Bitcoin vs. Gold: A Tale of Two Store-of-Value Assets

Let the Gold Bugs Have Their Moment in the Sun

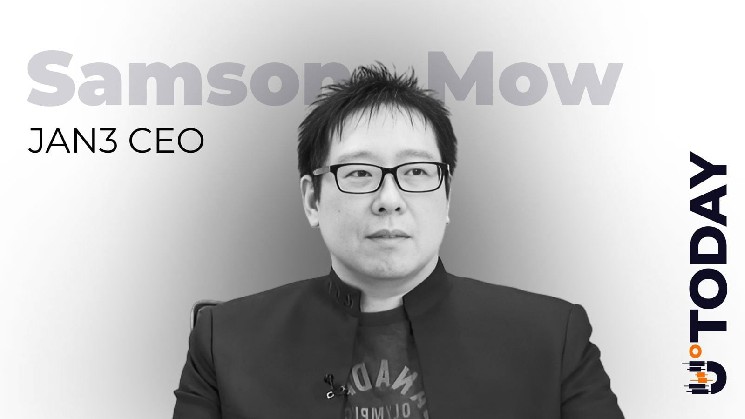

Samson Mow, one of Bitcoin’s most vocal advocates and evangelists, recently made waves in the cryptocurrency community with his candid acknowledgment that gold is currently having its time to shine. In a refreshingly magnanimous statement, Mow suggested that Bitcoin enthusiasts should step back and allow gold investors—affectionately known as “gold bugs”—to enjoy their moment of vindication. However, he added a confident caveat: once Bitcoin regains its momentum and “mojo,” it will start “melting faces,” a colorful crypto-community term that describes explosive price action that leaves skeptics stunned and believers celebrating. For now, though, the yellow metal is basking in the spotlight, experiencing a historic breakout that has validated decades of patience from its most devoted supporters. This moment represents more than just price appreciation; it’s a psychological victory for those who maintained faith in gold as a store of value through years of mockery and underperformance.

Gold’s Historic Breakout and Long-Awaited Vindication

The timing of Mow’s comments coincides with what many market analysts are calling a historic moment for gold. After spending years grinding sideways, moving in frustratingly tight ranges, or slowly trending upward without much excitement, gold has finally broken through major psychological resistance levels that had capped its price for years. The precious metal has been hitting new record highs with remarkable consistency, pushing past $2,500, then $3,000, and continuing its ascent into uncharted territory. For the gold bugs who have endured decades of ridicule from stock market enthusiasts and, more recently, from cryptocurrency advocates, this breakout represents a long-overdue validation of their investment thesis. These dedicated believers in gold’s fundamental value as a hedge against inflation, currency debasement, and geopolitical instability have weathered storms of criticism, financial underperformance, and cultural irrelevance. Now, as central banks around the world continue aggressive buying programs and global debt concerns mount to unprecedented levels, gold has finally entered what traders call “price discovery mode”—a phase where an asset breaks free from previous constraints and seeks new equilibrium levels based on current market conditions. The question on everyone’s mind is whether this rally has staying power or if it represents another false dawn for precious metals investors.

The Painful History: From Nixon to the 1980 Peak

To fully understand why gold’s current performance is so meaningful to its long-term holders, we need to rewind to a pivotal moment in monetary history. Mow’s reference to 1971 points to President Richard Nixon’s decision to end the convertibility of the US Dollar into gold, effectively severing the last link between the world’s reserve currency and the precious metal. This momentous decision, often called the “Nixon Shock,” transformed gold from a fixed currency peg into a free-floating asset whose price would be determined by market forces rather than government decree. The implications of this change would reverberate through the following decades in ways that few could have predicted at the time. In the years following this monetary transformation, inflation began to accelerate, driven by oil shocks, government spending, and loose monetary policy. By January 1980, amid extreme inflation that was eroding the purchasing power of the dollar at an alarming rate and geopolitical fears stemming from events like the Iranian Revolution and the Soviet invasion of Afghanistan, gold experienced a parabolic spike that saw it reach $850 per ounce. While $850 might sound modest by today’s standards, when adjusted for inflation, that peak was truly massive—equivalent to roughly $3,400 to $3,600 in mid-2020s dollars. This inflation-adjusted perspective is crucial to understanding the long, painful journey that gold investors endured in the subsequent decades.

