Trump Accounts Get Major Super Bowl Spotlight: A New Way for American Families to Save

White House Takes Prime-Time Approach to Promote Youth Investment Initiative

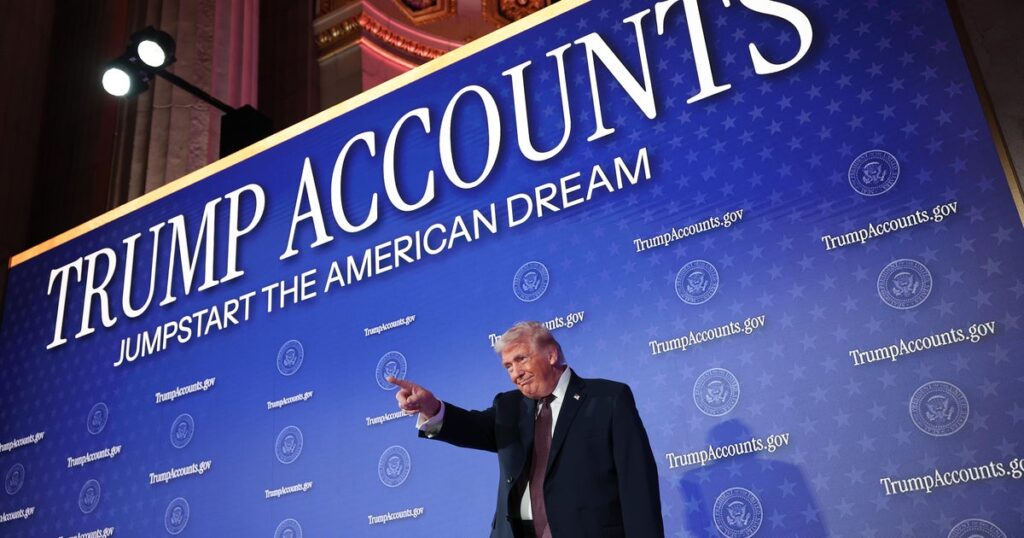

The Trump administration is pulling out all the stops to get Americans excited about a new savings program, securing one of the most coveted advertising slots in the world—a Super Bowl commercial. This Sunday, as nearly 100 million football fans settle in to watch Super Bowl LX, they’ll see something different from the usual beer and car commercials: a 30-second spot promoting “Trump Accounts,” a new government-backed investment program designed specifically for America’s youngest citizens. The advertisement, funded by the nonprofit advocacy organization Invest America, will air during the pregame broadcast, occupying premium television real estate that typically costs advertisers up to $10 million for just half a minute of airtime. It’s an unprecedented move that shows just how seriously the administration takes this initiative and how eager they are to spread the word to as many American families as possible.

The timing and placement of this advertisement speaks volumes about the government’s priorities and marketing strategy. Super Bowl Sunday has become more than just a sporting event—it’s a cultural phenomenon where advertising itself becomes part of the entertainment. Companies spend months crafting the perfect message to capture the attention of one of the year’s largest television audiences, and now the federal government is joining their ranks. Invest America made the announcement on social media platform X this past Thursday, posting a preview of the commercial with a message that tugs at the heartstrings: “This Sunday, on the world’s biggest stage, we’ll remind the nation that the American dream begins with our kids.” The choice to use such a high-profile platform demonstrates the administration’s commitment to making sure every American family knows about this opportunity and understands how it could benefit their children’s financial future.

What Exactly Are Trump Accounts and How Do They Work?

At their core, Trump Accounts are tax-deferred investment vehicles created to help young Americans build wealth from the very beginning of their lives. These accounts were established as part of the Republican Party’s comprehensive “big, beautiful bill”—a major tax and spending legislation that represents one of the administration’s signature policy achievements. Unlike traditional savings accounts that might earn minimal interest, these investment accounts are designed to grow over time, taking advantage of compound interest and market gains to potentially accumulate substantial value by the time the account holder reaches adulthood. According to Treasury Secretary Scott Bessent and other administration officials, the versatility of these accounts is one of their strongest features. The money saved can be used for a wide range of important life milestones and financial goals that young people typically face as they transition into independent adulthood.

The potential uses for Trump Account funds are impressively diverse, addressing many of the financial challenges that have made it harder for younger generations to achieve traditional markers of success. Young adults can tap into their Trump Accounts to make a down payment on their first home—a dream that has become increasingly difficult to achieve as housing prices have soared in recent years. The funds can also be used to pay for college tuition or vocational training, helping to reduce the crushing burden of student loan debt that has plagued millennials and Generation Z. Aspiring entrepreneurs can use their Trump Account savings as seed money to start a business, while those planning for the long term can even roll the funds into retirement savings. This flexibility makes the accounts potentially valuable regardless of what path a young person chooses in life, whether they become homeowners, business owners, or simply savers planning for a secure retirement.

