The Rise of Prediction Markets: A New Frontier in Sports Betting and Investment

A Billion-Dollar Game Within the Game

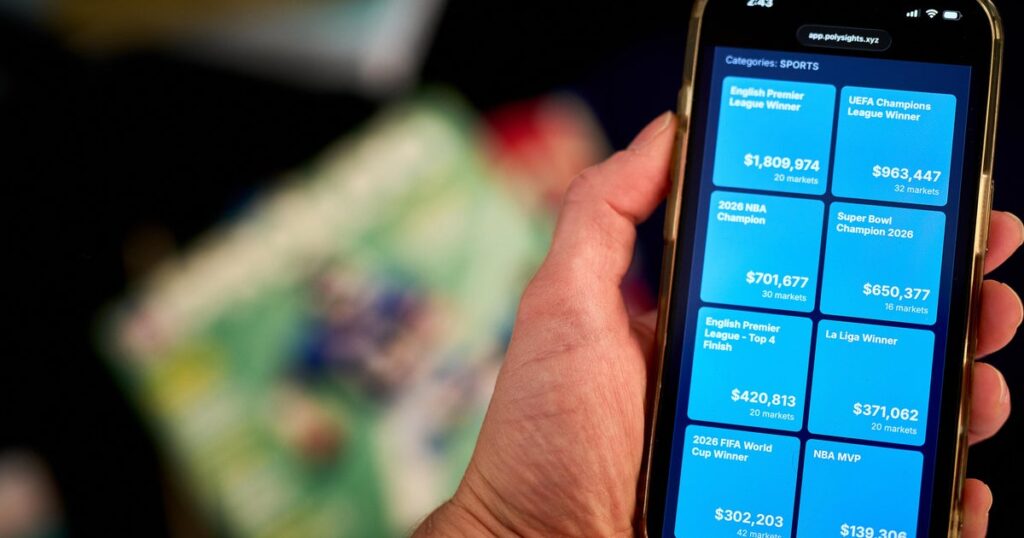

As millions of Americans prepare to watch this Sunday’s Super Bowl, another massive spectacle will unfold behind the scenes. Traditional sportsbooks are expecting a staggering $1.76 billion in wagers on the championship game—a record-breaking figure that speaks to America’s growing appetite for sports betting. But there’s a new player entering the arena that could fundamentally change how we think about wagering on sporting events. Prediction markets, once facing serious regulatory scrutiny under the previous administration, are now positioned to capitalize on major events like the Super Bowl, thanks to a dramatic shift in federal policy. These platforms allow users to place what they call “investments” on virtually any uncertain outcome, from election results to sports game statistics. The sudden green light from federal regulators has opened the floodgates for these companies to expand their sports-related offerings, creating what some experts view as a parallel gambling universe that operates with fewer restrictions than traditional sportsbooks and is accessible in all fifty states, regardless of local gambling laws.

The Regulatory Reversal That Changed Everything

The landscape for prediction markets transformed dramatically with a single announcement last week from the Commodities Futures Trading Commission (CFTC), the federal agency responsible for overseeing these emerging platforms. Michael Selig, the agency’s chair, revealed that the commission would abandon its 2024 proposal that sought to ban political and sports-related contracts on prediction markets. Instead, the CFTC plans to establish “clear rules and a clear understanding that the federal government supports lawful innovation in these markets.” This represents a complete about-face from the Biden administration’s approach, which had targeted the two largest prediction market companies, Kalshi and Polymarket, with enforcement actions. The policy shift aligns perfectly with the Trump administration’s broader agenda of reducing restrictions on alternative forms of currency and investment. However, critics have raised eyebrows at the timing and circumstances of this regulatory reversal, pointing out that both Kalshi and Polymarket have appointed Donald Trump Jr. to advisory positions on their boards of directors. This close connection to the president’s family has fueled concerns about potential conflicts of interest influencing federal policy decisions that could prove enormously profitable for these companies.

