Explosive Allegations Rock TRON Founder Justin Sun: What You Need to Know

A Bombshell Accusation Emerges from Personal Financial Crisis

The cryptocurrency world is buzzing with controversy after Chinese journalist and entrepreneur Zeng Ying dropped serious allegations against Justin Sun, the founder of TRON, one of the blockchain industry’s most recognized projects. What started as a personal confession about devastating financial losses has evolved into accusations of coordinated market manipulation dating back to TRON’s early days. Zeng claims that Sun orchestrated an elaborate scheme on Binance, one of the world’s largest cryptocurrency exchanges, to artificially inflate the price of TRX tokens before dumping them on unsuspecting retail investors. These allegations, while unverified, have reignited scrutiny of Sun’s business practices and raised questions about the wild-west atmosphere that characterized cryptocurrency markets during the 2017-2018 boom. The timing of these accusations is particularly noteworthy, coming shortly after Zeng publicly revealed she had been completely wiped out in leveraged trading positions, losing what she described as “an amount of money I can’t bear.” This context has led many observers to question the motivations behind her accusations, even as others argue that her detailed claims deserve serious investigation by regulatory authorities.

Who is Zeng Ying and Why Her Voice Matters

Understanding who Zeng Ying is provides important context for evaluating these serious allegations. She isn’t just another anonymous internet critic with an axe to grind—Zeng has legitimate credentials in both journalism and the cryptocurrency space. With an educational background from Japan’s prestigious Waseda University and experience as a television presenter in Japan, she established herself as a credible voice in financial media before diving into the crypto world. Her recognition by Forbes in their coveted “30 Under 30” list in 2019 marked her as an emerging leader in her field, and she was among the pioneering bloggers who helped explain cryptocurrency concepts to Chinese-speaking audiences during the industry’s formative years. However, her journey hasn’t been without significant personal struggles. Zeng has been remarkably open about battling depression since 2018, with particularly severe mental health challenges emerging in 2022. The fact that her Weibo account—China’s equivalent to Twitter—was subsequently shut down adds another layer of complexity to her story. Was this censorship, or consequences of problematic content? These personal challenges don’t automatically invalidate her claims, but they do form part of the larger picture that observers must consider when weighing her allegations against one of cryptocurrency’s most prominent and controversial figures.

The Financial Meltdown That Preceded the Accusations

Before leveling her explosive charges against Justin Sun, Zeng Ying shared the painful details of her own financial catastrophe—a complete liquidation of her cryptocurrency positions that left her financially devastated. In what reads as a cautionary tale about the dangers of leveraged trading, Zeng revealed that all of her Ethereum positions and two Solana positions had been wiped out after she had been using leverage since October. For those unfamiliar with trading terminology, leverage allows traders to control larger positions than their actual capital would permit, amplifying both potential gains and potential losses. When the market moves against leveraged positions, traders can lose not just their profits, but their entire investment in what’s called a liquidation event. Zeng’s candid admission of “greed and the use of leverage” shows a moment of raw vulnerability, as she acknowledged the psychological pitfalls that trap many crypto traders. She even revealed that she had reached out to former contacts in the crypto industry requesting loans—a humbling position for someone who had once been celebrated in Forbes and held up as a success story. This financial and emotional context is crucial because it was approximately 5.5 hours after sharing news of this liquidation that Zeng pivoted to making her accusations against Sun. Critics might see this timing as evidence that her claims are motivated by financial desperation or a desire to deflect from her own trading failures, while supporters might argue that hitting rock bottom gave her the freedom to finally speak truth to power without fear of professional consequences.

