Bitcoin Mining Under Pressure: Understanding the Hash Ribbon Signal and What It Means for Investors

The Perfect Storm Hitting Bitcoin Miners

Recent severe winter weather across the United States has created significant challenges for bitcoin mining operations, forcing many companies to make difficult decisions about their operations. As electricity costs soared and power grids strained under the pressure of extreme cold, mining facilities found themselves facing a harsh economic reality: continuing operations at full capacity simply wasn’t profitable. This led to a widespread reduction in computing power, known in the industry as “hashrate,” as miners temporarily powered down their equipment to avoid operating at a loss. While this might sound like alarming news on the surface, cryptocurrency traders and analysts are paying close attention to a particular technical indicator called the Hash Ribbon, which has historically provided valuable insights into bitcoin’s price movements during these challenging periods. This indicator operates on a fascinating principle: bitcoin’s price often hits bottom during these periods of what experts call “miner capitulation,” creating potential buying opportunities for those who understand the pattern.

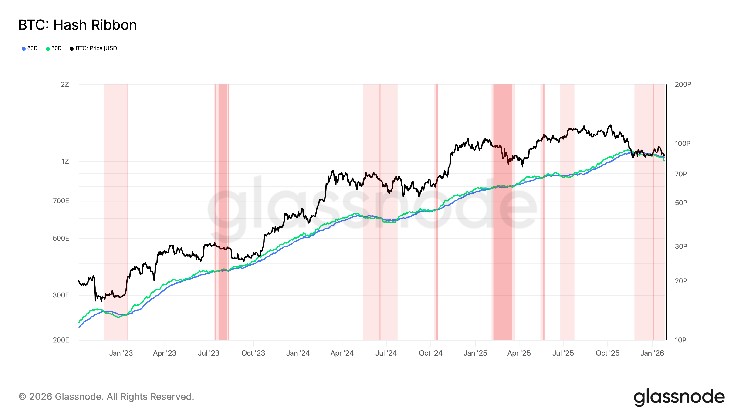

Decoding the Hash Ribbon: A Window Into Bitcoin’s Cycles

The Hash Ribbon isn’t just another random chart that crypto enthusiasts obsess over—it’s a carefully designed indicator that tracks meaningful changes in the Bitcoin network’s health and miner behavior. At its core, the Hash Ribbon monitors two moving averages of the network’s hashrate: a 30-day average representing short-term trends and a 60-day average showing longer-term patterns. When you visualize this on platforms like Glassnode, you can see these averages dancing around each other, telling a story about the pressures facing miners and the broader bitcoin ecosystem. The magic happens when these lines cross. When the short-term 30-day average dips below the longer-term 60-day average, indicated by a light red color on the chart, it signals that miners are capitulating—essentially throwing in the towel temporarily because operations have become unprofitable. The most intense phase of this capitulation is considered over when the 30-day measure climbs back above the 60-day average, marked by a darker red shade. But the real excitement for traders comes when this recovery synchronizes with a shift in bitcoin’s price momentum from negative to positive, represented by a transition from dark red to white on the indicator. This convergence has historically marked some of the best long-term buying opportunities in bitcoin’s history.

The Current Situation: Numbers That Tell a Story

The recent storm’s impact on bitcoin mining operations can be measured in concrete numbers that reveal just how significant this disruption has been. The network’s total hashrate—essentially the combined computing power of all miners working to secure the Bitcoin blockchain—has plummeted by approximately 20%. To put this in perspective, the hashrate dropped from around 1.2 zettahash per second down to roughly 950 exahashes per second. For those unfamiliar with these massive numbers, think of it as losing about a fifth of all the computational power that secures the entire Bitcoin network. This dramatic decline triggers an important automatic adjustment in the Bitcoin protocol called the difficulty adjustment, which is designed to keep blocks being mined at consistent 10-minute intervals regardless of how much computing power is active on the network. The upcoming difficulty adjustment is projected to decrease by about 17%, which would represent the largest single difficulty drop since July 2021—a period crypto veterans will remember as when China implemented its ban on bitcoin mining, forcing a massive exodus of mining operations from the country. This historical parallel underscores just how significant the current situation is for the Bitcoin network.

