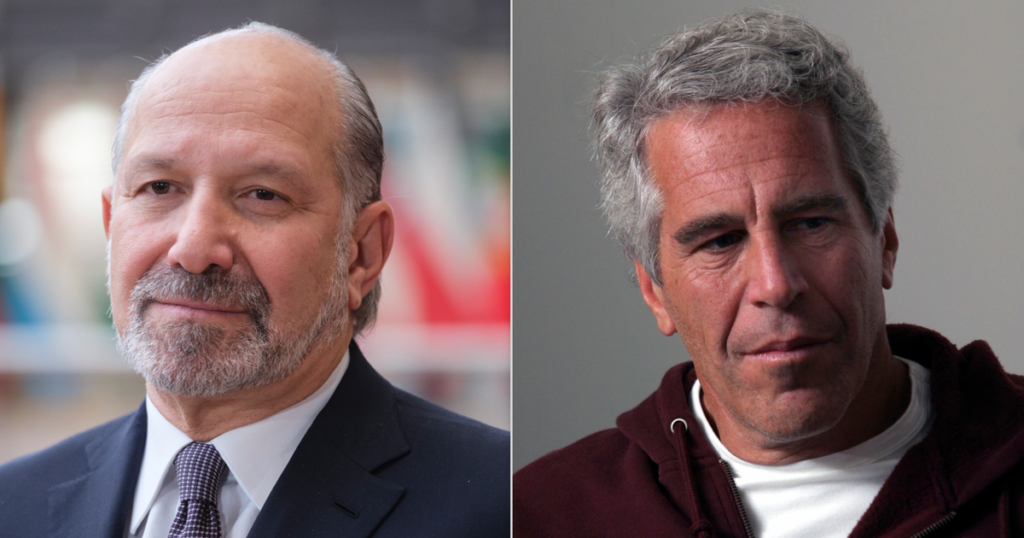

The Complex Business Relationship Between Howard Lutnick and Jeffrey Epstein

A Connection That Runs Deeper Than Acknowledged

U.S. Commerce Secretary Howard Lutnick has publicly maintained that his interactions with convicted sex offender Jeffrey Epstein were minimal and ceased years before Epstein’s criminal activities became widely known. However, newly released documents from the so-called “Epstein files” paint a considerably different picture, revealing a business relationship and personal connection that extended much further into the 2010s than Lutnick has previously admitted. These revelations add Lutnick to a growing list of powerful figures who find themselves reassessing their public statements about their associations with Epstein in light of documentary evidence that suggests those relationships were more substantial and longer-lasting than initially disclosed. The documents show not just casual acquaintance, but actual business partnerships, neighborly correspondence, and social interactions that continued well after Lutnick claims to have cut ties with the disgraced financier.

The Adfin Investment and Business Partnership

At the center of these revelations is a 2012 business deal involving an advertising technology company called Adfin, which has since closed its doors. On December 28, 2012, both Epstein and Lutnick signed a contract agreeing to acquire stakes in the company, with their signatures appearing on neighboring pages of the agreement. Epstein signed on behalf of his Southern Trust Company, Inc., while Lutnick represented a limited liability company called CVAFH I. The contract listed nine shareholders in total, indicating this was a significant investment arrangement involving multiple parties. What makes this particularly noteworthy is the timeline: this deal was signed more than four years after Epstein had pleaded guilty to Florida state charges of procuring a child for prostitution and soliciting a prostitute in 2008, a case that had already brought forth allegations of far broader sex trafficking and victimization of young girls.

The business relationship didn’t end with that initial signing. Correspondence relating to Adfin continued until at least 2014, when one of the other shareholders, David Mitchell, wrote to Epstein regarding additional fundraising that involved Cantor Ventures, a venture capital subsidiary of Cantor Fitzgerald—the very company where Lutnick had served as president and CEO since 1991 and chairman since 1996. A source close to Lutnick attempted to downplay his involvement by telling CBS News that Cantor Fitzgerald was merely a “small minority investor” in Adfin and that as such, Lutnick “would not have any knowledge of who the other investors were.” However, this explanation seems difficult to reconcile with the fact that Lutnick personally signed the investment documents, with his signature appearing directly adjacent to Epstein’s in the contract.

The Contradiction in Timeline and Social Interactions

Lutnick’s public statements about when he severed ties with Epstein don’t align with the documentary evidence. In an October interview with the New York Post, Lutnick stated that he and his wife Allison had cut ties with Epstein back in 2005, after taking a tour of Epstein’s infamous New York townhouse. According to Lutnick’s account, they decided at that time, “I will never be in the room with that disgusting person ever again.” Yet the emails and documents tell a markedly different story. Evidence shows that Epstein and Lutnick continued to maintain contact, arranging phone calls and planning to meet for drinks in 2011—six years after the alleged break in their relationship.

