The Epstein Files Reveal Crypto Industry’s Early Power Struggles

A Controversial Email Surfaces from the Past

The cryptocurrency world was recently shaken when a rather unexpected document surfaced among the newly released Jeffrey Epstein files. Among thousands of pages of documents related to the disgraced financier, investigators and the public discovered an email from 2014 that sheds light on the early competitive dynamics of the digital currency industry. This particular correspondence, dated July 31, 2014, was penned by Austin Hill, a significant figure in the cryptocurrency space, and addressed to both Jeffrey Epstein and technology investor Joi Ito. What makes this email particularly noteworthy isn’t just its unusual recipient list, but rather its candid discussion of competitive concerns within the emerging blockchain sector, specifically regarding two projects that would go on to become major players in the cryptocurrency market: Ripple and Stellar. The document provides a fascinating glimpse into the behind-the-scenes maneuvering, investment strategies, and interpersonal tensions that characterized the early days of the cryptocurrency industry, revealing that even in its infancy, the sector was marked by the same competitive pressures and strategic positioning that define mature industries.

The Core Complaint: Two Horses in the Same Race

The heart of Austin Hill’s email centered on what he perceived as a problematic investment strategy that was harming his company’s interests. In remarkably direct language, Hill expressed his concerns about investors who were simultaneously backing both Ripple and Stellar, two blockchain projects focused on similar objectives in the financial technology space. His exact words were telling: “Ripple and Jed’s new Stellar project is bad for the ecosystem we’re building, and we believe investors investing in two horses in the same race are harming our company.” This statement reveals the competitive anxiety that Hill and his colleagues were experiencing as they watched potential investors diversify their portfolios across what they viewed as competing projects. Hill made it clear that this wasn’t just his personal opinion but represented the collective concern of other co-founders at Blockstream, his company. The email specifically requested that recipients either reduce their investment allocation to these competing projects or withdraw from them entirely. This request highlights the classic tension in venture investing between diversification (which reduces risk for investors) and exclusivity (which benefits individual companies by ensuring undivided support from their backers). Hill’s argument centered on the concept of conflict of interest, suggesting that investors couldn’t effectively support Blockstream’s vision for the cryptocurrency ecosystem while simultaneously funding projects he viewed as incompatible with or harmful to that vision.

The Players Involved: A Who’s Who of Tech and Controversy

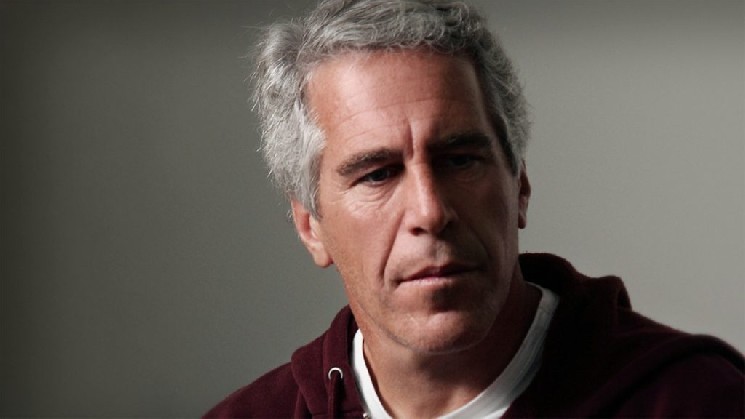

The recipient list of this email reads like a cross-section of technology innovation and controversy. Jeffrey Epstein, whose connection to technology investors and entrepreneurs has been well-documented despite his later infamy, was one of the primary recipients. His involvement in technology investment circles, particularly through his connections with prominent figures in Silicon Valley and academia, made him a conduit for deal flow and investment opportunities during this period. The second primary recipient was Joi Ito, a respected technology investor and academic who was serving as the director of the MIT Media Lab at the time. Ito’s reputation in technology circles was substantial, though it would later be tarnished by revelations about his financial connections to Epstein. The email also appears to have been copied to Reid Hoffman, the co-founder of LinkedIn and a prominent venture capitalist who has invested in numerous technology startups. Hoffman’s inclusion suggests that the email was part of a broader conversation among Silicon Valley’s elite investors about how to allocate capital in the emerging cryptocurrency space. The sender, Austin Hill, was himself a significant figure as a co-founder of Blockstream, a company focused on Bitcoin and blockchain infrastructure that had attracted investment from some of these same prominent technology figures. This interconnected web of relationships illustrates how small and interconnected the world of cryptocurrency investment was in 2014, and how personal relationships and informal communications played a crucial role in shaping investment decisions.

