The Middle East stock markets have shown mixed performance in 2025 as investors watch the effects of fluctuating oil prices and global trade changes. These factors create uncertainty but also opportunities for investors who look for strong companies with good growth potential. Many smaller or less-known stocks in the region have solid financial health and can be considered hidden gems.

A recent analysis of 244 Middle Eastern companies with strong fundamentals highlights several firms with low debt, good revenue growth, and positive earnings. Some of the top companies include Kerevitas Gida Sanayi ve Ticaret, MIA Teknoloji, Ege Endüstri ve Ticaret, and Gür-Sel Turizm. These companies show revenue growth rates from 40% to over 50% and have healthy financial ratings.

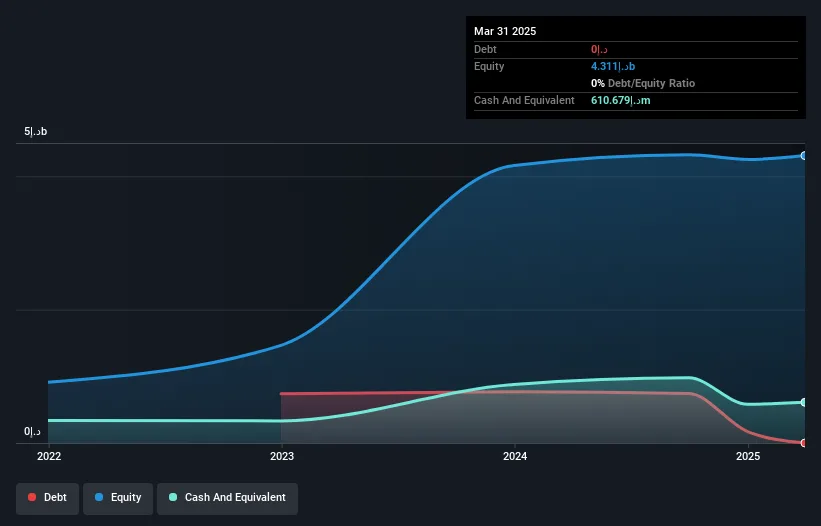

MAIR Group, a retail and real estate company based in the UAE with a market cap of around AED 3.48 billion, has experienced a 127.7% increase in earnings over the past year. The company is debt-free and currently trades significantly below its estimated fair value, suggesting potential undervaluation. MAIR has also approved AED 135 million in dividends, indicating a focus on shareholder returns.

Miahona Company Limited in Saudi Arabia, operating in water treatment services, has reported sales growth from SAR 81.6 million to SAR 175.17 million in Q1 2025. Its net income rose sharply to SAR 61.43 million, helped by a major long-term contract in Jeddah’s Industrial City worth SAR 1 billion over 25 years. Despite a net debt to equity ratio of 48%, Miahona’s earnings comfortably cover its interest expenses.

Rasan Information Technology, a Saudi fintech firm specializing in insurance services, has seen earnings growth of 116.4% in the past year. It is debt-free, with net income nearly doubling to SAR 94.73 million. Rasan’s revenue comes from its Tameeni Motors, Leasing, and Tameeni Health segments. The company’s recent equity offering may affect investor sentiment, but its strong financial results stand out.

Many Middle Eastern companies outside of oil and gas sectors, such as those in retail, water, and technology, offer promising investment opportunities. These firms show strong revenue and earnings growth combined with manageable debt levels.

Investors can explore the full list of 244 companies with strong fundamentals to find potential investment options. Keeping an eye on financial health, revenue trends, and earnings growth is crucial in this dynamic market.

Using tools that track investments and alert investors to any risks or changes can help manage portfolios effectively. Staying informed through reliable research platforms is important for navigating market volatility.

In summary, Middle Eastern markets have hidden gems with solid fundamentals. Companies like MAIR Group, Miahona, and Rasan Information Technology offer strong growth potential. Careful analysis and monitoring are key to identifying the best opportunities in this diverse region.

This article is based on data and analysis and is not financial advice. Investors should consider their own financial situation before making investment decisions.