Trump Names Kevin Warsh as Next Federal Reserve Chairman

A High-Profile Appointment for America’s Central Bank

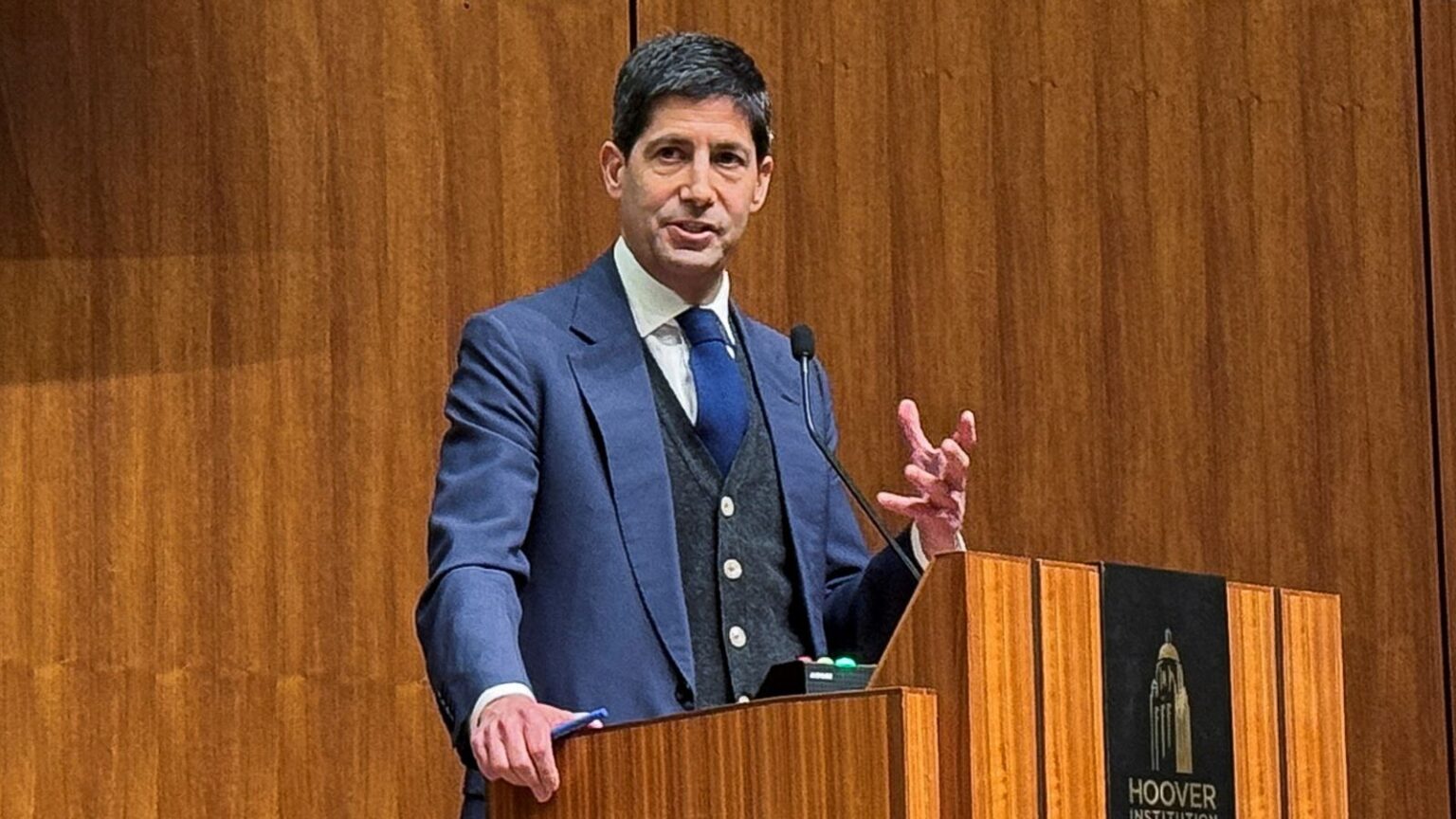

In a characteristic display of confidence, former President Donald Trump has announced his selection for what many consider the most influential financial position in the world: the chair of the Federal Reserve. Taking to Truth Social, Trump declared that Kevin Warsh, a former Federal Reserve Board governor, “may be the best” Fed chair ever, promising that Warsh would “never let you down.” This announcement brings to a close months of intense speculation and anxiety within financial markets about whether Trump would select someone willing to rubber-stamp his economic agenda, particularly his desire for aggressive interest rate cuts. The choice of Warsh appears to have somewhat calmed investor nerves, with the dollar strengthening overnight and commodity prices adjusting downward in response. The appointment carries enormous weight not just for the United States but for the global economy, as decisions made by the Federal Reserve ripple across international markets and influence economic conditions worldwide. Trump’s enthusiastic endorsement, complete with his signature phrase that Warsh is “central casting,” signals his confidence in this pick to reshape America’s monetary policy landscape.

Understanding Kevin Warsh’s Background and Philosophy

Kevin Warsh brings to the nomination a track record of experience and what many analysts describe as a measured, cautious approach to monetary policy. Having previously served as a member of the Federal Reserve’s Board of Governors, Warsh is no stranger to the complexities and pressures of central banking. His reputation suggests he takes a conservative stance on interest rate reductions, preferring careful deliberation over reactive policy changes. This philosophical approach could prove significant as he navigates the tension between Trump’s vocal demands for rate cuts to stimulate economic growth and the traditional independence that has characterized the Federal Reserve’s decision-making process. Additionally, Warsh has advocated for reducing the Fed’s balance sheet—a position that typically supports maintaining higher interest rates to prevent inflation and ensure economic stability. This aspect of his thinking provides a counterbalance to any pressure he might face to slash rates too quickly or dramatically. Interestingly, Warsh has also expressed support for loosening some of the banking regulations implemented after the 2008 financial crisis, suggesting he may favor a less restrictive regulatory environment for financial institutions. This combination of views paints a picture of someone who defies simple categorization, potentially offering a more nuanced approach to Federal Reserve leadership than either Trump’s critics or supporters might have anticipated.

