in genuine email headers. Additionally, the header line was mysteriously repeated in the recipient section, another clear sign of manipulation. Perhaps most tellingly, thorough searches of the actual Department of Justice archives revealed no trace of the phrase “little digital gold mine” or the email address mentioned in the fake document. This fabricated email exemplifies how misinformation can spread virally in the digital age, especially when it combines elements of existing conspiracy theories with legitimate news events. The fake email’s rapid spread demonstrates the public’s appetite for sensational revelations, even when they lack proper verification.

What the Documents Actually Reveal About Satoshi

While the viral email was fake, the Epstein documents do contain some references to both “Satoshi” and Bitcoin, though in a completely different context than the conspiracy theories suggest. Several documents within the massive file dump do indeed mention the name “Satoshi,” and one document specifically states that Epstein “spoke with some of Bitcoin’s founders.” However, context is crucial here. Speaking with Bitcoin developers or people involved in the cryptocurrency space in 2016—years after Bitcoin’s creation—in no way proves that Epstein himself created the protocol between 2008 and 2009. There is absolutely no technical evidence connecting Epstein to the early development of Bitcoin. Researchers have found no match between the communication style, technical knowledge, or cryptographic signatures in Satoshi Nakamoto’s known email correspondence and anything attributable to Epstein. Furthermore, there is no connection between Epstein and Bitcoin’s initial code commits, which are publicly available in repositories and have been extensively analyzed by countless researchers over the years. Perhaps most significantly, no links have been discovered between Epstein and the early Bitcoin wallets believed to belong to Satoshi Nakamoto, which contain approximately one million Bitcoin that have remained untouched since they were mined. The cryptographic keys controlling these wallets would be the ultimate proof of Satoshi’s identity, and there is zero evidence connecting them to Epstein. The distinction between being interested in or investing in Bitcoin versus creating it is enormous, and the evidence firmly places Epstein in the former category, not the latter.

Epstein’s Actual Cryptocurrency Investments

What the documents do conclusively prove is that Jeffrey Epstein was an investor in the cryptocurrency ecosystem, participating in the funding of several significant projects during the industry’s formative years. Newly released emails reveal that in December 2014, Epstein invested $3 million in Coinbase, which would become one of the world’s largest cryptocurrency exchanges. This investment was facilitated through Brock Pierce, co-founder of Tether (the largest stablecoin by market capitalization), and Blockchain Capital, an influential venture capital firm focused on cryptocurrency and blockchain technology. At the time of Epstein’s investment, Coinbase was valued at approximately $400 million—a significant valuation for a young cryptocurrency company, but modest compared to its current status. Today, Coinbase’s market value stands at roughly $51 billion, meaning Epstein’s stake would have appreciated enormously. The documents show that Epstein sold a portion of his Coinbase investment in 2018, converting approximately $15 million into cash—a substantial return on his original $3 million investment. Beyond Coinbase, the documents also reveal that Epstein invested in Blockstream, an important early Bitcoin infrastructure company that developed significant improvements to Bitcoin’s underlying technology. Adam Back, one of Blockstream’s founders and a respected cryptographer who was actually cited in Bitcoin’s original whitepaper, confirmed the 2014 investment through his social media accounts. Interestingly, Back himself has occasionally been speculated to be Satoshi Nakamoto due to his early involvement in digital cash systems and his correspondence with Satoshi, though these theories remain unconfirmed. Epstein’s investments demonstrate that he recognized cryptocurrency’s potential relatively early, but being an investor is fundamentally different from being a creator.

The MIT Connection and Bitcoin Development Funding

Perhaps the most complex aspect of Epstein’s connection to cryptocurrency involves his donations to the Massachusetts Institute of Technology (MIT), one of the world’s premier research institutions. The documents reveal that between 2002 and 2017, Epstein donated a total of $850,000 to MIT, with $525,000 of that amount specifically directed to the Digital Currency Initiative (DCI) within the MIT Media Lab. This initiative became particularly significant to Bitcoin’s development in 2015, when the Bitcoin Foundation—which had previously funded several core Bitcoin developers—experienced a severe financial crisis. During this turbulent period, several prominent Bitcoin Core developers transitioned to positions at MIT’s DCI, where they could continue their crucial work on Bitcoin’s code. These developers included highly respected figures such as Wladimir van der Laan, Gavin Andresen, and Cory Fields, all of whom made substantial contributions to Bitcoin’s development. However, multiple sources confirm that these developers were completely unaware of Epstein’s donations and received their salaries directly from MIT through standard university employment channels, not from any fund specifically tied to Epstein. This institutional layer between the donor and the recipients is significant. Furthermore, Bitcoin’s fundamentally decentralized governance structure makes it technically impossible for any single donor, investor, or individual to gain control over the protocol. Changes to Bitcoin’s code require broad consensus among developers, miners, node operators, and users—a distributed decision-making process that prevents any single point of control. Even substantial financial contributions cannot override this structural protection, which is one of Bitcoin’s core design features.

The Verdict: Resilience of Decentralized Systems

So what is the definitive answer to the question that sparked this entire controversy: “Is Jeffrey Epstein Satoshi Nakamoto?” The answer, based on all available evidence, is an unequivocal no. Despite the viral fake emails and breathless social media speculation, the current evidence offers absolutely no technical clues that Jeffrey Epstein wrote Bitcoin’s whitepaper, mined the first blocks of the Bitcoin blockchain, or controlled Satoshi Nakamoto’s cryptographic keys. What the Epstein documents actually reveal is that a wealthy investor with diverse interests made strategic investments in emerging cryptocurrency companies and indirectly funded Bitcoin development through institutional donations—activities that, while noteworthy, are completely different from creating Bitcoin itself. More broadly, the Epstein papers do not indicate that cryptocurrency technology itself is compromised or at risk. Bitcoin’s protocol, as designed by the still-anonymous Satoshi Nakamoto, features a decentralized structure that was specifically engineered to prevent control by any single individual, organization, or government. The network continues to operate independently of any particular donor, investor, or participant, processing transactions and securing the blockchain through the collective efforts of thousands of participants worldwide. Open-source networks like Bitcoin and Ethereum continue to function independently of their early funding structures, demonstrating remarkable resilience against attempts at centralized control. This independence is widely regarded as one of cryptocurrency’s greatest strengths and points of resilience. The Epstein documents episode ultimately serves as a reminder of two important lessons: first, the necessity of verifying sensational claims before accepting them as truth, especially in the age of viral misinformation; and second, the robustness of properly designed decentralized systems, which can maintain their integrity even when controversial figures participate in their broader ecosystem. As always with cryptocurrency matters, this analysis is informational and does not constitute investment advice.