The Wall Street Journal Questions Trump’s Tariff Strategy: A Critical Analysis

Introduction: A Conservative Voice Raises Concerns

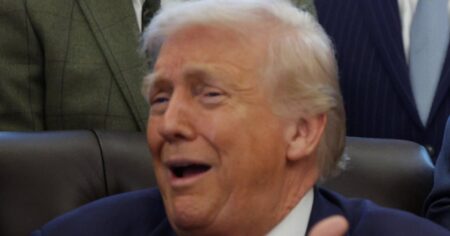

In a striking editorial published Wednesday, The Wall Street Journal—a newspaper known for its conservative leanings and owned by media mogul Rupert Murdoch—took direct aim at President Donald Trump’s cornerstone economic policy: tariffs. The editorial board didn’t mince words as they posed a fundamental question that cuts to the heart of Trump’s trade strategy: “All of this for what benefit?” This isn’t just another opinion piece from a left-leaning publication; it’s a serious challenge coming from within the conservative establishment that has traditionally supported Republican economic policies. The fact that such a prominent conservative voice is openly questioning the wisdom of Trump’s approach signals that concerns about tariffs extend far beyond partisan lines. The editorial represents the latest in an ongoing series of critiques the Journal has published regarding the president’s trade policies, suggesting a deepening skepticism about whether these measures are actually delivering the promised results for American workers and businesses.

The Real Cost of Tariff Wars: More Than Just Numbers

The Wall Street Journal’s editorial paints a sobering picture of what Trump’s tariff policies have actually cost the United States, and the price tag extends far beyond simple economics. On the diplomatic front, these trade measures have created significant friction with allies and trading partners around the world, straining relationships that took decades to build. Countries that have historically stood alongside America are now finding themselves targeted by punitive trade measures, creating an atmosphere of uncertainty and resentment in international relations. But perhaps even more concerning for everyday Americans is the direct hit to their wallets. The newspaper points out that American consumers—not foreign countries, as Trump has sometimes suggested—are the ones paying higher prices for imported goods. When tariffs are imposed on products coming into the United States, companies importing those goods typically pass those costs along to consumers through higher retail prices. This means that Americans are paying more for everything from electronics to clothing to household goods, effectively functioning as a hidden tax on consumption that disproportionately affects working-class and middle-class families who spend a larger percentage of their income on consumer goods.

The Stock Market Paradox: Rising Despite, Not Because Of

One of the most interesting observations in the Journal’s editorial concerns the relationship between Trump’s tariff announcements and stock market performance. The president has frequently taken to social media to celebrate when the stock market rises, often implying that his policies are responsible for the gains. The editorial board acknowledges that yes, the market has indeed experienced upward movement during Trump’s presidency. However, they point out a crucial pattern that undermines the narrative that tariffs are good for the economy: the stock market tends to rise when Trump backs away from tariff threats and falls when he announces new ones. This creates a perverse situation where the economy seems to perform better when the president restrains his signature policy rather than when he implements it. Investors, who collectively represent a fairly sophisticated understanding of economic trends, appear to view tariffs as a threat rather than an opportunity. The board’s conclusion is unambiguous: tariffs are “broadly a market loser.” This assessment carries significant weight because it comes from a publication that is generally sympathetic to business-friendly policies and isn’t prone to knee-jerk criticism of Republican economic strategies.

The Promise Versus the Reality: What Voters Actually Wanted

The editorial strikes at the core of Trump’s political brand by examining whether his policies are actually delivering on his campaign promises. The Journal reminds readers that voters elected Trump with specific economic expectations: they wanted to see robust economic growth that would create jobs and opportunities, and they wanted to see inflation brought under control so their paychecks would stretch further. These were reasonable expectations and represented real concerns among American workers who had felt left behind by globalization and economic changes. However, the newspaper suggests that Trump’s biggest economic successes—and there have been some—have occurred despite his tariff policies, not because of them. This is a crucial distinction. It suggests that other factors, whether tax cuts, deregulation, or simply the natural business cycle, have been driving positive economic outcomes, while tariffs have been acting as a drag on growth. In other words, the economy might actually be performing better if the tariff policies weren’t in place. This assessment challenges the fundamental logic behind Trump’s trade war strategy and raises uncomfortable questions about whether political considerations have trumped sound economic policy.

A Path Forward: The Case for Declaring Victory and Moving On

Perhaps the most pragmatic element of the Journal’s editorial is its suggested off-ramp for the president. Rather than continuing to escalate tariff threats and imposing new trade barriers, the editorial board proposes a face-saving solution: Trump should freeze tariffs where they currently stand and declare victory. This approach would allow the president to claim that he’s been tough on trade, that he’s secured better deals for America, and that his mission has been accomplished—all while preventing further economic damage from additional tariffs. It’s essentially a political escape hatch that acknowledges the reality that Trump is unlikely to completely abandon tariffs given how central they are to his economic identity and political brand. The newspaper argues that this strategy would give Trump “a better chance of persuading Americans that he’s fulfilling his promise.” In other words, stop digging the hole deeper, claim credit for whatever improvements have occurred, and move on to other priorities. This recommendation reflects a kind of weary pragmatism—an acknowledgment that completely reversing course might be politically impossible, but that limiting further damage is still a worthwhile goal.

Broader Implications: When Conservative Institutions Challenge Conservative Leaders

The significance of this editorial extends beyond the specific policy debate about tariffs. It represents something potentially more important: a willingness among conservative institutions to publicly challenge a Republican president when they believe he’s pursuing counterproductive policies. The Wall Street Journal has long been considered a pillar of the conservative establishment, and its editorial page carries considerable influence among business leaders, policymakers, and Republican politicians. When such an institution repeatedly criticizes a signature policy of a Republican president, it signals that concerns exist within the conservative coalition itself, not just from political opponents. This kind of internal criticism can be more effective than attacks from predictable partisan sources because it can’t be easily dismissed as politically motivated. The editorial also highlights a fundamental tension within modern conservatism between traditional free-market principles, which generally oppose government intervention in trade, and populist nationalism, which emphasizes protecting domestic industries even at the cost of economic efficiency. Trump’s tariffs represent a clear break from decades of Republican orthodoxy on trade, and the Journal’s critiques suggest that many traditional conservatives remain uncomfortable with this shift. Whether this internal pressure will influence Trump’s policies remains to be seen, but the fact that these criticisms are being voiced openly and repeatedly suggests that the debate over the direction of conservative economic policy is far from settled.