Market Reactions and What They Reveal

The financial markets’ response to Warsh’s nomination provides valuable insight into how investors interpret this crucial appointment. Overnight trading saw the dollar strengthen—a movement that had been under pressure from Trump’s various economic policies and trade tensions. Simultaneously, commodities priced in dollars, including gold and oil, experienced downward pressure as the currency gained value. These market movements suggest that investors view Warsh as a more independent, methodical figure than they had feared Trump might select. The concern among many market participants had been that Trump would choose someone completely beholden to his demands for aggressive rate cuts, which could undermine the Federal Reserve’s credibility and independence. Such a scenario might have triggered market instability and raised inflation concerns. Instead, the market’s positive reception indicates a collective sigh of relief that Warsh, while likely sympathetic to some of Trump’s economic objectives, won’t simply function as a presidential yes-man. Nick Kennedy, a currency strategist at Lloyds Banking Group, characterized Warsh as his “preferred candidate” and noted that from a policy perspective, Warsh’s track record leans “more on the hawkish side,” meaning more cautious about cutting rates. However, Kennedy also acknowledged the political reality that anyone accepting this role under Trump would need to demonstrate some alignment with the president’s policy preferences, suggesting that the dollar’s initial strength might prove temporary as these competing pressures play out.

The Political Context and Fed Independence

The nomination arrives amid significant political turmoil surrounding the Federal Reserve and its current leadership. The position is available because the incumbent chair, Jay Powell, is scheduled to step down in May after serving two terms. Ironically, Trump himself appointed Powell during his first presidency, yet their relationship deteriorated dramatically, with Trump frequently criticizing Powell’s decisions and even threatening to fire him on multiple occasions. The situation has grown even more contentious recently, with the Department of Justice launching an investigation into Powell over Federal Reserve renovation costs—an inquiry that Powell has characterized as part of a broader Trump administration effort to influence the Fed’s decisions by securing a voting majority on its rate-setting panel. This political warfare has created an unusual situation where both Democrats and Republicans on the Senate Banking Committee have rallied to Powell’s defense, highlighting concerns about preserving the Fed’s traditional independence from political pressure. This same committee will now evaluate Warsh’s nomination, creating a fascinating dynamic where senators must balance their support for institutional independence against the constitutional authority of the president to make such appointments. The broader question looming over this appointment is whether the Federal Reserve can maintain its crucial role as an independent arbiter of monetary policy or whether it will become increasingly politicized and subject to presidential whims.

Why This Appointment Matters Globally

The significance of the Federal Reserve chair extends far beyond American borders, making this a consequential decision for the entire world economy. As the central bank of the world’s largest economy, the Federal Reserve’s policies influence global financial conditions, international trade, exchange rates, and economic growth prospects across continents. When the Fed adjusts interest rates, it affects borrowing costs not just for American businesses and consumers but for governments and corporations worldwide. The dollar’s role as the primary global reserve currency means that Fed decisions ripple through international markets, influencing everything from emerging market debt sustainability to commodity prices that affect developing nations’ economies. In an era already characterized by substantial economic uncertainty—much of it emanating from American policy decisions on trade, tariffs, and international relations—the Federal Reserve serves as a crucial stabilizing mechanism. A Fed chair who maintains credibility and independence can help anchor expectations and provide a degree of predictability that markets desperately need. Conversely, a Fed perceived as politically compromised or prone to short-term thinking could amplify global economic volatility and undermine confidence in the international financial system. Therefore, investors, policymakers, and ordinary citizens from Beijing to Brussels, from São Paulo to Sydney, have a stake in whether Kevin Warsh can successfully navigate the pressures he will inevitably face.

The Road Ahead: Challenges and Uncertainties

Kevin Warsh’s path to confirmation and his potential tenure as Fed chair will be fraught with challenges that will test both his diplomatic skills and his economic judgment. The Senate confirmation process itself may prove contentious, as senators from both parties scrutinize his views on independence, his relationship with Trump, and his likely approach to the competing demands of controlling inflation while supporting economic growth. Once confirmed, Warsh will immediately face the delicate balancing act of maintaining the Federal Reserve’s institutional credibility while working under a president who has demonstrated little patience for bureaucratic independence and who has very specific, publicly stated expectations about monetary policy. Nick Kennedy’s observation that “this idea that this is good for the dollar is going to be short-lived” hints at the market’s recognition that initial optimism may give way to renewed concerns as the practical realities of Warsh’s position become apparent. The fundamental tension remains unresolved: can someone survive in this role while genuinely maintaining independence from presidential pressure, or will the position require compromises that gradually erode the Fed’s traditional autonomy? Additionally, Warsh will inherit an economy facing multiple crosscurrents—potential inflation from tariffs, uncertainty from trade conflicts, concerns about government debt levels, and questions about long-term growth prospects—all requiring nuanced, thoughtful responses rather than politically motivated quick fixes. His success or failure will likely depend not just on his technical economic expertise but on his ability to build coalitions, communicate clearly with markets and the public, and demonstrate the kind of principled independence that has historically characterized the Federal Reserve at its best. The coming months will reveal whether Trump’s confidence in his pick as potentially “the best” Fed chair ever has any foundation in reality or whether this appointment becomes yet another flashpoint in the ongoing struggle over the proper role of expertise and independence in American governance.