Even more telling, the following year in 2012, Lutnick, his wife, and their four children planned a visit to Epstein’s private Caribbean retreat, Little St. James island, which would later become known in media reports as a location where some of Epstein’s alleged crimes took place. Lutnick was invited for lunch on December 24, 2012, and afterward, Epstein’s assistant wrote on Epstein’s behalf that “it was nice seeing you.” Just four days later, on December 28, the Adfin investment contract was signed. This sequence of events—a family visit to Epstein’s private island followed almost immediately by a joint business venture—suggests a relationship that was active, comfortable, and multifaceted, incorporating both social and financial dimensions. The interactions didn’t stop there either. On January 8, 2013, just eleven days after the Adfin deal was finalized, Epstein had his assistant forward Lutnick a document related to casino legislation in the U.S. Virgin Islands, where Epstein maintained his island and various business interests.

The Neighborly Connection and Real Estate Ties

The relationship between Lutnick and Epstein also had a literal proximity dimension that added another layer to their connection. In 1996, the same year Lutnick was elevated to chairman of Cantor Fitzgerald, Epstein sold a property located at 11 East 71st Street in New York to an entity called Comet Trust. Two years later, in 1998, Comet Trust sold that same property to Lutnick, and it became his primary residence—conveniently located right next door to Epstein’s notorious New York City mansion. Living as neighbors on Manhattan’s Upper East Side, one of the most exclusive addresses in the world, the two men would have had ample opportunity for casual interaction beyond whatever formal business or social arrangements they might have made.

This neighborly relationship apparently extended to looking out for each other’s interests. In 2018—a full thirteen years after Lutnick claims to have sworn off any contact with Epstein—Lutnick emailed Epstein to warn him about an expansion plan for the nearby Frick Collection art museum. Lutnick cautioned that the renovation might “block your sunlight and views,” and urged Epstein to take action: “You should put in a letter. I’m sending a lawyer. Don’t ignore this,” Lutnick wrote. This communication demonstrates a level of neighborly concern and ongoing contact that seems inconsistent with someone who had supposedly decided more than a decade earlier to never be in the same room with Epstein again. The casual, advisory tone of the email suggests the kind of regular communication that exists between people who maintain an active relationship, not individuals who have gone years without contact.

Epstein’s Awareness and Financial Support

The documents also reveal that Epstein himself was acutely aware of the public relations challenges his associations posed to the powerful people in his network. In 2017, when he agreed to donate $50,000 to a dinner honoring Lutnick, Epstein wrote to billionaire hedge fund manager John Paulson, one of the dinner’s organizers, with a telling two-word question: “hope pr is ok.” This brief message speaks volumes about Epstein’s understanding that by 2017, his reputation was so damaged that even his financial support for events honoring his associates might create problems for them. Despite making a donation at a level that would typically earn a donor an entire table at the event, Epstein declined to take the seats, writing that Lutnick could fill them instead—another indication that Epstein recognized his presence would be unwelcome or problematic, even as he continued to financially support his associate.

This donation came nearly a decade after Epstein’s 2008 guilty plea and at a time when scrutiny of his activities and associations was intensifying. The fact that Epstein was still making substantial donations to events honoring Lutnick, and that this support was apparently accepted, raises questions about how thoroughly these powerful figures had actually distanced themselves from the financier. The “hope pr is ok” comment also suggests that there may have been ongoing discussions between Epstein and his associates about managing the optics of their continued relationships—a concern that would prove prescient given the current situation where those relationships are now under intense public examination.

Official Responses and the Broader Pattern

In response to these revelations, both Lutnick’s personal representatives and the Commerce Department have issued statements attempting to minimize the significance of the Epstein connection. A Commerce Department spokesperson dismissed the reports as “nothing more than a failing attempt by the legacy media to distract from the administration’s accomplishments including securing trillions of dollars in investment, delivering historic trade deals and fighting for the American worker.” The spokesperson added that “Secretary Lutnick had limited interactions with Mr. Epstein in the presence of his wife and has never been accused of wrongdoing.” A spokesperson for Lutnick specifically addressed the Virgin Islands casino document that Epstein sent him in 2013, stating that Lutnick ignored it.

However, these official responses must be weighed against the documented evidence of business partnerships, social visits including a planned family trip to Epstein’s private island, real estate connections, financial donations, and correspondence that continued until at least 2018. Lutnick’s situation reflects a broader pattern that has emerged in the wake of the Epstein files’ release: a network of powerful international figures who publicly distanced themselves from Epstein are now being asked to clarify relationships that appear to have been closer, more collaborative, and longer-lasting than they previously acknowledged. Epstein died in jail in August 2019, just weeks after his arrest on federal charges including sex trafficking, but the documentary trail he left behind continues to complicate the narratives that many of his former associates have constructed about the nature and duration of their connections to him. While having a business or social relationship with someone who later commits crimes doesn’t imply any wrongdoing on the part of associates, the discrepancies between public statements and documented evidence raise legitimate questions about transparency and the full nature of these relationships.