The Brutal Bear Market and Twenty Years of “Dead Money”

What happened after gold’s spectacular 1980 peak serves as one of the most cautionary tales in investment history and explains why gold bugs have been so patient and resilient in their conviction. After the blow-off top in 1980, gold entered what can only be described as a brutal, soul-crushing bear market that lasted approximately twenty years. The price collapsed from $850 to under $300 per ounce, representing a loss of more than 65% in nominal terms and an even more devastating loss when considering inflation and opportunity cost. For two full decades, anyone who had bought near the top in 1980 watched helplessly as their investment lost purchasing power year after year. This wasn’t just a financial loss; it was a test of conviction and belief that separated true gold believers from fair-weather investors. During this same period, from 1980 to 2000, the stock market—particularly the S&P 500—experienced one of its greatest bull runs in history, fueled by falling interest rates, technological innovation, globalization, and the rise of the internet economy. Stocks “ripped higher” as Mow notes, while gold was dismissively referred to as “dead money,” an investment that went nowhere while inflation slowly eroded whatever value remained. This era traumatized an entire generation of precious metals investors, many of whom capitulated and sold at the worst possible times. Those who held on did so not because of short-term profit expectations but because of a deeply held belief in gold’s role as a monetary asset and store of value across millennia of human history.

The Long Road to Real Recovery

Even when gold finally began to show signs of life in the 2000s and eventually hit new nominal highs of $1,920 per ounce in 2011, the celebration was muted for those who understood inflation-adjusted returns. In real terms—meaning when accounting for the loss of purchasing power of the dollar over the intervening decades—the 2011 peak was still arguably below the 1980 peak. This sobering reality meant that investors who bought at the top in 1980 had to wait more than three decades just to break even in real terms, an almost incomprehensibly long time horizon that would test anyone’s resolve. It wasn’t until the massive inflation waves that began in 2020, triggered by unprecedented monetary expansion, supply chain disruptions, and pandemic-related government spending, that gold finally and convincingly shattered those 1980 inflation-adjusted levels. For the gold bugs who had maintained their positions through decades of underperformance, mockery, and opportunity cost, this moment represented vindication on a scale that’s difficult to overstate. They had been right about gold’s role as an inflation hedge and store of value; they had simply had to wait an extraordinarily long time for that thesis to play out. Now, with central banks around the world engaged in coordinated buying programs, adding thousands of tons of gold to their reserves as they diversify away from dollar-dominated assets, and with global debt reaching levels that many consider unsustainable, gold has broken into entirely new territory, consistently hitting record highs and showing no signs of exhaustion.

Bitcoin’s Challenge: Can Digital Gold Catch Up to the Original?

This brings us back to Samson Mow’s original comments and the implicit question they raise: will Bitcoin be able to catch up with gold’s current performance, or has the cryptocurrency missed its moment? Bitcoin advocates have long positioned the digital asset as “digital gold,” arguing that it possesses many of gold’s desirable properties—scarcity, durability, divisibility—while solving some of gold’s practical problems, such as difficulty of transport, storage costs, and verification challenges. However, Bitcoin’s recent performance has been relatively muted compared to gold’s breakout, leading some to question whether the narrative of Bitcoin as a superior store of value will hold up in practice. Mow’s suggestion that Bitcoin will eventually “melt faces” reflects the crypto community’s enduring belief that Bitcoin’s fundamental properties—particularly its absolutely fixed supply of 21 million coins, its decentralized nature, and its growing acceptance as an institutional asset—will ultimately drive prices to levels that will shock even optimistic supporters. Whether this confidence is justified remains an open question. Bitcoin faces challenges that gold doesn’t, including regulatory uncertainty, technological risks, competition from other cryptocurrencies, and questions about its energy consumption and environmental impact. At the same time, Bitcoin offers advantages that gold cannot match, including ease of transfer across borders, perfect divisibility, cryptographic security, and transparency of supply. The ultimate outcome of this competition between the original store of value and its digital challenger will likely unfold over years or decades, and both assets may well have room to thrive in a world where trust in traditional financial institutions and fiat currencies continues to erode. For now, though, Mow is right: the gold bugs have earned their moment in the sun, and Bitcoin enthusiasts would do well to watch, learn, and wait for their asset’s next chapter to unfold.