The Detailed Allegations: Market Manipulation at Scale

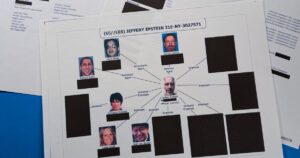

The specific accusations Zeng Ying has leveled against Justin Sun paint a picture of coordinated, systematic market manipulation during TRON’s crucial early period. According to Zeng’s claims, Sun allegedly created a network of fake accounts on Binance using the personal information and phone numbers of multiple TRON employees, essentially turning his own staff into unwitting accomplices in a scheme they may not have even known about. Through this network of accounts, Zeng alleges that coordinated buying and selling of TRX tokens took place—a practice known as “wash trading” when it involves the same entity on both sides of trades, or market manipulation when it involves coordinated activity designed to create false impressions of trading volume and price momentum. The alleged scheme’s endgame, according to Zeng, was to artificially pump up the price of TRX tokens and then sell them to retail investors—everyday people hoping to catch the next big cryptocurrency wave—generating what she characterizes as “a large amount of illicit profit” for Sun and potentially other insiders. Zeng insists this wasn’t just aggressive marketing or enthusiastic promotion, but rather “organized market manipulation” that crossed legal and ethical lines. To support these serious charges, she claims to possess concrete evidence including WeChat chat records, statements from employees, and internal company documents. Going further, she has publicly stated her willingness to cooperate with the U.S. Securities and Exchange Commission and has requested that American authorities contact her directly. This invitation to regulatory investigation is significant—it’s one thing to make accusations on social media, quite another to invite law enforcement scrutiny, though skeptics note this invitation doesn’t itself constitute proof.

The Personal Connection and Historical Context

Adding another layer of complexity to this already tangled situation, Zeng Ying has claimed she had a romantic relationship with Justin Sun during TRON’s early entrepreneurial phase. This alleged personal connection could cut both ways in terms of credibility—on one hand, a former romantic partner might have insider access to information and operations that outsiders would never see; on the other hand, failed relationships can sometimes motivate accusations that mix legitimate grievances with personal animosity. It’s worth noting that there is no publicly available evidence confirming that Zeng was directly involved in TRON’s operations during the critical 2017-2018 period when the alleged manipulation would have occurred. Some recent tabloid-style articles have referred to her as Sun’s “ex-girlfriend,” but these claims remain unconfirmed by either party. The historical context here is important: 2017-2018 represented the absolute peak of the Initial Coin Offering (ICO) boom, a period when regulatory oversight was minimal and market manipulation was, by many accounts, rampant across the cryptocurrency industry. TRON launched during this wild period and quickly became one of the highest-profile projects, with Sun himself becoming one of crypto’s most visible and controversial personalities. Interestingly, Zeng’s accusations aren’t the first time Sun has faced allegations of market manipulation. The U.S. SEC actually accused Justin Sun of wash trading in 2023, bringing formal charges that seemed to vindicate critics who had long questioned his business practices. However, those charges were dropped in 2025, and notably, the SEC documents from that case didn’t include any specific details about accounts being opened using employee identities—the particular scheme Zeng now describes.

Unanswered Questions and the Path Forward

As of now, Justin Sun has remained silent on these latest allegations, neither confirming nor denying Zeng Ying’s claims. This silence is itself noteworthy—Sun has historically been quite active on social media and generally quick to defend himself against criticism, so his lack of response might indicate he’s consulting with legal counsel or simply doesn’t view these accusations as credible enough to warrant a response. The crypto community remains divided in its reaction. Some see Zeng’s detailed claims and willingness to cooperate with authorities as signs she’s telling the truth, finally exposing practices that were commonplace but rarely documented during crypto’s early wild-west period. Others point to the timing of her accusations—coming hours after her own trading catastrophe—and her acknowledged mental health struggles as reasons to treat her claims with skepticism until concrete evidence emerges. The truth is that as serious as these allegations are, there is currently no proven evidence that the manipulation Zeng describes actually occurred. We have accusations, claimed evidence that hasn’t been made public, and an invitation for regulatory investigation, but no independent verification. The cryptocurrency industry has matured significantly since 2017-2018, with regulatory frameworks tightening and exchanges implementing more robust compliance measures, but questions about the practices that built some of crypto’s biggest fortunes remain largely unexamined. Whether Zeng Ying’s allegations lead to formal investigations, legal consequences, or simply fade as unproven claims remains to be seen. What’s certain is that this controversy once again highlights the tension in cryptocurrency between revolutionary financial innovation and the fundamental need for market integrity and investor protection—a tension that remains unresolved as the industry continues to evolve and face scrutiny from regulators worldwide.