Learning from History: When Miners Capitulate, Opportunity Knocks

One of the most compelling aspects of the Hash Ribbon indicator is its track record of coinciding with significant price bottoms and subsequent recoveries in bitcoin’s value. The most recent example occurred just a few months ago in late November, when the Hash Ribbon flashed its capitulation signal and bitcoin established a local bottom around $80,000. Since then, bitcoin has recovered to trade around $88,000, demonstrating the pattern’s relevance even in recent market conditions. Looking back further, an even more dramatic example unfolded in mid-2024, when the Hash Ribbon showed capitulation coinciding with the unwinding of the yen carry trade—a complex financial maneuver that sent shockwaves through global markets. During that turbulent period, bitcoin bottomed near $49,000 in August, only to embark on an impressive rally that saw it reach $100,000 by the following January. Perhaps the most striking historical example occurred during the catastrophic collapse of the FTX cryptocurrency exchange in 2022, an event that shook investor confidence to its core and sent bitcoin plummeting to around $15,000 amid widespread miner capitulation. Yet even during that dark period, the Hash Ribbon indicator provided a roadmap for recovery: once the indicator normalized, showing that miners had weathered the storm and were returning to profitable operations, bitcoin’s price rebounded to approximately $22,000. These historical patterns don’t guarantee future results, but they do suggest that periods of miner stress often precede stronger phases for bitcoin once conditions stabilize.

Why Miner Capitulation Matters for Bitcoin’s Price

Understanding why miner capitulation often precedes price recoveries requires grasping the unique role miners play in the Bitcoin ecosystem. Miners are essentially forced sellers—they must regularly sell at least some portion of the bitcoin they earn to cover operational expenses like electricity, equipment, and facility costs. When mining becomes unprofitable and hashrate drops, the weakest miners are forced to shut down operations, which actually reduces the selling pressure on bitcoin’s price. Additionally, difficulty adjustments that follow significant hashrate drops make mining more profitable for the remaining miners, creating more favorable conditions for the industry as a whole. This creates a sort of natural stabilizing mechanism within the Bitcoin network: when times get tough and prices drop, the weakest participants are shaken out, reducing supply pressure and setting the stage for recovery. Furthermore, the cryptocurrency market has developed a certain psychological relationship with these miner capitulation events. Experienced traders and institutional investors who track indicators like the Hash Ribbon often view these periods as accumulation opportunities—times to buy bitcoin at depressed prices before the next upward move. This creates a self-reinforcing cycle where the technical indicator actually influences market behavior, as traders position themselves based on historical patterns.

The Critical Question: Will History Repeat Itself?

As the dust settles from this latest storm-induced disruption to bitcoin mining operations, the cryptocurrency community faces a crucial question: will the established pattern hold true once again, leading to another expansionary phase for bitcoin as hashrate and the Hash Ribbon normalize? Several factors suggest the conditions might be right for another recovery. First, the upcoming difficulty adjustment will make mining more profitable for operations that remain online, potentially stabilizing the network more quickly than some expect. Second, bitcoin has shown remarkable resilience over its 15-year history, consistently recovering from periods of stress and doubt. Third, the current price level around $88,000 represents a significant discount from bitcoin’s all-time highs, potentially attracting both retail and institutional buyers who view this as an opportunity. However, it’s important to acknowledge the uncertainties that could disrupt this pattern. The current macroeconomic environment differs from previous capitulation events, with ongoing concerns about inflation, interest rates, and global economic stability. Regulatory pressures on the cryptocurrency industry continue to evolve, creating additional variables that didn’t exist during earlier Hash Ribbon signals. Energy costs and environmental concerns about bitcoin mining remain hot-button issues that could influence how quickly hashrate recovers. For investors and traders watching these developments, the key is to view the Hash Ribbon as one tool among many—a valuable historical indicator that provides context but shouldn’t be the sole basis for investment decisions. As always in cryptocurrency markets, the only certainty is uncertainty, but understanding patterns like the Hash Ribbon at least provides a framework for navigating the volatility and making more informed decisions during turbulent times.