Understanding Blockstream’s Position in the Crypto Ecosystem

To fully appreciate the context of Hill’s concerns, it’s important to understand what Blockstream represented in the cryptocurrency landscape of 2014. Blockstream was founded as a company dedicated to building infrastructure for Bitcoin and blockchain technology, with a particular focus on developing sidechain solutions that would extend Bitcoin’s functionality without compromising its core protocol. The company’s vision was to strengthen Bitcoin’s position as the primary cryptocurrency while enabling new features through sidechains—separate blockchains that are interoperable with Bitcoin’s main chain. This technical approach required significant research and development investment, and the company had attracted backing from prominent Silicon Valley investors, including Reid Hoffman among others. From Blockstream’s perspective, projects like Ripple and Stellar represented a fundamentally different vision for blockchain technology—one that emphasized creating new, separate networks for financial transactions rather than building on top of Bitcoin’s existing infrastructure. This philosophical difference was more than academic; it represented competing visions for how blockchain technology would transform finance and other industries. If investors were spreading their capital across multiple competing visions, Blockstream feared it would dilute the resources available to pursue any single approach effectively. Furthermore, the success of alternative blockchain projects could potentially undermine Bitcoin’s dominance, which would in turn reduce the value proposition of Blockstream’s Bitcoin-focused infrastructure work.

The Ripple-Stellar Rivalry and Jed McCaleb’s Role

The reference to “Jed’s new Stellar project” in Hill’s email points to one of the cryptocurrency industry’s most interesting origin stories and rivalries. Jed McCaleb was one of the original co-founders of Ripple, a blockchain project designed to facilitate fast, low-cost international money transfers and payments. However, McCaleb had a falling out with other Ripple leadership and left the company in 2013, subsequently launching Stellar in 2014—the same year as Hill’s email. Stellar was created with a mission very similar to Ripple’s: facilitating cross-border payments and creating financial infrastructure, particularly for underserved populations. The launch of Stellar created an awkward situation in the cryptocurrency investment community because it meant there were now two very similar projects, led by people who had recently been collaborators but were now competitors, both seeking investment from the same pool of cryptocurrency-friendly venture capitalists. The technical differences between Ripple and Stellar were relatively subtle to outside observers—both used consensus protocols rather than proof-of-work mining, both focused on financial institutions and payment processing, and both aimed to be faster and more scalable than Bitcoin. From an investor’s perspective, backing both projects might have seemed like a reasonable hedging strategy—if one succeeded, the investor would benefit regardless of which one won the market. However, from the perspective of someone like Austin Hill, who was building a different vision entirely, investors splitting their attention and capital between these similar projects represented a distraction from what he saw as the more important work of building Bitcoin infrastructure. The Ripple-Stellar rivalry would continue for years, with both projects eventually carving out their own niches in the cryptocurrency ecosystem, though neither achieved the level of adoption their founders originally envisioned.

Implications and Reflections on Crypto’s Early Days

The emergence of this email from the Epstein documents provides valuable insights into the early cryptocurrency industry that extend beyond the specific companies and individuals mentioned. It reveals that even in 2014, when cryptocurrency was still a relatively niche interest, the industry was already characterized by sophisticated investment strategies, competitive positioning, and the kind of strategic maneuvering typically associated with more mature sectors. The email demonstrates that early cryptocurrency entrepreneurs understood they were competing not just on technology but on narrative and vision—they needed to convince investors that their particular approach to blockchain technology was the one most likely to succeed. The fact that these conversations were happening among such a small, interconnected group of investors and entrepreneurs also highlights how concentrated decision-making power was in the early cryptocurrency space, despite the technology’s decentralized and democratizing rhetoric. Additionally, the email’s emergence in the Epstein files serves as a reminder of the sometimes uncomfortable connections between cryptocurrency’s early development and controversial figures in finance and technology. While there’s no suggestion of wrongdoing in the email itself, its presence in these documents illustrates how Epstein maintained connections across various cutting-edge technology sectors, including cryptocurrency. Today, both Ripple and Stellar continue to operate as significant projects in the cryptocurrency space, while Blockstream remains an important Bitcoin infrastructure company, suggesting that the ecosystem was perhaps large enough to support multiple visions after all. The email serves as a historical artifact from a formative moment in cryptocurrency history, capturing the anxieties, ambitions, and interpersonal dynamics that shaped an industry that has since grown to represent trillions of dollars in value and captured the attention of governments, institutions, and individual investors worldwide.