Kevin Warsh Nominated as Federal Reserve Chair: A Veteran’s Return to Lead America’s Central Bank

A Safe Pair of Hands for Uncertain Times

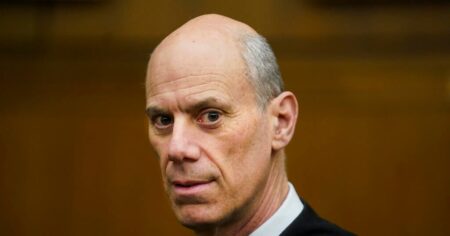

In a move that has drawn cautious optimism from Wall Street and Washington insiders alike, President Trump has nominated Kevin Warsh to lead the Federal Reserve Board, America’s central banking system. The announcement, made via Truth Social on Friday, featured the president’s characteristic enthusiasm, with Trump declaring his confidence that Warsh would become “one of the GREAT Fed Chairmen, maybe the best.” At 55 years old, Warsh brings a wealth of experience from his previous tenure on the Fed’s board of governors between 2006 and 2011, where he made history as the youngest member ever appointed. Since leaving the Fed, he has stayed close to the world of high finance, working alongside billionaire investor Stanley Druckenmiller and maintaining his academic credentials through positions at prestigious institutions like the Hoover Institution. IBM Vice Chairman Gary Cohn, who previously served as National Economic Council director during Trump’s first term, appeared on “Face the Nation” Sunday to enthusiastically endorse the nomination, calling Warsh “very highly qualified” and predicting he would restore the Fed to its “traditional norms.”

Battle-Tested Leadership from the Financial Crisis

What sets Warsh apart from other potential candidates is his front-row experience during one of the most tumultuous periods in American economic history—the 2008 financial crisis. Gary Cohn didn’t mince words when discussing Warsh’s critical role during those dark days when the entire global financial system teetered on the brink of collapse. “He was instrumental in that crisis,” Cohn emphasized during his Sunday television appearance, going so far as to say that “without Kevin’s expertise, and without Kevin being there, we would not have come out of the 2008 crisis as well as we have.” This experience fighting economic fires during the Great Recession gives Warsh a practical understanding of crisis management that simply can’t be taught in textbooks or acquired through academic study alone. He was the point person at the Fed, involved in every major discussion and decision as policymakers scrambled to prevent a complete economic meltdown. This baptism by fire has given him insights into how financial systems can fail and what interventions actually work when everything seems to be falling apart around you.

What a Warsh-Led Federal Reserve Might Look Like

So what can Americans expect if Warsh takes the helm at the Federal Reserve? According to Cohn, the nominee will likely focus on core monetary policy issues while steering clear of the various social and political controversies that have occasionally drawn the Fed into uncomfortable territory in recent years. “I think that he will probably follow through on the one to two cuts this year,” Cohn predicted, acknowledging the current pressure for interest rates to decline—something that would provide relief to borrowers, from homeowners with mortgages to businesses seeking to expand. Beyond interest rate policy, Warsh is expected to take a hard look at the Fed’s balance sheet, which ballooned to unprecedented size as the central bank purchased enormous amounts of securities during various economic crises. Cohn believes Warsh will work to reverse this expansion, selling down the Fed’s holdings to return to a more traditional, leaner approach. On the regulatory front, Warsh is described as a “traditionalist” who believes in strong oversight of financial institutions but wants regulations that actually work in practice—rules that protect the system without strangling it, allowing markets to grow while ensuring consumers maintain access to the capital they need for homes, cars, education, and business ventures.

The Independence Question: A Central Bank Under Pressure

The nomination comes against a backdrop of serious concerns about Federal Reserve independence—the principle that America’s central bank should make decisions based on economic data and sound policy rather than political pressure. For months, President Trump has publicly criticized current Fed Chairman Jerome Powell, repeatedly urging him to lower interest rates and even musing about the possibility of firing him before his term expires in May 2026. These public disputes have raised alarm bells among economists and policy experts who view Fed independence as crucial to maintaining credibility in financial markets and making difficult decisions that might be politically unpopular but economically necessary. Gary Cohn attempted to address these concerns head-on during his Sunday interview, insisting that “the president completely understands the independence of the Fed” and noting that “Kevin has been a staunch advocate for independence of the Fed” throughout his career. The question of whether Warsh can maintain that independence if confirmed, particularly when facing pressure from the president who nominated him, will likely be a central theme during his confirmation hearings and throughout his potential tenure.

A Rocky Road to Confirmation Ahead

Despite Warsh’s qualifications and Wall Street-friendly credentials, his path to confirmation in the Senate is far from guaranteed and promises to be contentious. The political landscape has been dramatically complicated by a recent bombshell revelation from current Fed Chairman Jerome Powell, who disclosed earlier this month that the Federal Reserve had received subpoenas threatening him with criminal charges. Powell didn’t mince words in characterizing what he believed was really happening, arguing that the investigation represented an attempt to intimidate the Fed over its interest rate decisions in a clear assault on the institution’s independence. This extraordinary development has prompted at least one Republican senator, North Carolina’s Thom Tillis, to draw a line in the sand, vowing to oppose all Federal Reserve nominees “until this legal matter is fully resolved.” This stance from a member of the president’s own party signals that Warsh’s confirmation hearings will likely become a broader referendum on Fed independence and the appropriate relationship between the White House and the central bank. Senators from both parties will almost certainly grill Warsh about how he would handle political pressure, what he thinks about the subpoenas targeting Powell, and whether he can credibly promise to put sound economic policy ahead of presidential preferences.

What Warsh’s Nomination Means for America’s Economic Future

The selection of Kevin Warsh to lead the Federal Reserve represents a pivotal moment for American economic policy at a time when the country faces multiple financial challenges, from persistent inflation concerns to questions about sustainable growth and the long-term health of financial markets. Warsh brings a resume that combines real-world crisis experience, deep connections in the financial industry, and a track record of advocating for traditional central banking principles. His supporters see him as exactly the right person to navigate these choppy waters—someone who understands both the theory and practice of monetary policy, who has proven himself under pressure, and who can communicate effectively with markets, politicians, and the public. His critics, however, will likely question whether anyone nominated by a president who has so publicly attacked the current Fed chairman can truly be independent, and whether Warsh’s close ties to Wall Street might make him too sympathetic to the interests of big finance over Main Street concerns. As the confirmation process unfolds in the coming weeks and months, Americans will get a clearer picture of what kind of Fed chairman Warsh might become. Will he be the “traditionalist” that Gary Cohn describes, someone who returns the Fed to time-tested approaches while maintaining independence from political interference? Or will he become another chapter in the ongoing story of tension between presidents who want lower interest rates and central bankers who must sometimes deliver economic medicine that tastes bad but promotes long-term health? The answers to these questions will have profound implications not just for financial markets but for every American whose life is touched by interest rates, employment levels, and the overall health of the economy.