Cryptocurrency Market Braces for Major Token Unlocks Following Sharp Decline

Market Turbulence Sets the Stage for Critical Week

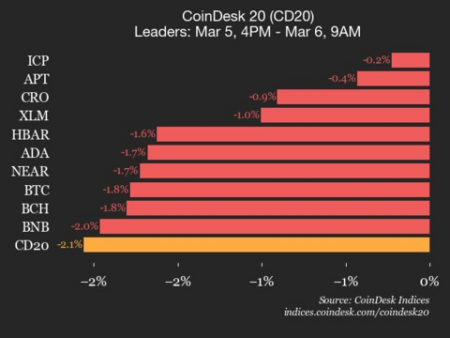

The cryptocurrency landscape experienced a brutal week of trading, with investors watching their portfolios shrink as sharp declines swept across the entire market. Bitcoin, often considered the bellwether of the crypto world, wasn’t spared from the carnage, posting double-digit percentage losses that sent shockwaves through the community. For altcoins—those cryptocurrencies other than Bitcoin—the situation proved even more dire, with many suffering devastating losses that left traders and long-term holders alike reassessing their positions. This widespread selloff has created a tense atmosphere in the market, with participants now turning their attention to a series of scheduled token unlocks that could potentially add further pressure to already fragile price levels. These upcoming unlocks represent moments when previously locked or vested tokens become available for trading, potentially increasing selling pressure as early investors, team members, or other stakeholders gain the ability to liquidate their holdings.

Understanding Token Unlocks and Their Market Impact

Token unlocks are scheduled events that occur according to predetermined vesting schedules established when cryptocurrency projects launch. These mechanisms are designed to align the long-term interests of project founders, early investors, and team members with the success of the protocol, preventing immediate dumps that could crash the price. However, when these tokens finally become available for trading, they represent a potential influx of new supply into the market. The impact of these unlocks varies dramatically depending on several factors, including the percentage of total market capitalization being unlocked, the current market sentiment, and the intentions of those receiving the newly liquid tokens. In a bullish market, unlocks might be absorbed without significant price impact, but in the current environment—following sharp declines across the board—these events take on heightened significance. Market participants watch these dates carefully, as they can trigger anticipatory selling before the unlock or create buying opportunities if the feared selling pressure fails to materialize.

Early Week Unlocks: Quack AI, Orbler, Ethereum, and Impossible Cloud Network

The week begins with several notable unlock events that will test market resilience. Quack AI (Q), with a market valuation of $69.63 million, faces a substantial unlock of $7.93 million worth of tokens on February 2nd at 3:00 AM Turkish time. This represents a concerning 12.95% of the project’s total market capitalization—a significant percentage that could create meaningful selling pressure if recipients choose to liquidate. On the same day and time, Orbler (ORBR) will unlock $1.13 million in tokens, representing 3.12% of its $36.38 million market value. While this percentage is more modest, in the current fragile market conditions, even smaller unlocks can trigger outsized reactions. Later that morning, at 11:00 AM, Ethereum (ENA)—not to be confused with Ethereum itself—will see $12.96 million in tokens become available for trading. Despite being the largest dollar amount among the early-week unlocks, this represents only 1.18% of ENA’s substantial $1.10 billion market capitalization, potentially limiting the impact. Rounding out the early week unlocks, Impossible Cloud Network (ICNT) will release $3.16 million in tokens on February 3rd at 3:00 AM, accounting for 3.41% of its $92.60 million market value. These varied percentages and amounts will provide important data points for understanding how the market absorbs new token supply in the current downturn environment.

Mid-Week Developments: Lagrange and the Berachain Event

As the week progresses, attention shifts to two particularly interesting unlock events. Lagrange (LA), scheduled for February 4th at 3:00 AM, will unlock $2.81 million worth of tokens, representing 5.94% of its $47.30 million market capitalization. While this percentage falls into the moderate range, it’s significant enough to warrant close attention from traders and analysts looking for price movement opportunities. However, the week’s most significant event arrives on February 6th at 3:00 AM, when Berachain (BERA) undergoes a massive unlock that dwarfs all others on the schedule. With $29.34 million in tokens becoming available against a market capitalization of just $49.25 million, this unlock represents an extraordinary 59.59% of the project’s total market value. This is the kind of event that can fundamentally alter a project’s trading dynamics, as the circulating supply is about to increase by more than half. Such a dramatic increase in available tokens typically creates significant uncertainty, and market participants will be watching closely to see whether holders choose to retain their newly liquid positions or take profits. The Berachain unlock will serve as a crucial test case for how the market handles extreme dilution events, potentially setting precedents for how similar situations are approached in the future.

Late Week Unlocks: INFINIT and Stable Round Out the Schedule

The final days of this eventful week bring two more unlock events that deserve attention. INFINIT (IN), scheduled for February 7th at 3:00 AM, will see $5.39 million in tokens become tradable, representing a substantial 31.45% of its relatively modest $19.90 million market capitalization. This unlock is particularly significant because it represents nearly a third of the project’s value, creating potential for considerable volatility as the market absorbs this new supply. Projects with smaller market caps like INFINIT often experience more pronounced price movements from unlock events, as the available liquidity may be insufficient to absorb large sales without substantial price impact. The week concludes with Stable (STABLE) on February 8th at 3:00 AM, unlocking $21.27 million worth of tokens. While this represents the second-largest dollar amount of the week’s unlocks, it accounts for only 5.05% of Stable’s substantial $458.66 million market capitalization, suggesting the project may be better positioned to absorb the new supply without dramatic price disruption. The timing of this unlock, coming after the market has digested all the previous week’s events, may also work in its favor, potentially providing clearer signals about market appetite for absorbing new token supply.

Strategic Considerations and Risk Management for Investors

As these unlock events approach, cryptocurrency investors and traders face important decisions about position management and risk exposure. The current market environment, already weakened by the recent sharp declines, creates a particularly challenging backdrop for absorbing significant new token supply. Historically, unlock events have shown varied outcomes—sometimes the anticipated selling pressure fails to materialize as long-term believers retain their positions, while other times substantial dumps occur as early participants take profits. Smart market participants will approach this week with heightened caution, possibly reducing position sizes in affected tokens ahead of unlock dates or, conversely, preparing to capitalize on panic selling that may create temporary bargains. The wide range of unlock percentages—from ENA’s modest 1.18% to Berachain’s massive 59.59%—provides diverse scenarios for observation and potential trading opportunities. It’s crucial to remember that token unlocks don’t occur in isolation; they interact with broader market sentiment, project fundamentals, and technical chart patterns to create the actual price outcome. This analysis is provided for informational purposes and should not be construed as investment advice. Each investor must conduct their own research, consider their risk tolerance, and make decisions appropriate to their individual circumstances. The coming week will undoubtedly provide valuable lessons about market dynamics, token economics, and the resilience of cryptocurrency projects during challenging times.