Blurring the Lines Between Investing and Gambling

The implications of this regulatory change extend far beyond Sunday’s big game. According to Dustin Gouker, a gaming industry consultant and publisher of the Closing Line, sports-related betting now represents approximately 90% of trading volume on Kalshi. Gouker views the CFTC’s announcement as a powerful signal that prediction markets have federal backing and aren’t going anywhere soon. “It is saying out loud, ‘Hey the federal government wants prediction markets to exist,'” he explained. “It’s a sign along the road toward prediction market growth, that this isn’t going away in the short term.” However, Gouker also expressed significant concerns about what this rapid expansion means for American consumers. The fundamental problem, he argues, is that prediction markets are creating confusion between sports gambling—which remains illegal in several states—and investing, which is generally accessible nationwide. By framing bets as “investments” and operating under different regulatory frameworks than traditional sportsbooks, prediction markets have essentially created a workaround that allows people in all fifty states to wager on sports outcomes. “We now have not just sports betting, but betting on pretty much any event that you want in 50 states,” Gouker noted. “That’s a huge thing that we’ve basically done with very little thought.”

The NFL Pushes Back Against Prediction Markets

Despite the federal government’s embrace of prediction markets, the National Football League is taking a firm stand against their growth. According to sources familiar with the league’s advertising policy, commercials promoting prediction markets will not be permitted to air during this Sunday’s Super Bowl broadcast. This decision represents a significant financial sacrifice, considering the premium advertising rates for the most-watched television event of the year, but it reflects the NFL’s serious concerns about how prediction markets might affect the integrity of professional sports. These concerns were articulated publicly by Jeff Miller, the NFL’s executive vice president of public affairs and policy, during testimony before a House committee in December. Miller stated unequivocally that the league “has no plans to participate in prediction markets due to several outstanding legal, regulatory, and commercial concerns on how these markets operate and the possible impact on the integrity of sporting events.” He specifically warned that the substantial financial stakes involved in sports-related contracts on prediction markets could pose “substantially greater risks to contest integrity” than traditional sports betting. The NFL’s position highlights a fundamental tension: while the federal government is embracing these platforms as legitimate financial innovation, the very sports leagues whose events fuel these markets remain deeply skeptical about their impact.

Consumer Protections and Integrity Concerns

Prediction market companies insist they have adequate safeguards in place to address integrity concerns. Kalshi points to its “extensive in-house surveillance monitors for suspicious activity” and a partnership with IC360, an integrity monitoring firm used by established sportsbooks and sports leagues nationwide. However, critics argue that the regulatory framework governing prediction markets is far less robust than what traditional gambling operators must follow. Jonathan Cohen, author of “Losing Big: America’s Reckless Bet on Sports Gambling,” told CBS News that the consequences of this regulatory disparity extend well beyond questions of sports integrity. “Sports gambling companies are not required to do enough to protect consumers, and prediction markets are required to do even less to protect consumers,” he explained. This gap in consumer protection is particularly troubling given how these platforms operate. Traditional sportsbooks in legalized states must comply with responsible gambling measures, including self-exclusion programs, deposit limits, and resources for problem gamblers. Prediction markets, by positioning themselves as investment platforms rather than gambling services, may not face the same requirements, potentially leaving vulnerable users with fewer protections and support systems when they develop problematic behaviors.

A Public Health Crisis in the Making

Perhaps the most alarming concern about the explosion of prediction markets is their potential impact on young men, a demographic already showing troubling signs of gambling-related problems. A 2024 poll from Fairleigh Dickinson University revealed that 24% of men reported at least one problem gambling behavior—a concerning figure that jumped to 45% for men aged 30 and under. Cohen argues that prediction markets, with their nationwide accessibility and investment-like framing, could accelerate what is already emerging as a significant public health crisis. “What we’ve done is unleashed a technologically supercharged version of gambling that can ensnare young men, and that puts young men and their finances and their mental health particularly at risk,” he warned. The combination of smartphone accessibility, the legitimacy conferred by being labeled as “investments,” and the removal of geographic restrictions that previously limited sports gambling creates a perfect storm for addictive behavior. Young people who might have been protected from sports gambling by living in states where it remains illegal can now access prediction markets from anywhere, placing bets on everything from game outcomes to specific player performances. As Sunday’s Super Bowl approaches with its record-breaking wagering expectations, the bigger question looms: have we created a system that prioritizes innovation and corporate profits over consumer protection and public health? The answer may determine not just who wins the big game, but what kind of relationship Americans will have with gambling and risk for generations to come.