Government Investment and Corporate Participation Create Strong Foundation

One of the most attractive features of Trump Accounts is that families don’t have to start from zero. The federal government is jumpstarting each account with a one-time contribution of $1,000. While that might not sound like a fortune, financial experts know that even a modest initial investment can grow substantially over two decades when properly invested. This seed money gives every eligible child a financial head start, regardless of their family’s economic circumstances. It’s a recognition that wealth building often requires that crucial first step—having some money to invest in the first place—which has traditionally been a barrier for families struggling to make ends meet. By providing this initial contribution, the government is leveling the playing field and giving all children the same starting point.

The program has also gained impressive support from the private sector, with numerous major U.S. corporations pledging to contribute to Trump Accounts on behalf of their employees’ children. This corporate involvement amplifies the program’s impact significantly, potentially adding hundreds or thousands of additional dollars to accounts beyond the government’s initial contribution. For employees at participating companies, this represents a valuable benefit that could make a real difference in their children’s financial futures. The combination of government seed funding and corporate contributions creates a powerful foundation for long-term wealth building, especially for families who might otherwise struggle to set aside money for their children’s future. It transforms the Trump Account from a nice idea into a tangible asset that could genuinely help the next generation achieve financial stability and independence.

Eligibility Requirements Keep Focus on Newest Americans

The Trump Accounts program has specific eligibility criteria that determine which children can receive these investment accounts. To qualify, a child must be a United States citizen and must be born during a four-year window: between January 1, 2025, and December 31, 2028. This timeframe means the program is specifically designed for the newest members of American society—babies and young children born during the current administration. Parents who had children before 2025 won’t be able to establish Trump Accounts for those older kids, which may disappoint some families but keeps the program focused and financially manageable from a government budget perspective. The citizenship requirement is also straightforward: these benefits are reserved for American citizens, reflecting the administration’s broader policy priorities.

This eligibility window creates an interesting dynamic where the program will benefit a specific cohort of young Americans who will grow up with these accounts as a standard part of their financial landscape. Children born during these years will reach adulthood between roughly 2043 and 2046, by which time their Trump Accounts could have been growing for nearly two decades. The timing also means that families planning to have children in the next few years have an additional financial incentive and security—knowing that their future children will automatically qualify for this government benefit. For expectant parents and those considering starting or expanding their families during this period, the Trump Account represents an unexpected financial boost that could influence family planning decisions and provide peace of mind about their children’s financial futures.

The Advertisement’s Message: Starting Early Makes All the Difference

The Super Bowl commercial itself takes a child-centered approach that makes the sometimes-abstract concept of long-term investing feel immediate and real. Rather than featuring government officials or financial experts talking about tax-deferred growth and compound interest, the ad puts children front and center, allowing young people to speak directly about their dreams and aspirations. “I can save for a house,” one child says in the commercial, articulating a goal that resonates with millions of Americans who have watched homeownership become increasingly difficult to achieve. Another child responds with enthusiasm: “Sign me up,” capturing the accessible, optimistic tone the administration wants to associate with the program. This messaging strategy is clever because it shifts the focus from complex financial mechanisms to relatable human goals and dreams.

The advertisement emphasizes a fundamental principle of wealth building that financial advisors have preached for generations: the earlier you start investing, the better your results will be. Time is one of the most powerful factors in building wealth because it allows even modest investments to grow exponentially through the magic of compound returns. By establishing these accounts for children from birth or early childhood, the program gives investments maximum time to grow before the money is needed. A $1,000 investment made at birth and left to grow for twenty years could potentially be worth several times that amount, depending on market performance and additional contributions. The commercial’s child-friendly approach makes this somewhat dry financial concept feel exciting and accessible, translating the abstract idea of “starting early” into concrete dreams like owning a home or starting a business that children and their parents can easily understand and get excited about.

Broader Implications: Government Marketing and Financial Policy Intersect

The decision to purchase Super Bowl advertising for a government program represents an interesting intersection of public policy and marketing that raises thought-provoking questions about how governments communicate with citizens in the modern media landscape. Traditionally, government programs have been announced through press releases, official statements, and perhaps some public service announcements on television and radio. The Trump Accounts Super Bowl ad represents a more aggressive, commercially-minded approach to policy promotion that borrows tactics from corporate America. By competing for attention alongside beer commercials and movie trailers, the government is acknowledging that capturing public attention requires meeting people where they already are—in this case, gathered around televisions for the year’s biggest sporting event.

This approach has both advantages and potential concerns. On the positive side, a Super Bowl advertisement will reach an enormous, diverse audience that might never read a government press release or visit a federal website. It democratizes information, ensuring that families across all economic backgrounds and education levels learn about this opportunity. The entertaining, accessible format makes complex financial information digestible and memorable. However, some might question whether spending millions on a Super Bowl ad (even through a nonprofit advocacy group) represents the best use of resources, or whether such marketing blurs the line between governing and campaigning. Regardless of where one stands on these questions, the Trump Accounts Super Bowl commercial represents a significant moment in how governments communicate policy to citizens, potentially setting a precedent for future administrations seeking to promote their initiatives to the widest possible audience. As families across America watch the big game this Sunday, they’ll be making their own judgments about whether this new savings program represents a genuine opportunity to help their children achieve the American dream.